Tax Exemption for Holding Company Conversion Ends This Year

Human Split for Holding Company Conversion

"Costs to Strengthen Control Ultimately Burden External Shareholders

Measures Needed to Restrain Controlling Shareholders"

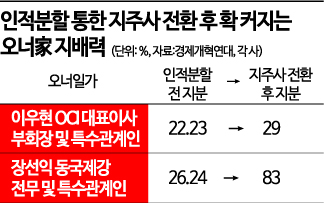

Is the succession formula of chaebol conglomerates unchanging? OCI and Dongkuk Steel, where the eldest sons of the owner families are at the forefront of management, are splitting their companies to transition to a holding company structure. OCI will undergo a two-way demerger, and Dongkuk Steel will split into three companies. Through the holding company transition via demerger, the owner families' holding company shareholding ratio will increase by 7% for OCI and 57% for Dongkuk Steel compared to before.

A demerger refers to splitting one company to establish a new company with the same shareholder composition as the existing company. When a demerger occurs, existing shareholders receive shares of both the surviving company and the newly established company proportional to their holdings. Subsequently, to meet holding company requirements (owning 30% of listed subsidiaries and grand-subsidiaries, and 50% of unlisted companies), a kind of 'stock swap' is conducted. This involves exchanging shares between the surviving company and the new company, where the new company’s shares are received in exchange for issuing new shares of the surviving company. This is called a paid-in capital increase by contribution in kind.

At this time, the owner family contributes the shares of the newly established company received during the split as contribution in kind to the surviving company and receives shares of the surviving company. As a result, the surviving company, i.e., the holding company, sees an increase in its shareholding. In conclusion, a demerger raises the owner family’s shareholding ratio in the surviving company (holding company). In many cases, this process is used to increase control and naturally carry out management succession. For example, only the successor inheriting the corporate group contributes the newly established company’s shares to receive shares of the surviving company. In 2007, under government leadership, a boom in holding companies among chaebol groups occurred. Many companies created holding companies through demergers at that time.

This year is the last year to receive the 'tax benefits for holding company transition.' The tax benefit for holding company transition allows shareholders to defer taxes on capital gains arising from contributing business company shares to the holding company in kind during the holding company restructuring process until the shares are disposed of. From January 1 next year, this benefit will no longer be available. Since the second half of last year, 10 companies have applied for preliminary review for re-listing via demerger in the KOSPI market. Among them, six companies pursued demergers to transition to holding companies, including Hyundai Department Store, OCI, Dongkuk Steel, Hyundai Green Food, Dongkuk Steel, and Chosun Refractories.

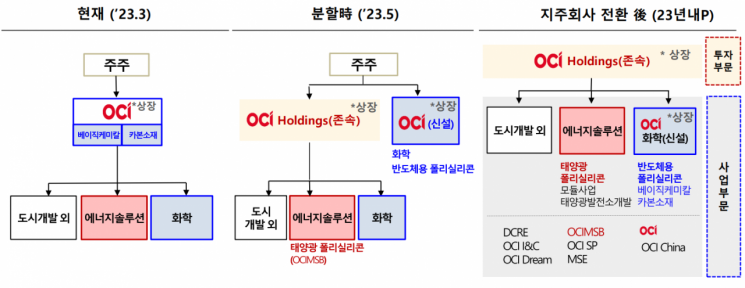

OCI plans to split the company in May to transition to a holding company. The surviving company will be the holding company ‘OCI Holdings’ (solar power and urban development), and the newly established company will be ‘OCI’ (chemicals). The split ratio is set at 69% to 31%. For OCI Holdings to become a holding company, it must acquire at least 30% of the newly established company OCI’s shares by law. OCI Holdings plans to secure shares by publicly tendering for the new company’s shares. Lee Woo-hyun, Vice Chairman and CEO of OCI, and his family are expected to contribute all of their newly established company shares (22.23% of existing OCI shares), which have lost their meaning to hold, as contribution in kind to the holding company and exchange them for holding company shares. Once all processes are complete, the governance structure of ‘Vice Chairman Lee and related parties → OCI Holdings → affiliates’ will be established.

