Increase in LNG Import Prices... City Gas Rates Raised by Only 30%

Worsening Financial Situation Due to Rising Receivables Despite Record High Performance

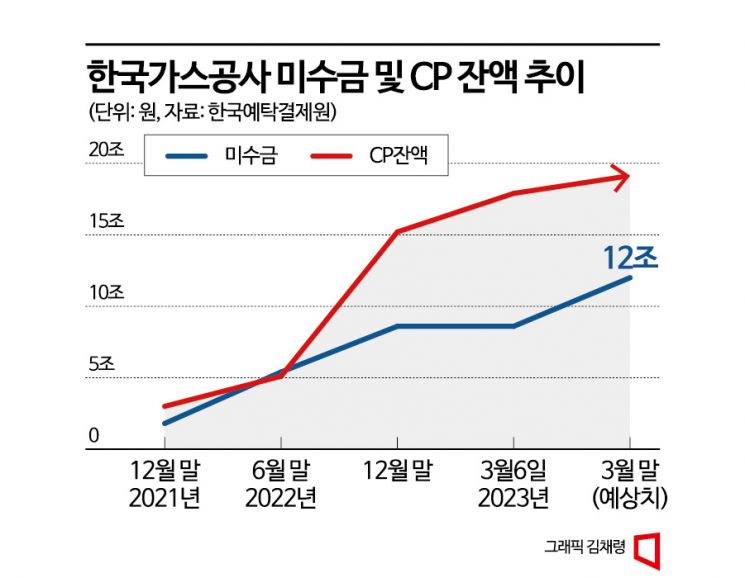

Korea Gas Corporation has been issuing commercial paper (CP, including electronic short-term bonds) consecutively to cover its liquidity shortage, pushing the outstanding CP balance close to 18 trillion won. Despite record-high operating profits, the company is resolving its cash liquidity shortage through short-term funding due to accounts receivable burdens amounting to 8 trillion won. With absolute interest rates rising, the interest burden on CP has also increased significantly. As the government continues to delay the application of the fuel cost linkage system, side effects such as worsening financial conditions and disputes with shareholders over unpaid dividends are expanding.

Issued 1.9 trillion won just last week... LNG Purchase Operating Funds Increase

According to the investment banking (IB) industry on the 6th, Korea Gas Corporation issued a total of 1.88 trillion won worth of CP just last week. This includes 520 billion won on the 27th of last month, 810 billion won on the 28th, 400 billion won on the 2nd, and 150 billion won on the 3rd. Considering that 840 billion won matured during the same period, the company effectively made a net issuance of over 1 trillion won over four business days, excluding one day. Most of the CP was underwritten by small and medium-sized securities firms such as Hanyang Securities and then sold to institutional investors like asset management companies.

As of the 3rd of last week, the outstanding CP balance of Korea Gas Corporation reached 18 trillion won. Considering that the balance was in the low 5 trillion won range in June last year before the sharp rise in international liquefied natural gas (LNG) prices, it increased by about 13 trillion won in approximately eight months. Compared to early March last year, when the balance was around 7 trillion won after adjusting for seasonal factors, it more than doubled. Korea Gas Corporation increases short-term funding as the operating fund burden from LNG purchases grows during the winter heating demand surge.

The volume of CP issuance by Korea Gas Corporation is highly correlated with the increase in accounts receivable. Accounts receivable arise because the purchase cost has significantly increased due to rising natural gas prices, but this cost has not been fully passed on to city gas tariffs. In general companies, if costs exceed sales, losses are reflected in the current period. However, Korea Gas Corporation treats accounts receivable as assets and accounts for them by recovering (reducing) the receivables when profits occur from the difference between the supply price and LNG import cost.

Since the Russia-Ukraine war, LNG import prices have doubled along with the surge in winter heating demand. In contrast, city gas tariffs increased by only 30%. Costs surged, but cash recovery was insufficient, leading to increased operating fund burdens (cash shortages). The company has been filling the liquidity gap by issuing corporate bonds or CP, causing borrowings to rise sharply.

Further Increase in Accounts Receivable Could Worsen Borrowing Structure

As of the end of last year, Korea Gas Corporation's accounts receivable had surged to 8.6 trillion won. The securities industry expects accounts receivable to increase to 12 trillion won in the first quarter due to frozen gas tariffs. Despite achieving a record-high performance of 2.46 trillion won last year, the debt ratio rose to the 500% range, worsening the actual financial situation. An industry insider said, "The significance of last year's record performance has weakened considerably due to the deteriorating financial structure," adding, "If accounts receivable are written off as losses, it is effectively equivalent to recording a large-scale operating loss."

The problem is that the trend of increasing accounts receivable is likely to continue. At the end of last year, the Ministry of Trade, Industry and Energy submitted a plan to the National Assembly to normalize Korea Gas Corporation's management by raising gas tariffs by 10.4 won per megajoule (MJ) sequentially over four quarters this year. The increase is 1.9 times the 5.47 won hike made last year. However, gas tariffs were frozen in the first quarter of this year. Due to rising inflation and difficulties in people's livelihoods, the 'heating cost bomb' issue has become a major national concern. Many also predict that tariff hikes in the second quarter are unlikely.

Even without raising gas tariffs, there is a possibility that the pace of accounts receivable growth may slow or decrease as international LNG prices stabilize downward. A securities industry official said, "Although it is difficult to guarantee, given last year's gas tariff increase and the recent downward trend in LNG prices, Korea Gas Corporation's operating fund burden may decrease starting in the second quarter."

Interest Expense Burden Increases... Vicious Cycle if Fuel Cost Linkage System Delayed

As the CP balance increases, the interest expense burden is also expected to rise significantly. After the Legoland incident last year, CP interest rates soared, pushing short-term funding rates to 4-6%, but recently they have stabilized downward to around 3-4%. However, compared to the average of previous years, the absolute interest rate level has nearly doubled, and with the CP balance increasing, interest expense growth is inevitable.

Korea Gas Corporation reportedly considered issuing hybrid capital securities (perpetual bonds) recognized as capital to improve its recently deteriorated financial structure but abandoned the plan due to rising interest expenses. The increase in interest expenses due to accounts receivable is also expected to negatively impact dividends, which have recently become a hot issue.

An asset management company official pointed out, "In a situation where accounts receivable are unlikely to decrease significantly in the short term, a sharp rise in borrowing interest expenses will inevitably reduce the net profit available for dividends," adding, "The continuous delay in applying the fuel cost linkage system is causing side effects to expand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.