Growing Coffee Market... 6.6% Average Increase Over 4 Years

RTD and Whole Bean Coffee Continue to Grow Instead of Instant

New Trends Like Decaffeinated and Vegan Coffee Also Emerging

Koreans' love for coffee shows no signs of cooling down. Both domestic coffee sales and green bean imports have consistently reached record highs each year, demonstrating steady growth. In particular, the growth of roasted coffee, represented by 'Iced Americano,' and RTD (Ready to DrinK) coffee?liquid coffee in PET bottles or cans?is strong. On the other hand, the market for traditionally consumed instant coffee and coffee mixes made from it has been shrinking annually.

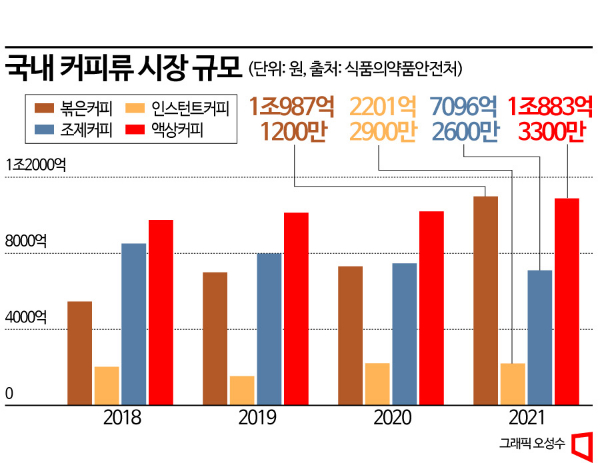

According to the annual domestic food industry production performance data from the Ministry of Food and Drug Safety on the 14th, the domestic coffee sales volume in 2021 was 3.1168 trillion KRW, an increase of more than 14% compared to the previous year (2.7179 trillion KRW). The average annual growth rate from 2018 to 2021 reached 6.6%. In particular, roasted coffee accounted for 35.3% of the coffee market, with sales and market share steadily rising. Roasted coffee is coffee made from roasted or ground beans and generally includes coffee prepared at cafes. In 2021, roasted coffee surpassed the liquid coffee market size, growing by 50.3% compared to the previous year. The industry analyzes that this is largely due to the home cafe trend during COVID-19 and consumers' preference for premium products. Recently, rising prices of coffee beans, ingredients, and logistics costs have also contributed to the increase in cafe coffee prices.

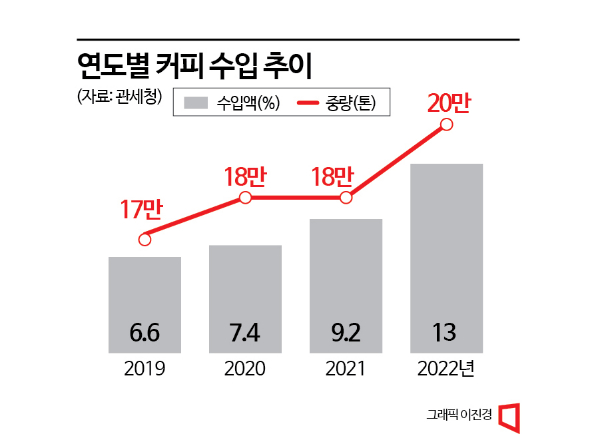

Fueled by the rise in roasted coffee, green bean imports have also increased significantly. According to customs statistics, last year’s coffee (green beans + roasted beans) import value was 1.3 billion USD, up 42.4% from the previous year (920 million USD). The import volume also reached a record high of 200,000 tons, increasing by 20,000 tons from the previous year (180,000 tons). The rise in coffee import value is attributed to increased import volumes due to international price hikes caused by global logistics disruptions and reduced coffee production. As of last year, Brazil was the largest coffee importer at 23%, followed by Vietnam (16%), Colombia (15%), and Ethiopia (9%).

The rise of RTD coffee has been partly driven by the overall food price inflation. The 'Pyeonkeo-jok' (convenience store + coffee drinkers) who use relatively affordable convenience store coffee are replacing vending machine coffee, which was once synonymous with cheap coffee. The biggest advantage is that they can enjoy cost-effective coffee at about one-third the price of coffee from specialty cafes.

With increased health awareness after COVID-19, the decaffeinated coffee market is also expanding. Imports of decaffeinated green beans and roasted beans have grown significantly. Decaffeinated green bean imports increased by 53.2% to 6,000 tons, and decaffeinated roasted bean imports rose by 21% to 1,000 tons compared to the previous year. Decaffeinated beans undergo an additional caffeine removal process during manufacturing, reducing caffeine content by over 90%. The growth of the decaffeinated coffee market has been effectively driven by the zero-marketing trend in the beverage industry following COVID-19. Although coffee consumption frequency increased with the spread of the home cafe trend, growing health concerns have made decaffeinated coffee a popular menu item. In response, coffee shops and beverage companies continue to introduce decaffeinated products.

The home coffee machine market is also expanding, with import volumes steadily increasing. The import value of home coffee machines rose significantly from 86 million USD in 2018 to 156 million USD last year. In 2021, it increased by 32.2% from the previous year (121 million USD) to 160 million USD. The growth of the capsule coffee market has also contributed. The capsule coffee market, which was worth 100 billion KRW in 2018, nearly doubled to 198 billion KRW in 2020 and exceeded 400 billion KRW last year. The home cafe and office cafe trends during COVID-19 and changes in consumption patterns are expected to sustain this growth. In the capsule coffee market, overseas brands, cafes, and rental companies such as SK Magic and Cheongho Nice are fiercely competing to expand market share. Recently, Dongseo Food, the market leader in coffee mix, has also entered the capsule coffee market.

Environmental friendliness has also emerged as a key keyword in the coffee industry. This trend accelerated with the enforcement of the ban on disposable cups in cafes in April last year. In November, the use of disposable plastic straws and sticks was also banned, speeding up the adoption of eco-friendly packaging and ingredients. Convenience store chains are also making efforts to switch most packaging components, including cups, straws, and lids, to eco-friendly materials along with eco-friendly coffee beans. Recently, the vegan and alternative food trends, which are hot topics in the food industry, are also influencing the coffee market. Products that replicate coffee flavor using black barley, sword bean, and other ingredients instead of coffee beans or vegan coffee are emerging one after another.

An industry insider said, "The coffee market has completely changed after COVID-19," adding, "In franchises, there is polarization between premium and cost-effective brands, and the home cafe trend has expanded the home market, making the changes rapid in the current situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.