Seoul Office Sales Index in Q4 Last Year

Negative for the First Time in 12 Quarters

Seoul Office Prices Down 10% from This Year's Peak

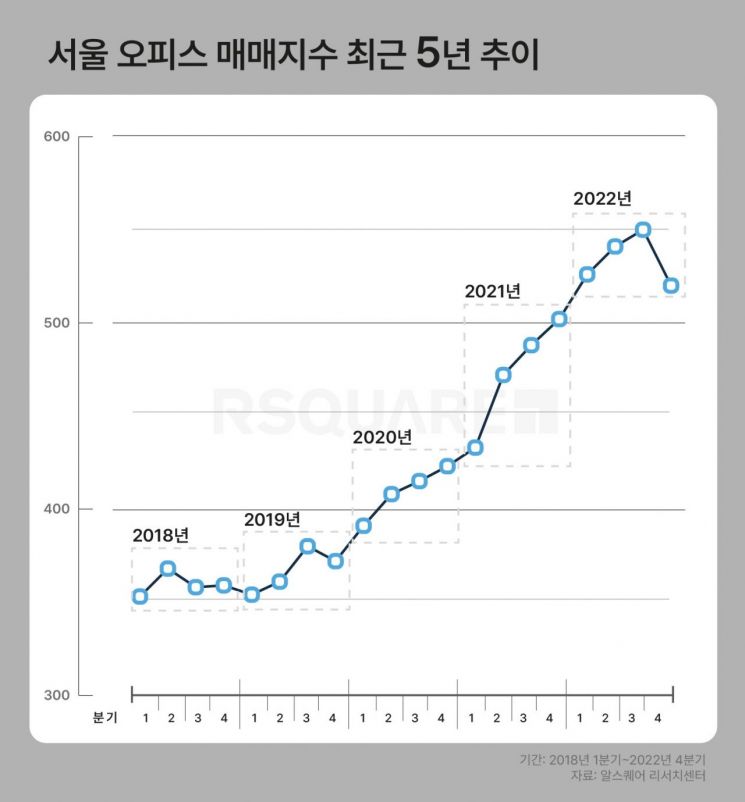

[Asia Economy Reporter Minyoung Kim] The Seoul office sales index fell in the fourth quarter of last year for the first time in three years. This is analyzed to be due to increased burdens on financing and investment returns caused by interest rate hikes.

The Seoul office sales index compiled by R Square Research Center fell for the first time in three years due to the impact of interest rate hikes. (Photo by R Square)

The Seoul office sales index compiled by R Square Research Center fell for the first time in three years due to the impact of interest rate hikes. (Photo by R Square)

According to RSquare, a commercial real estate data specialist company, the Seoul office sales index in the fourth quarter of 2022 was 520.19, down 5.6% from the previous quarter.

This is the first time since the fourth quarter of 2019 that the quarter-on-quarter rate of change recorded a negative value. The index surged 47.9% from 372.51 in the fourth quarter of 2019 to 550.96 by the third quarter of last year.

The Seoul office sales index is a benchmark price index created by applying the Standard & Poor's (S&P) CoreLogic Case-Shiller model, a representative U.S. housing sales price index, to the Korean office market. It was developed in 2019 by Kangmin Ryu, head of the RSquare Research Center, and has been previously published by Aegis Asset Management and Daishin Securities.

The decline in the Seoul office sales index is attributed to the deteriorating investment environment caused by recent sharp interest rate hikes. The U.S. Federal Reserve raised the benchmark interest rate from 0.25% at the beginning of last year to 4.75% in February this year, while the Bank of Korea raised it from 1.25% at the beginning of last year to 3.50% in January this year.

Gross Domestic Product (GDP) growth is also slowing down. The Korean economy grew by only 2.6% last year. The IMF lowered its forecast for Korea's economic growth rate this year by 0.3 percentage points from 2.0% to 1.7%.

Center head Kangmin Ryu said, "Seoul office prices in 2023 are expected to fall by 10% from the peak," adding, "Although the spread?the difference between the cap rate (investment return rate) and government bond yields?is at an all-time low and high rent increases are expected, the cap rate is still lower compared to loan interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)