OCI, which previously had no treasury shares, caused controversy by purchasing 300,000 treasury shares (1.26%) immediately after the demerger disclosure. Treasury shares originally have no voting rights. However, in the case of a demerger, they are recorded as assets of the surviving company and regain voting rights. From the perspective of the holding company OCI Holdings, after the demerger, it will hold 1.26% treasury shares and 1.26% shares of the newly established OCI, allowing the owner family to strengthen control over the new company without spending money. An OCI official said, “Since the split ratio of the new company is much lower than that of the surviving company, even after the paid-in capital increase by contribution in kind to transition to a holding company, the increase in major shareholder shares is only about 7%,” adding, “The proportion of treasury shares is also relatively large compared to other companies.”

Vice Chairman Lee, the third generation owner, completed his share succession in 2017 by inheriting shares from his late father, Chairman Lee Soo-young. The holding company transition is regarded as the final piece of the ‘management succession’ puzzle. At the time of inheritance, Vice Chairman Lee held the largest shareholder position (6.12%), but to pay inheritance tax, he sold some shares and is currently the third-largest shareholder (5.04%) after his uncle Lee Hwa-young, Chairman of Unid (5.43%), and half-brother Lee Bok-young, Chairman of SGC Group (5.4%). Additionally, SK Siltron purchased shares sold by Vice Chairman Lee at that time, securing about 2% of friendly shares. SK Siltron stated the purpose of acquisition was “a share investment to strengthen cooperation.”

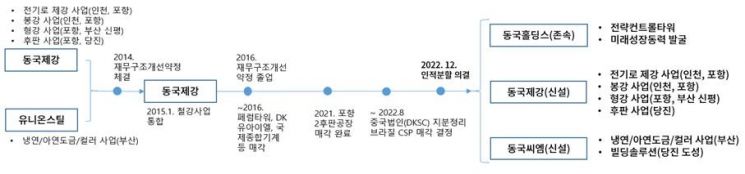

Dongkuk Steel decided to split the company into three through a demerger: the holding company ‘Dongkuk Holdings’ and business companies ‘Dongkuk Steel’ (hot-rolled) and ‘Dongkuk CM’ (cold-rolled). The surviving company is Dongkuk Holdings. The demerger will be approved at an extraordinary shareholders’ meeting in May, with the split date set for June 1. The company will be split at a ratio of 16.7% (Dongkuk Holdings) to 52% (Dongkuk Steel) to 31.3% (Dongkuk CM).

In Dongkuk Steel’s case, since the business company’s split ratio is higher than that of the holding company, exchanging business company shares for holding company shares through a paid-in capital increase by contribution in kind will significantly increase the owner family’s shareholding. The company also holds about 4% treasury shares. The Economic Reform Solidarity said, “After the split, Chairman Jang Se-ju and related parties’ holding company shareholding ratio will increase from 26.28% to about 83%,” adding, “If treasury shares are not canceled but allocated to the surviving company during the demerger, treasury shares can become a means for the owner family to expand control.”

Jang Sun-ik, Executive Director and the top succession candidate, increased his shares to 1.37% by receiving 200,000 shares of Dongkuk Steel from his father Chairman Jang on the 2nd, about four months after the demerger disclosure. Executive Director Jang is the third-largest shareholder after Chairman Jang (13.62%) and uncle Vice Chairman Jang Se-wook (9.43%). On the day the company announced the holding company transition, Executive Director Jang was promoted to Executive Director just two years after becoming Managing Director.

Both companies explain that they created holding companies to strengthen business expertise and accelerate group growth engines. However, the capital market views demergers differently. Holding companies have been persistently undervalued, with stock prices trading at a 50-60% discount to net asset value (NAV) for several years. General shareholders of OCI and Dongkuk Steel protest, saying they are “victims of the owner family’s succession work.” Hyundai Department Store also pursued a demerger but was recently rejected at an extraordinary shareholders’ meeting because many shareholders opposed the infringement of minority shareholders’ interests despite strengthening Chairman Chung Ji-sun’s control through the demerger.

An analysis by the Korea Capital Market Institute of 144 demergers of listed companies from 2000 to 2021 showed that the controlling shareholder’s shareholding ratio before the demerger averaged 27.01%, but after transitioning to a holding company, the surviving company’s shareholding ratio nearly doubled to 45.89%.

Kim Jun-seok, Senior Researcher at the Korea Capital Market Institute, stated in a recent report, “The ‘treasury share magic’ that strengthens controlling shareholders’ control over the new company without additional contribution during a demerger is a means for controlling shareholders to enhance their control,” adding, “Ultimately, external shareholders bear the cost of control enhancement.” He further emphasized, “Measures to restrain controlling shareholders must be devised.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)