Announcement of 'Foreign Exchange System Reform Direction' on the 10th

Complex Foreign Exchange Law Revised for the First Time in 24 Years

Concerns Over Easier Split Remittances

Banking Sector Says "Foreign Exchange Revenue Impact Unavoidable"

The government’s “Foreign Exchange System Reform Direction” announced on the 10th consists of three main parts. The core goals are to resolve inconveniences in foreign exchange transactions for citizens and businesses, establish a competitive foundation for foreign exchange services, and strengthen crisis response capabilities. Except for the enhancement of crisis response capabilities, most measures involve deregulation, marking a significant change after about 24 years.

The background for the government’s substantial easing of foreign exchange regulations lies in the recognition that the Foreign Exchange Transactions Act itself is currently a “poor fit” for Korea. Compared to 1999, Korea’s gross domestic product (GDP) has tripled, funds related to studying abroad and travel have increased more than fivefold, and resident overseas securities investment has surged nearly 70 times. Nevertheless, capital transaction regulations remain complex, causing significant inconvenience to citizens, businesses, and financial institutions. Currently, there are over 350 regulations remaining in the foreign exchange law, composed of various exceptions and exceptions to exceptions.

Korea’s foreign exchange law is particularly stringent because it was originally established to suppress and control capital outflows. Foreign exchange regulations in Korea began in December 1961 with the enactment of the Foreign Exchange Control Act. Since the domestic capital market was not large, there was a high risk that a large outflow of foreign exchange at once could destabilize the domestic economy or exchange rates, so the law was designed to protect against this. The law, which was mainly focused on regulation and control, was revised after the 1999 foreign exchange crisis following IMF recommendations, resulting in the current “Foreign Exchange Transactions Act.”

The government’s stance is that, given the soundness of the external sector and crisis response capabilities, it is necessary to move away from a “control-oriented” system. However, since changing the foreign exchange system maintained for decades will take a long time, the process will be carried out in two stages. Policies that can be implemented by revising enforcement ordinances or regulations will be promoted within the first half of this year. Issues requiring legislation, such as a complete overhaul of the prior notification system for capital transactions or the abolition of business regulations by sector, will be addressed considering the economic situation.

Concerns have also been raised that this measure might facilitate illegal transactions using the so-called “split remittance” method. When the Ministry of Economy and Finance held a seminar on the “Direction for Enacting a New Foreign Exchange Act” in July last year and announced plans to enact a new foreign exchange law, similar criticisms emerged. Experts attending the seminar generally agreed on the necessity of enacting the new foreign exchange law but mentioned the possibility of increased volatility and offshore tax evasion. Since regulations that prevented illegal transactions are being abolished or relaxed, there is a need for management to prevent improper foreign exchange remittances.

Concerns over Offshore Tax Evasion, etc.: "Reviewing How to Coordinate with the Financial Supervisory Service"

If the foreign exchange regulation method is changed to “principle of freedom with exceptions” through legislation, related risks will increase further. The government is preparing a “negative” regulation that permits everything except what is prohibited by the foreign exchange law. Documentation procedures will disappear for most transaction types, such as changing the prior notification system for capital transactions and remittance/receipt to a post-reporting system. To promote corporate investment, the prior notification burden for overseas direct investment will be significantly reduced except in cases necessary for economic security.

In fact, in the past, foreign exchange dealers were caught using a method of dispersing small remittances to the same recipient under multiple names to avoid notification to foreign exchange authorities and submission of prior documentation. According to an investigation by the Financial Supervisory Service, in two banks and three branches, gift-like remittances totaling $1,105,000 were made without documentation or reporting, with total damages approaching 71.4 billion KRW. Recently, illegal foreign exchange speculation chat rooms have been thriving, and attempts to bypass foreign exchange regulations with abnormal remittances have been increasing, leading to related incidents and accidents.

Shim Hyun-woo, head of the Foreign Exchange System Division at the Ministry of Economy and Finance, explained, “Abnormal foreign exchange remittances in the banking sector are unrelated to this issue,” but added, “We are reviewing how to verify the form of overseas remittances.” He also mentioned, “The Financial Supervisory Service will make a separate announcement.”

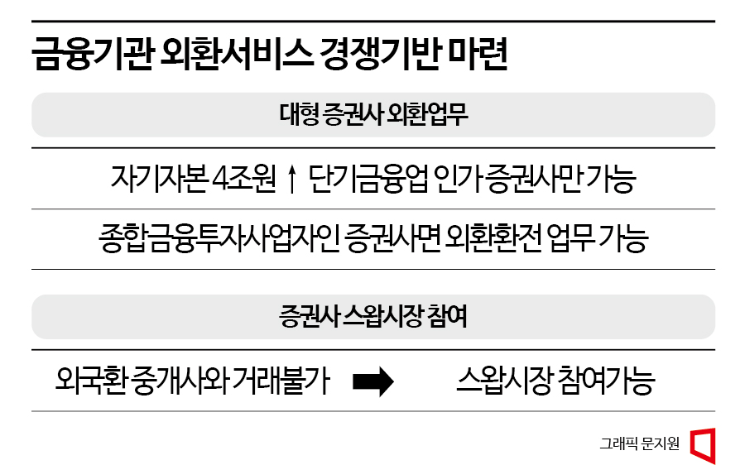

Among the main players in foreign exchange operations, the banking sector is closely watching the impact of this measure on foreign exchange market profits. This is because securities firms will be able to conduct foreign exchange business at almost the same level as banks. The current law distinguishes foreign exchange operations that can be performed based on regulations and foreign exchange differences. For securities firms, general currency exchange is allowed only for businesses and limited to four firms. However, if general currency exchange for customers by securities firms is permitted, currency exchange business targeting the public will also become possible.

An official from the banking sector said, “In terms of credit, regulation, capability, and experience, securities firms will not be able to offer customers better exchange rates than banks,” but lamented, “Since many loyal customers are linked to securities firms through investments, foreign exchange customers will inevitably leave banks.” Another banking sector official predicted, “Since the pie remains the same but the number of players has increased, a decline in related profits is inevitable.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.