Focus on Last Year's Q4 Earnings Announcement

Bright Outlook from Investment Banks and Institutional Investors

Concerns Over Vertical Platform Growth and Others

As Coupang's earnings announcement approaches, the e-commerce industry is closely watching. Following its first quarterly operating profit in eight years in the third quarter of last year, expectations are high that the company will post consecutive profits in the fourth quarter.

According to Coupang on the 28th, the fourth-quarter results for last year will be announced at 5:30 PM Eastern Time on the 28th, which corresponds to 7:30 AM Korean time on the 1st. The consensus for Coupang's fourth-quarter earnings per share (EPS) last year is between $0.04 and $0.05. Although the company is expected to report an annual loss of $0.08 per share, if the forecast is not significantly missed, it will achieve two consecutive quarters of profitability.

In fact, the outlook from investment banks and institutional investors is also positive. Barclays, a UK-based investment bank (IB), has issued an 'overweight' rating on Coupang with a target price of $24.25. BlackRock, the world's largest asset manager, purchased 7.04 million shares of Coupang in the fourth quarter of last year, and the California Public Employees' Retirement System (CalPERS) bought 550,000 shares.

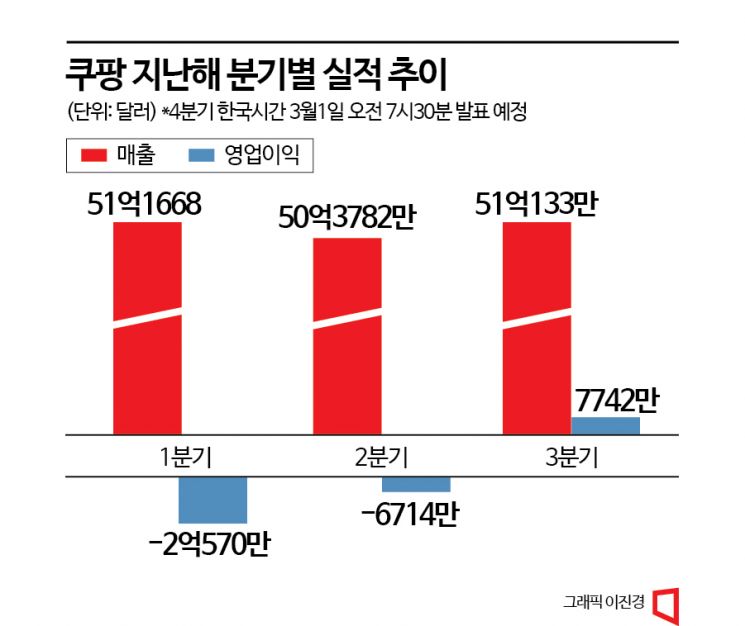

Coupang turned profitable in operating income in the third quarter of last year, posting $77.42 million. Revenue increased 27% year-over-year to $5.113 billion, and net income was $90.67 million. Since its IPO in March 2021, Coupang had been posting quarterly losses ranging from 250 billion to 500 billion KRW until the first quarter of last year, but after reducing losses for two consecutive quarters, it returned to quarterly profitability.

Coupang improved profitability through an integrated logistics network, delivering fresh products using regular trucks without a cold chain system. Revenue from product commerce sectors such as Rocket Delivery and Rocket Fresh increased 28% year-over-year to $4.947 billion, and sales in new growth sectors like Coupang Eats also rose by 10%. As of the third quarter, the number of active customers who purchased at least once on Coupang was 17.992 million, up 7% from the same period last year and roughly flat compared to the previous quarter.

Kim Beom-seok, Chairman of Coupang Inc., said during a conference call after the third-quarter earnings announcement, "This is the result of investing billions of dollars over the past seven years in a logistics network that integrates technology, fulfillment, and last-mile delivery," adding, "Using machine learning technology to forecast demand, we reduced fresh product inventory losses by about 50% compared to last year."

Coupang is widely regarded as having effectively taken the lead in the online distribution market. While major online retailers such as Naver, Lotte On, and SSG.com have seen their market shares stagnate, Coupang has been increasing its market share and widening the gap. Especially with the reopening era of economic activities, as overall market growth slows, smaller players have begun improving profitability by suspending dawn delivery and streamlining operations.

However, Coupang faces two medium- to long-term concerns. Recently, the penetration rate of the online distribution market has plateaued. While this temporarily highlights Coupang's market share gains, it inevitably limits growth potential. Additionally, the growth of various vertical platforms such as fashion (Musinsa), cosmetics (Oneul Dream), and household goods (Oneul's House) poses a variable. The segmentation of online shopping by category could act as a factor reducing Coupang's market share.

Seohyun Jung, an analyst at Hana Securities, said, "With simultaneous achievements in market share growth and operating profit turnaround, Coupang's stock momentum can be expected," but added, "In the medium to long term, whether and how Coupang responds to and overcomes the slowdown in online distribution market growth and the rise of vertical platforms will determine the possibility of sustained stock price increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)