Withdrawal of Listing After Submission of Securities Registration Statements in October and December Last Year

Successful Demand Forecast Two Months Later... Offering Price Exceeding the Upper Limit of the Expected Range

[Asia Economy Reporter Hyungsoo Park] The perception of Jaram Technology, which submitted its third securities registration statement to list on the KOSDAQ market, has changed. The company set its public offering price above the upper limit of the expected price range in the demand forecast targeting institutional investors, and a high subscription rate is expected in the public offering for general investors. This is due to the fact that it submitted the securities registration statement with a lowered expected price range without selling existing shares, as well as the surge in stock prices of artificial intelligence (AI)-related companies in global stock markets.

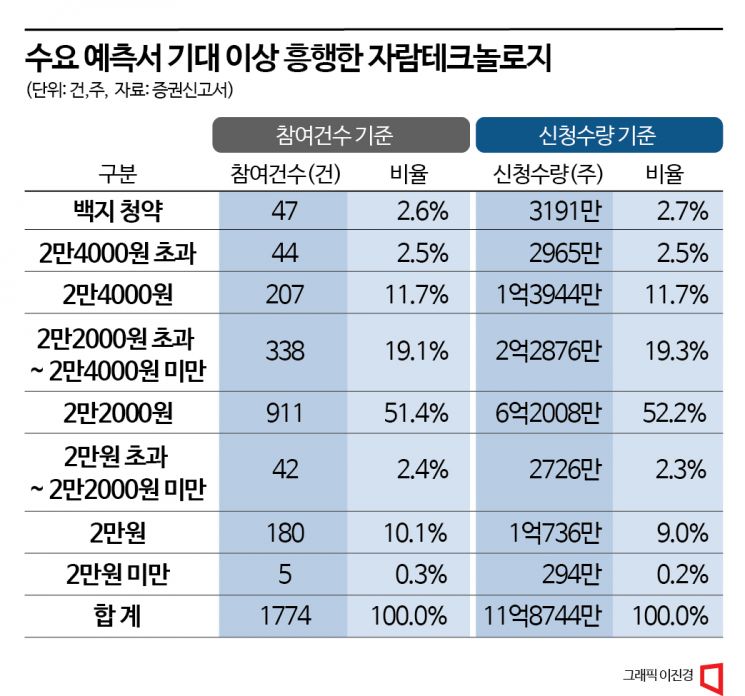

According to Shin Young Securities on the 21st, Jaram Technology finalized its public offering price at 22,000 KRW. This exceeded the expected price range (16,000 to 20,000 KRW) suggested by Shin Young Securities, the lead underwriter for Jaram Technology’s listing. The public offering size increased by at least 10% to 20.5 billion KRW. The market capitalization after listing is 136.4 billion KRW based on the public offering price.

In the demand forecast, the subscription volume willing to accept shares even if the price exceeded 22,000 KRW accounted for 36% of the total subscription. The subscription volume that promised not to sell shares for at least half a month after Jaram Technology’s listing was 135 million shares.

Jaram Technology attempted to list in October and November last year but withdrew its registration statements. It explained that the offering was postponed considering the overall conditions such as domestic and international market situations where it was difficult to receive a proper valuation of corporate value and various internal and external issues. Until the withdrawal of the registration statement on December 6, following October last year, interest in Jaram Technology in the IPO market was not high.

Jaram Technology submitted its third securities registration statement on the 14th. Since it passed the preliminary listing examination at the end of September last year, the approval validity expires at the end of next month. After two setbacks, Jaram Technology lowered the expected price range and decided not to sell existing shares held by financial investors (FIs). The FIs voluntarily agreed to a lock-up to support Jaram Technology’s listing.

With FIs and individual investors holding existing shares agreeing to the lock-up, the circulating shares immediately after listing account for only 14.1% of the total issued shares. Looking at Jaram Technology’s shareholder distribution, the largest shareholder CEO Baek Jun-hyun (30.25%), President Seo In-sik (13.33%), and Vice President Park Seong-hoon (14.01%) hold more than half of the shares. Shares secured by KDB Infra IP Capital Private Special Asset Investment Trust (9.28%) and Venture Finance (8.99%) also exceed 20%. Considering that some institutions that received public offering shares promised not to sell for at least half a month, the circulating shares in the early stage of listing are expected to be extremely low.

Jaram Technology, a fabless company designing communication semiconductors, is developing AI semiconductors based on neural processing units (NPU) in collaboration with the Korea Electronics Technology Institute (KETI). These semiconductors are expected to have high applicability in the Internet of Things (IoT) field due to their ability to rapidly compute large amounts of data. The company has secured core competitive technologies such as processor design, distributed processing, and low-power semiconductor design, and is expected to gain competitiveness in the edge-oriented AI processor sector. It plans to develop a low-power intelligent lightweight AI engine capable of learning. Currently, deep learning services perform computations by calling servers. Edge-oriented AI processors can reduce memory usage and solve data transmission issues. They have the advantage of reducing power consumption by lowering server dependency.

Jaram Technology is conducting a subscription for general investors over two days until the 23rd. CEO Baek Jun-hyun expressed his ambition, saying, "We will become a global leading company in system semiconductors, taking a market-leading position through this listing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)