Gold Futures Prices Rebound as Dollar Value Drops

Long-Term Outlook Predicts Rise to $2100

As the 'King Dollar (ultra-strong dollar)' trend weakens, 'Gold Tech (gold + investment)' is gaining attention again. The demand for safe assets has increased due to inflation and recession concerns, and with the continued weakness of the dollar, which is considered a representative safe asset alongside gold, gold is benefiting from this indirect effect. Additionally, the large-scale gold purchases by central banks around the world last year are also cited as a factor driving up gold prices.

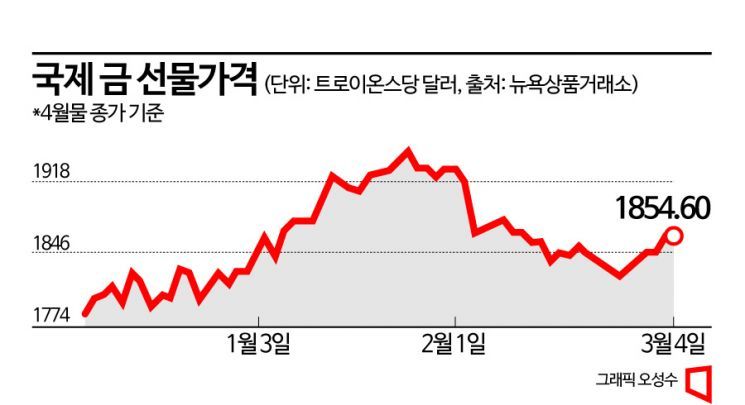

According to the New York Commodity Exchange (COMEX) on the 6th, the April gold futures price is trading at $1,860.25 per troy ounce (approximately 2.4 million KRW). The previous day closed at $1,854.60. The international gold futures price, which approached $2,000 at the beginning of last year, had been on a downward trend due to the strong dollar caused by the Federal Reserve's aggressive tightening. Gold is an asset denominated in dollars, and gold prices and the dollar have an inverse correlation. When the dollar weakens, the competitively related gold price rises.

The growing interest in Gold Tech recently is due to the weakening of the 'King Dollar' trend and increasing recession concerns. Both the dollar and gold are considered representative safe assets. The won-dollar exchange rate, which once surged to the 1,440 won level, has now dropped to the 1,200 won level.

Last year’s large-scale gold purchases by major central banks also contributed to the rise in gold prices. According to the World Gold Council (WGC), gold demand last year was 4,741 tons, an 18% increase compared to the previous year (2021). Due to the prolonged Russia-Ukraine war and the Fed’s aggressive interest rate hikes, central banks around the world began hoarding gold. It was found that central banks purchased 1,136 tons (about $70 billion) of gold last year alone. This is more than double the 450 tons purchased in 2021 and the largest scale in about 55 years since 1967.

Gold Exchange-Traded Funds (ETFs) have also risen accordingly. On the 6th, ACE Gold Futures Leverage (synthetic H) closed at 15,870 KRW, up 1.12% from the previous trading day. Since hitting a low of 12,470 KRW on October 17 last year, it has risen about 27.27%. KODEX Gold Futures (H) also closed at 12,150 KRW, up 0.66%, which is about 13% higher compared to last October. TIGER Gold Futures (H) rose about 13% in about five months, closing at 13,015 KRW, up 0.70% from the previous trading day.

Gold prices are expected to rise further amid the weak dollar. Hwang Byung-jin, a researcher at NH Investment & Securities, said, "The recent gold price below $1,900 is a long-term buying opportunity targeting $2,100," adding, "The opinion to 'increase the weighting' in precious metals investment remains valid."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)