If the General Meeting Dividend Proposal is Approved, 304.8 Billion Won

Jung Eui-sun, Koo Kwang-mo, and Choi Tae-won Receive 254.3 Billion Won

From 5th Place Chung Mong-yoon, It Drops to the 30 Billion Won Range

Samsung Electronics Chairman Lee Jae-yong receives overwhelmingly more dividends than any other head of a major South Korean conglomerate (same person). The amount exceeds the combined dividends of Hyundai Motor Chairman Chung Eui-sun, LG Chairman Koo Kwang-mo, and SK Chairman Chey Tae-won.

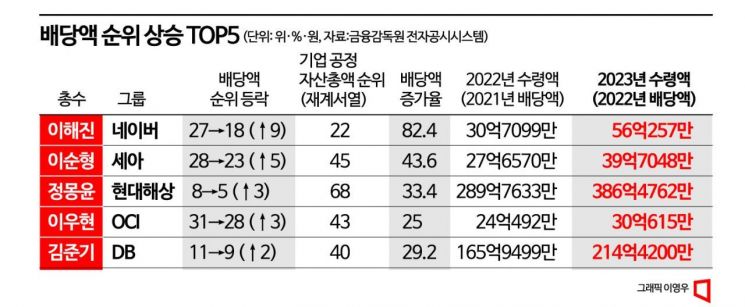

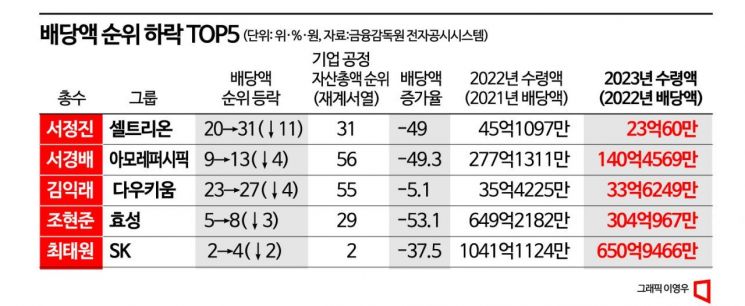

The heads of conglomerates purchased shares evenly across 4 to 7 affiliates, overcoming last year's poor performance of major affiliates and securing substantial dividends. Business leaders ranked 20th to 60th by total fair assets, such as Naver Global Investment Officer (GIO) Lee Hae-jin, Hyundai Marine & Fire Insurance Chairman Chung Mong-yoon, and SeAH Chairman Lee Soon-hyung, showed resilience by receiving 30-80% more dividends than the previous year. Meanwhile, dividends for honorary chairman Seo Jung-jin of Celltrion and Amorepacific Chairman Seo Kyung-bae were halved.

Samsung Electronics Chairman Lee Jae-yong encouraging the Korean team at the closing ceremony of the 2022 International Skills Olympics Special Competition held on October 17 last year at KINTEX in Goyang-si, Gyeonggi-do.

Samsung Electronics Chairman Lee Jae-yong encouraging the Korean team at the closing ceremony of the 2022 International Skills Olympics Special Competition held on October 17 last year at KINTEX in Goyang-si, Gyeonggi-do. [Photo by Yonhap News]

According to a full survey by Asia Economy on dividends received by heads of 76 conglomerates listed by the Korea Fair Trade Commission, Chairman Lee Jae-yong will receive 304.8 billion KRW in dividends this year. The number of annual dividend payments varies by company. The amount of common and preferred shares held by each head also differs greatly. For example, Chairman Lee Jae-yong received dividends this year from Samsung Electronics, Samsung C&T, Samsung Life Insurance, Samsung SDS, and Samsung Fire & Marine Insurance.

Samsung Electronics paid dividends four times last year. Common shares paid 361 KRW per quarter, and preferred shares paid 361 KRW for the first to third quarters and 362 KRW for the fourth quarter. Multiplying the per-share dividend by the number of common and preferred shares held by Chairman Lee reveals the dividend amount. Chairman Chung Eui-sun also received dividends from seven companies including Hyundai Motor. Hyundai Motor paid dividends twice, in the first and second halves of the year. Adding the payments from both halves and multiplying by the number of shares held gives the dividend amount.

Chairman Lee Jae-yong’s dividends are three times those of second-place Chairman Chung Eui-sun, who received 114 billion KRW. Even when combining the dividends of third-place Chairman Koo Kwang-mo (75.3 billion KRW) and fourth-place Chairman Chey Tae-won (65.1 billion KRW) with Chung’s dividends (254.4 billion KRW), the total is less than Lee’s dividends. Heads receive dividends from quarterly and year-end dividends approved as originally proposed at regular shareholders’ meetings. Heads of companies where they do not engage in management activities (such as HD Hyundai), companies where the head is not a person but a holding company or cooperative (such as POSCO), and companies that did not pay dividends (such as Netmarble) were excluded from the survey, totaling 39 companies.

