CATL Leads China's Battery Industry in Full-Scale 'Low-Price Offensive'

Willing to Sacrifice Some Lithium Mine Profits for Low-Price Strategy

Strategy Aiming for 'Lock-In Effect'

Resembles China's Global Solar Power Domination Strategy 10 Years Ago

Massive Subsidies and Complete Supply Chain Control

Some Predict Battery Industry Will Differ from Solar Power Amid US-China Tensions

China's leading battery company CATL is launching a full-scale 'low-price offensive.' Chinese companies that control the entire supply chain of battery production, from raw material mining to finished product manufacturing, are employing a low-price bidding strategy to lock in their customers. The attempt by the Chinese government and companies to dominate entire industries based on cost competitiveness feels familiar, as it resembles the growth and global market penetration of China's solar power industry.

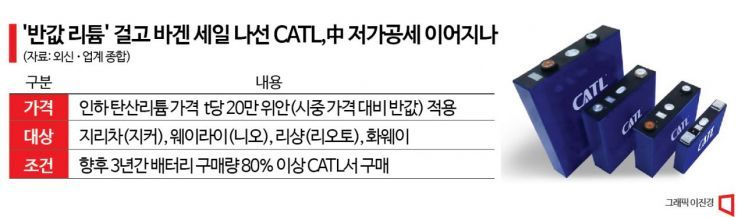

Starting in the second half of this year, CATL will initiate a 'half-price lithium' discount program. If customers commit to sourcing more than 80% of their battery purchases from CATL over the next three years, CATL will supply lithium at about half the market price. Currently, lithium costs 400,000 yuan per ton (approximately 75.32 million KRW), but CATL will supply it at 200,000 yuan per ton (approximately 37.66 million KRW). By applying the 'half-price lithium,' CATL will supply its batteries to electric vehicle companies at prices 10-15% lower than existing prices.

Lithium is a key raw material for batteries and directly affects battery prices. Battery and electric vehicle companies enter into contracts linked to raw material prices. Simply put, if material prices rise, delivery prices also increase. The rise in lithium prices leads to higher battery prices. Therefore, CATL's 'half-price lithium' is good news for electric vehicle companies. Even if profits from CATL's own lithium mines decrease, the company expects a 'lock-in' effect to retain its customers.

CATL will first apply this discount program to Chinese electric vehicle companies such as Geely. Global electric vehicle companies, which must compete with Chinese electric vehicles on price, will also face pressure to reduce prices. Professor Park Cheol-wan of the Department of Automotive Engineering at Seojeong University said, "Tesla's price cuts since the end of last year signal a 'chicken game.' Price reduction pressure may intensify on domestic battery companies that mainly produce ternary batteries, which are more expensive than Chinese companies producing LFP (lithium iron phosphate) batteries with price competitiveness."

This 'low-price offensive' by the Chinese battery industry recalls the strategy of China's solar power industry 10 years ago. In the 2000s, when China had almost no solar power industry base, it began nurturing the eco-friendly solar power industry in the 2010s by providing massive subsidies totaling 150 trillion KRW over a decade. Subsidies were poured into the entire solar power value chain, from polysilicon, the basic material for solar panels, to ingots, wafers, cells, and modules. Currently, global solar module prices have dropped by more than 90% compared to 10 years ago. China now controls most of the global solar panel supply chain.

As a result, the domestic solar power industry has been greatly weakened. LG Electronics ended its solar panel business in June last year. OCI and Hanwha Solutions stopped domestic polysilicon production in February 2020. Because Chinese products are so low-priced, domestic companies faced losses the more they produced.

China has also used massive subsidy policies in the battery market but abolished them starting this year. It declared that the electric vehicle and battery ecosystem has matured and that preparations to dominate the global supply chain are complete.

However, there are analyses that China's industrial strategy based on cost competitiveness may not work in the battery sector. Conflicts between the U.S. and China over supply chain dominance in next-generation industries are intensifying. Moreover, Western countries are openly pursuing 'China exclusion.' Another difference from the solar power industry is that Korean battery companies already have strong cooperative relationships with global automakers, including U.S. automakers. Regarding raw material procurement, various countries and companies from North America, South America, Australia, and domestic battery companies are involved, making supply chain dominance challenging, according to prevailing opinions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.