[Impact and Outlook of China's Reopening] Domestic China Funds

12.74 Billion KRW Inflow into China Funds and 2 Trillion KRW into China ETFs This Year

The Chinese government has expressed its intention to stimulate the economy through boosting domestic demand, increasing expectations for a 'reopening (resumption of economic activities).' Riding this wave, funds are flowing into China-related funds. However, the returns on China-related funds have remained at the bottom compared to major countries since the beginning of this year, indicating that the reopening effect has yet to fully materialize. Experts believe that since the reopening effect is already detectable in real economy indicators, it is only a matter of time, and the outlook for China's economic recovery remains valid.

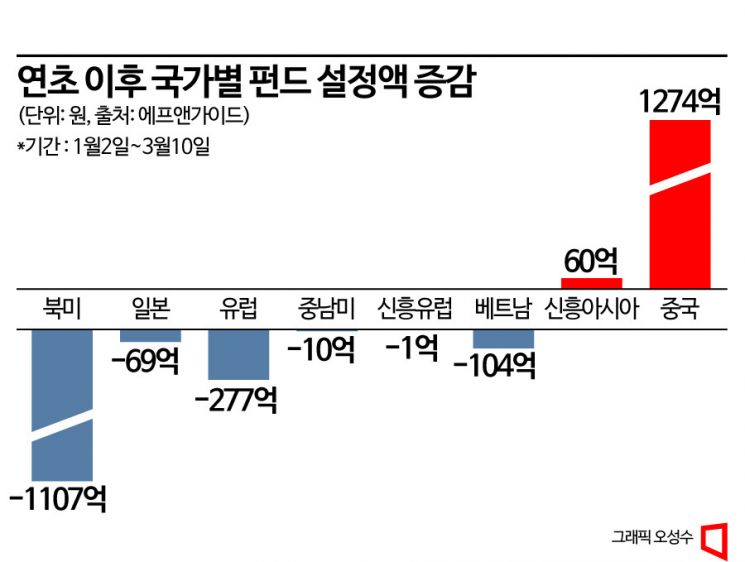

According to financial information provider FnGuide on the 15th, the total assets under management of 181 domestic China funds amounted to KRW 6.4156 trillion from January 2 to March 10 this year. KRW 127.4 billion flowed in since the beginning of the year. This inflow is the largest among regional funds classified by FnGuide. This contrasts with continued outflows from other countries such as North America (-KRW 110.7 billion), Europe (-KRW 27.7 billion), Vietnam (-KRW 10.4 billion), and India (-KRW 2.6 billion). The inflow into China funds is analyzed to be driven by the Chinese government's easing of COVID-19 lockdowns since last year and the domestic demand stimulation expectations announced through the Two Sessions.

The expectation for China's reopening is also evident in the domestic Exchange-Traded Fund (ETF) market. According to the Korea Exchange, among ETFs tracking the Chinese stock market and industrial sectors, 'TIGER China Electric Vehicle SOLACTIVE' attracted KRW 2.0693 trillion in funds this year. Although the top 1 to 12 ETFs by trading volume in the domestic market are all domestic index-tracking or bond ETFs, this is the top among ETFs tracking overseas markets. 'KODEX China Hang Seng Tech' also attracted KRW 196.6 billion, and 'TIGER China Hang Seng Tech Leverage' drew KRW 164.5 billion in large-scale investments.

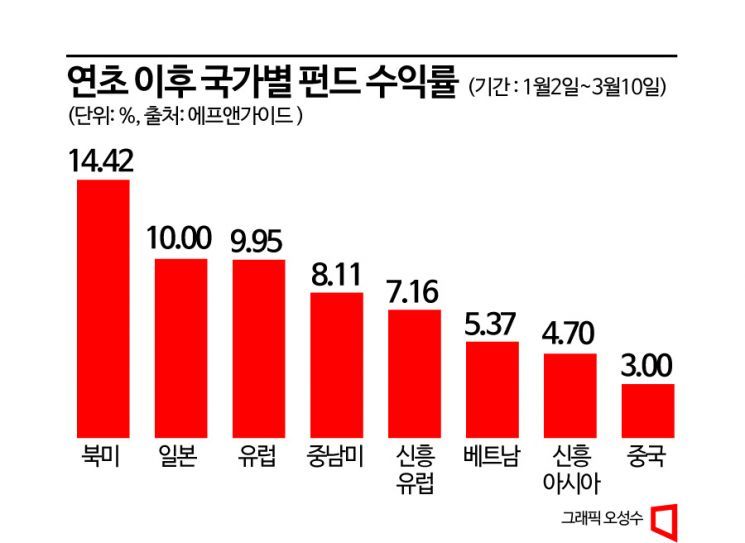

However, China-related funds have shown sluggish returns this year. According to FnGuide, the return since the beginning of the year is 3%. This contrasts with returns around 10% recorded by North America (14.42%), Japan (10%), and Europe (9.95%) since the start of the year. The 13 Greater China funds also recorded a return of only 0.56%, leading to evaluations that the demand recovery from reopening has not yet been reflected.

Experts say it is still too early to expect the effects of China's reopening, but the outlook for China's economic recovery remains valid. In fact, China's economic recovery trend is confirmed by real economy indicators. The Manufacturing Purchasing Managers' Index (PMI) for February, released by the National Bureau of Statistics of China, rose 2.5 points from the previous month (50.1) to 52.6. A PMI above 50 indicates economic expansion compared to the previous month, while below 50 indicates contraction. In December last year, China's manufacturing PMI was 47.0, the lowest since February 2020 (35.7) when the COVID-19 pandemic began, but it has been on a solid rebound since January this year (50.1).

Hong Rok-gi, a researcher at Kiwoom Securities, said, "Expectations for the recovery of China's real economy indicators remain at the beginning of the year, but the demand recovery momentum has not yet been reflected in inflation. However, the February manufacturing PMI recorded the highest level in 11 years, accelerating the economic recovery trend since the 'with COVID' policy." Kim Kyung-hwan, a researcher at Hana Securities, explained, "China's recovery in the first half of the year will gradually accelerate in the order of services, infrastructure, consumption, and real estate," and added, "We maintain our view to increase the weighting of mainland China and Hong Kong stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)