Chairman Lee’s dividends decreased by 16.1% compared to last year’s amount (2021 dividends) of 363.4 billion KRW. This is because Samsung C&T’s dividends dropped from 142.3 billion KRW to 77.9 billion KRW. The special dividend per share for Samsung C&T fell from 4,200 KRW in 2021 to 2,300 KRW last year, halving the amount. Dividends from Samsung Electronics, Samsung Life Insurance, Samsung SDS, and Samsung Fire & Marine Insurance remained similar to the previous year. Dividends are also subject to taxes. According to the Income Tax Act, if dividend income exceeds 20 million KRW annually, comprehensive income tax must be paid instead of dividend income tax (which includes local tax at 15.4%). For annual income exceeding 1 billion KRW, the highest tax rate of 45% applies, plus an additional 4.5% local tax. This means the effective tax rate on Chairman Lee’s 304.8 billion KRW dividends is 49.5%. As a result, Chairman Lee pays 150.9 billion KRW (49.5% of 304.8 billion KRW) to the government and receives 153.9 billion KRW.

Dividends are mainly used as resources for inheritance tax. Since 2021, Chairman Lee has had to pay the 2.9 trillion KRW inheritance tax on shares from the late Chairman Lee Kun-hee in six annual installments of 483.3 billion KRW each. Additionally, under the amended Enforcement Decree of the Inheritance and Gift Tax Act effective since 2020, an annual interest rate of 1.2% applies. Including interest, this means he must pay 489.1 billion KRW in inheritance tax this year. Even if the entire 153.9 billion KRW of net dividends is used for inheritance tax, the remaining 68.5% (335.2 billion KRW) must be covered by other income.

Chairman Chung Eui-sun’s dividends increased by about 30 billion KRW thanks to strong performance from major affiliates. Hyundai Motor’s dividends (39.2 billion KRW) rose 40% compared to the previous year. Dividends from Hyundai Glovis increased by 28.8% (42.7 billion KRW), Kia by 29.4% (27.4 billion KRW), and Hyundai AutoEver by 55.7% (2.2 billion KRW). LG Chairman Koo Kwang-mo’s dividends from LG Corporation increased by 5 billion KRW. SK Chairman Chey Tae-won’s dividends decreased by 37.5%, from 104.1 billion KRW to 65 billion KRW, as SK Corporation’s per-share dividend dropped from 8,000 KRW to 5,000 KRW.

While the four major group chairmen receive between 60 billion and 300 billion KRW, the amount halves from the fifth place onward. Notably, Hyundai Marine & Fire Insurance Chairman Chung Mong-yoon ranked fifth with 38.6 billion KRW, surpassing sixth-place CJ Chairman Lee Jae-hyun (31.1 billion KRW) and seventh-place Lotte Chairman Shin Dong-bin (31 billion KRW). This was due to Hyundai Marine & Fire Insurance’s operating profit increasing by 26.4% compared to 2021, raising dividends from 28.9 billion KRW to 38.6 billion KRW, a 33.6% increase.

Former DB Chairman Kim Joon-ki also ranked ninth, helped by a 31.4% increase in dividends from DB Insurance. Hyosung Chairman Cho Hyun-joon saw his total dividends fall from the 60 billion KRW range to the 30 billion KRW range, dropping from fifth to eighth place, as dividends from Hyosung TNC plummeted from 31.6 billion KRW to 6.3 billion KRW. Hyosung TNC’s operating profit last year was 1.2359 trillion KRW, a 91.3% decrease from 14.2365 trillion KRW in 2021. Its stock price also fell 33.2% over the year.

Outside the top 10, Naver GIO Lee Hae-jin notably jumped nine places from 27th to 18th, with dividends doubling from 3.1 billion KRW to 5.6 billion KRW. Dividends also increased for Chairman Lee Soon-hyung (28th to 23rd, 4 billion KRW) and OCI Vice Chairman Lee Woo-hyun (31st to 28th, 3 billion KRW). Conversely, honorary chairman Seo Jung-jin’s dividends halved from 4.5 billion KRW to 2.3 billion KRW, dropping from 20th to 31st place. Amorepacific Chairman Seo Kyung-bae’s dividends also fell 49.3%, from 27.7 billion KRW to 14 billion KRW, pushing him out of the top 10 to 13th place.

Despite the KOSPI index falling 25.2% and the KOSDAQ index dropping 34.6% compared to 2021, the decrease in dividends for conglomerate heads was not considered significant.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.