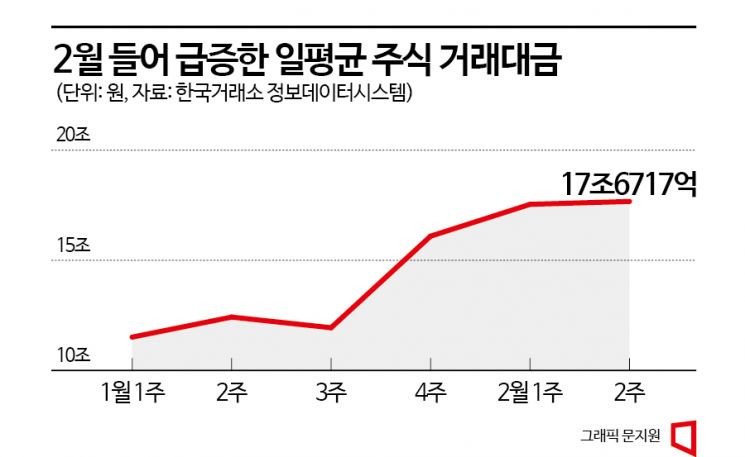

Increase from 1.1 trillion won on January 11 to 2.17 trillion won on February 17

Recovery of trading volume essential for continued stock price rebound

[Asia Economy Reporter Son Seon-hee] Since February, the trading volume of domestic stocks has increased noticeably. The KOSPI, which showed a steep upward curve at the beginning of the year, has been stuck in a box range, unable to break through the 2500 level and remaining stagnant. However, this is interpreted as a positive sign in terms of increasing liquidity in the stock market.

According to the Korea Exchange Information Data System on the 15th, the average daily trading volume for the first week of this year’s stock market opening day (January 2) (KOSPI + KOSDAQ + KONEX) was recorded at 11.515 trillion KRW. This is significantly lower compared to the same period last year (22.7 trillion KRW) or in 2021 (48.03 trillion KRW). It is a figure similar to the first week of 2020 (11.5 trillion KRW), when the COVID-19 crisis first emerged and investor anxiety spread.

Investor sentiment, which had sharply frozen since the second half of last year, reversed rapidly toward the end of January. In February, the weekly average daily trading volume rose to the 17 trillion KRW range. In the most recent second week of February (6th?10th), it recorded 17.6717 trillion KRW, more than 1.5 times higher than the beginning of the year. This is attributed to expectations that the U.S. Federal Reserve’s interest rate hike would narrow to a 'baby step' (0.25 percentage points), as well as profit-taking selling following the early-year stock price rise.

There was also a change in the 'listed stock turnover rate' (an indicator calculated by dividing trading volume by the number of listed shares), which shows how actively stock trading has been conducted. The turnover rate, which averaged 1.34 in January, slightly rose to 1.59 in February. An increase in the listed stock turnover rate means that ownership of stocks changed hands more frequently, indicating a more active stock market.

Looking at investors by type, individual and institutional investors still have a selling bias over buying this year. However, individual investors, who sold 5.75 trillion KRW worth of stocks in January, have limited their net selling to 117.9 billion KRW in February, showing a cautious stance toward the market. So far, trading volumes for individuals, institutions, and foreigners have all sharply increased since the fourth week of January.

Since trading volume itself reflects investors’ interest in the market, the recent upward trend can be interpreted meaningfully. However, it still falls short of the levels seen during the stock boom in 2021?2022, and the lack of large-scale initial public offerings (IPOs) that could strongly attract investor attention after LG Energy Solution is considered a limitation. Researcher Yoo Myung-gan of Mirae Asset Securities explained, "For the stock price rebound to continue, a recovery in trading volume is essential, because stock price increases without a certain level of trading volume backing them are difficult to interpret as meaningful." He added, "To judge the direction of the stock market, it is necessary to focus on whether trading volume is increasing rather than on valuation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)