Last Year's Q4 Market Share Gap Between Two Companies Expanded from 40.6%p to 42.7%p

Global Foundry Sales Declined for the First Time in 14 Quarters

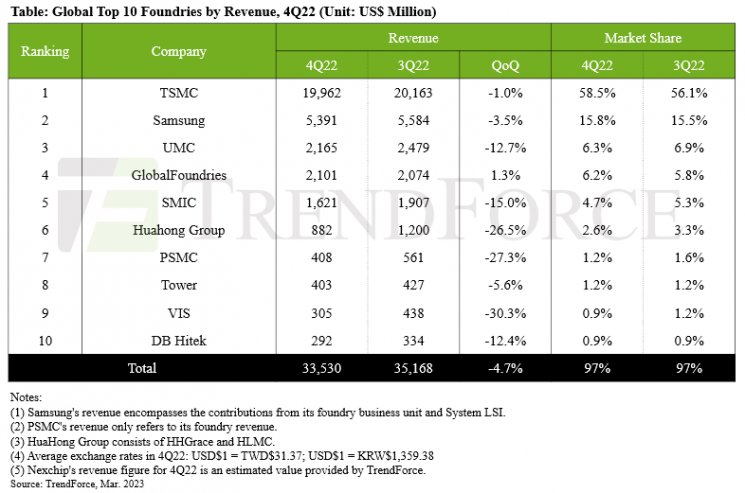

Last year, in the fourth quarter, the revenue of major foundry (semiconductor contract manufacturing) companies turned to negative growth for the first time in 14 quarters. The market share gap between Taiwan's TSMC (No. 1) and Samsung Electronics widened to 42.7 percentage points compared to the previous quarter.

Market research firm TrendForce announced on the 13th that the combined revenue of the world's top 10 foundry operators in the fourth quarter of last year recorded $33.53 billion, down 4.7% from the previous quarter. TrendForce stated, "After 13 consecutive quarters of growth, it decreased for the first time in the fourth quarter of last year," attributing the decline to customer inventory adjustments.

In fact, major foundry operators saw their revenues decline in the fourth quarter of last year compared to the previous quarter. Among the top 10 operators, only GlobalFoundries showed an increase of 1.3%. TSMC (-1.0%), Samsung Electronics (-3.5%), and UMC (-12.7%) all recorded revenue declines.

Comparison Table of Revenue and Market Share by Top 10 Foundry Operators Worldwide for Q3 and Q4 Last Year / [Image Provided by TrendForce]

Comparison Table of Revenue and Market Share by Top 10 Foundry Operators Worldwide for Q3 and Q4 Last Year / [Image Provided by TrendForce]

Comparing market shares, companies experienced mixed fortunes. While TSMC (up 2.4 percentage points), Samsung Electronics (up 0.3 percentage points), and GlobalFoundries (up 0.4 percentage points) increased their shares, UMC (down 0.6 percentage points), SMIC (down 0.6 percentage points), and Hua Hong Group (down 0.7 percentage points) generally saw their influence diminish.

TrendForce pointed out that despite TSMC's revenue decline, its market share increased due to the impact of customer inventory adjustments. Unlike lower-tier operators who struggled with inventory adjustments, TSMC was relatively less affected, allowing it to increase its market share.

It was also explained that TSMC raised revenue mainly through advanced process technologies. TrendForce said, "The revenue decrease from the 7nm and 6nm processes was offset by an increase in revenue from the 5nm and 4nm processes," adding, "The share of processes below 7nm accounts for 54% of TSMC's total revenue, indicating stability."

Samsung Electronics also saw a revenue decline but increased its market share, although the increase was smaller than TSMC's. TrendForce explained that Samsung Electronics "experienced order reductions and demand contraction in advanced processes." The market share gap between TSMC and Samsung Electronics widened to 42.7 percentage points in the fourth quarter of last year, up from 40.6% in the previous quarter.

TrendForce expects that in the first quarter, seasonal factors and uncertain macroeconomic conditions will continue to impact, potentially causing the top 10 foundry operators' revenues to decline further. The decrease could be steeper than in the fourth quarter of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)