[Asia Economy Reporter Buaeri] Banks have once again shown poor performance in the competition for private certificates for year-end tax settlement against big tech companies such as Naver and Kakao, following last year.

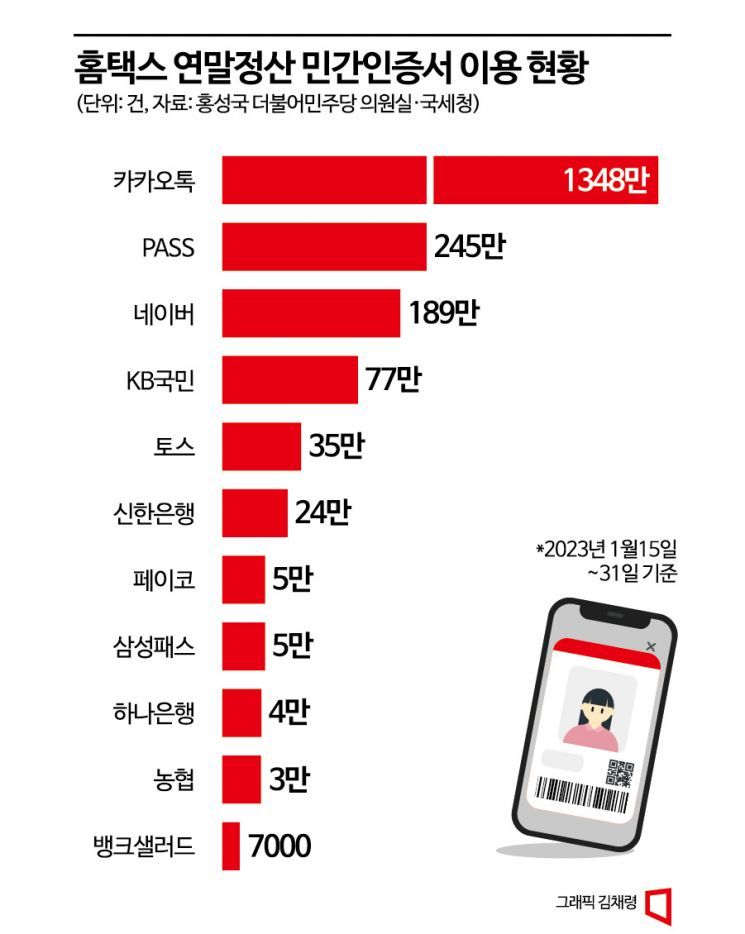

According to the certificate usage status of the National Tax Service Hometax during the year-end tax settlement period (January 15-31) obtained by Asia Economy through the office of Hong Seong-guk, a member of the National Assembly's Planning and Finance Committee from the Democratic Party, the usage rate of certificates by banks was only 1.44%.

According to the National Tax Service Hometax, the total number of certificate uses during this year's year-end tax settlement period (for 2022 income) was 76.84 million. Among them, KB Kookmin Bank's certificate usage was 770,000, about 1%. KB Kookmin Bank, which proactively introduced private certificates in the banking sector, has maintained a usage rate around 1% for three consecutive years.

Shinhan Bank also recorded a total usage of 240,000, accounting for about 0.3% of the total. Hana Bank, which introduced private certificates for the first time this year, had 40,000 uses, accounting for 0.1%, while NH Nonghyup Bank recorded 30,000 uses, accounting for 0.04%.

Comparing the usage rates of private certificates, there was nearly a 16-fold difference between banks and ICT companies. The usage rates of Kakao, Naver, PASS, and others were about 23.3%. Looking at individual companies, Kakao's certificate usage reached 13.48 million, surpassing 10 million uses for the first time in year-end tax settlement.

Next, the PASS certificates of the three major telecom companies recorded 2.45 million uses, and Naver certificates recorded 1.89 million uses. Following were Toss with 350,000 uses, Samsung Pass with 50,000, and Payco with 50,000.

The use of the former public certificates (joint certificates and financial certificates) remained high at 74.7%, but has been decreasing annually from 89% in 2021 and 81.1% in 2022. This year, joint certificate usage was 54.32 million, and financial certificate usage was 3.1 million. The usage rate of private certificates increased to about 25.3%.

The banks' poor performance appears to be due to accessibility and usability of certificates still lagging behind platform companies. To obtain a private certificate from banks, customers who do not usually use mobile banking apps need to download a separate app. Moreover, the certificate issuance process in banks is more complicated compared to big tech companies.

Regarding this, Representative Hong pointed out, "Since banks have recently been criticized for focusing only on interest income, it is necessary to enhance IT capabilities and develop new business capabilities to seek non-interest income."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)