Overdue Loan Balance at 5.4 Trillion Won in December Last Year

Increased by About 1 Trillion Won Compared to September

Further Increase in Overdue Balance Expected This Year

"Sales have dropped so much that even running the store doesn't cover my labor costs, and I ended up closing the business altogether. Yet, the store still hasn't been vacated, and every month I have to pay interest, rent, water bills, and electricity bills. I don't have the capacity to repay the loans, so delinquencies have started. People come to my house, my phone keeps ringing nonstop. It's not that I refuse to pay; I will repay even if I have to do two or three jobs, I just need some time, but it's really tough." (Excerpt from a self-employed internet community)

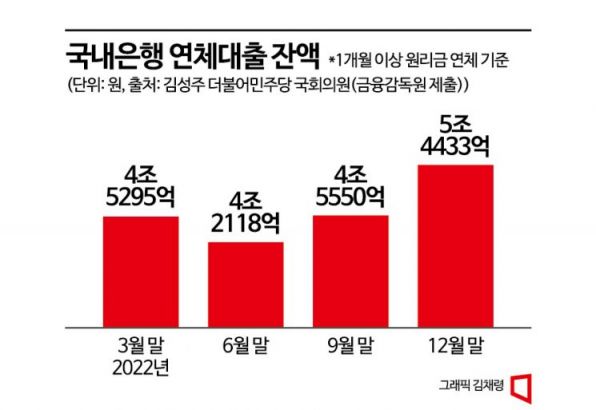

It has been revealed that the balance of delinquent loans at domestic banks increased by about 1 trillion KRW over three months. According to data received by Kim Sung-joo, a member of the National Assembly from the Democratic Party of Korea, from the Financial Supervisory Service on the 11th, the balance of delinquent loans (defined as principal and interest overdue by more than one month) was recorded at 5.4433 trillion KRW as of the end of December last year. This accounts for about 0.25% of the total loan balance (2,160.2 trillion KRW).

Comparing the balance of delinquent loans, it increased by about 1 trillion KRW from 4.555 trillion KRW at the end of September last year, three months prior, and the delinquency rate also rose by 0.04 percentage points. At the end of June last year, the balance of delinquent loans was 4.2118 trillion KRW, showing a clear upward trend over time. A representative from a commercial bank explained, "In the fourth quarter of last year, bond yields surged, and the base interest rate also rose sharply, pushing the upper limit of mortgage and credit loans above 7%. During that period, interest rates rose rapidly and the economy worsened, causing the delinquency rate to rise accordingly."

Among these, internet-only banks, which mainly handle loans for medium- and low-credit borrowers, also saw a significant increase in delinquent balances. At the end of December last year, the balance was 291.6 billion KRW, about three times higher than 106.2 billion KRW at the end of March the same year. This is interpreted as the interest burden on medium- and low-credit borrowers having increased accordingly.

So far, the banks' loss absorption capacity is not insufficient. As of the end of September last year, domestic banks' loan loss provisions stood at 21.7 trillion KRW, about 2 trillion KRW more than 19.6 trillion KRW at the end of March the same year. Nevertheless, with warning signs triggered by the delinquency rate this year, domestic banks are expected to build up more provisions. Last month, Lee Bok-hyun, Governor of the Financial Supervisory Service, said, "Please thoroughly check the adequacy of loan loss provisions and capital capacity and induce the expansion of loss absorption capacity so that banks can faithfully perform their primary function of supplying funds even in future crisis situations."

This year, with interest rates continuing to soar and the economy worsening, the delinquency rate is expected to keep rising. As of the 7th, the interest rates at the five major banks (KB, Shinhan, Hana, Woori, NH) ranged from 4.53% to 6.39% for variable-rate mortgage loans, and from 5.36% to 6.64% for six-month credit loans. A commercial bank official said, "Although rates have come down compared to early this year due to pressure from financial authorities, compared to the low-interest period during the COVID-19 crisis, rates have risen by about 3 to 4 percentage points, so customers still feel the rates are high. Since interest rates have been rising for over a year, vulnerable borrowers and insolvent companies will start to show their limits, and the delinquency rate is expected to rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)