Tether Daily Trading Volume in February Up 13.88% from Previous Month

Surges 53% Compared to December Last Year

[Asia Economy Reporter Lee Jung-yoon] Recently, as the virtual asset market has revived, the trading volume of stablecoins, which serve as a means of coin transactions, has also increased significantly.

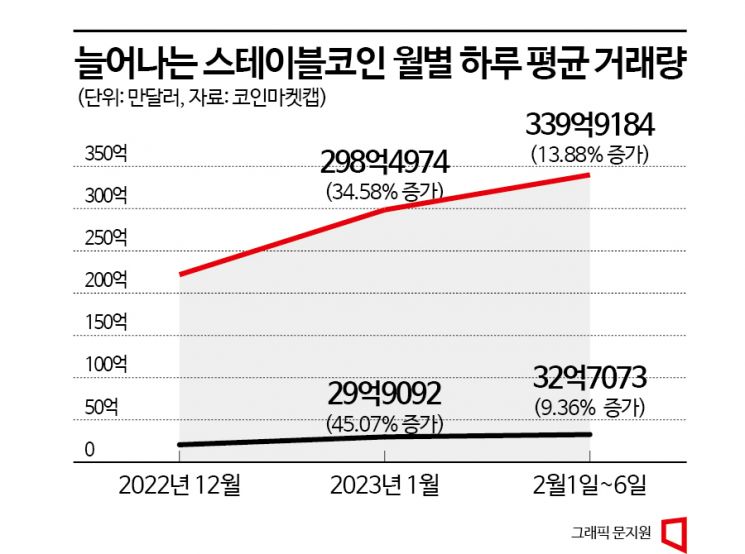

According to CoinMarketCap, a global virtual asset market status relay site, the average daily trading volume of the stablecoin Tether (USDT) from the 1st to the 6th of this month was $33,991.84 million (approximately 42.6836 trillion KRW). Compared to last month's average daily trading volume of $29,849.74 million, this represents an increase of about 13.88%. Compared to December of last year, the increase is even greater. Due to the sluggish coin market in December last year, the volume had dropped to $22,179.63 million, so compared to that time, this month's average daily trading volume surged by 53.26%.

The trading volumes of other stablecoins showed a similar pattern to USDT. USD Coin (USDC) recorded an average daily trading volume of $3,270.73 million (approximately 4.1152 trillion KRW) from the 1st to the 6th of this month, which is a 9.36% increase compared to last month. Compared to December last year, it increased by as much as 58.64%.

The significant increase in stablecoin trading volume is due to growing interest in coins and the revitalization of the market. This occurred as the U.S. Federal Reserve (Fed) began to slow the pace of interest rate hikes. Until December last year, Bitcoin prices remained in the $16,000 to $17,000 range. However, starting from the 12th of last month, prices began to rise, soaring to the $24,000 range on the 2nd of this month. The upward trend continued on that day as well; as of 3:26 PM, Bitcoin was priced at $23,212 (approximately 29.25 million KRW), up 1.12% from the previous day. When Fed Chair Jerome Powell said at the Washington DC Economic Club event on the 7th (local time) that "disinflation has begun," the Nasdaq index, which is technology stock-centered and showed synchronization, also rose.

USDT, the representative stablecoin, is a virtual asset designed to be pegged (fixed) to 1 dollar and is issued by Tether Limited, established in 2014. It emerged due to the fluctuating prices of virtual assets and was developed with the purpose of price stability. It was first popularized in the Bitcoin community by the technical whitepaper of Mastercoin in January 2012.

The circulation process of USDT begins with users depositing fiat currency into Tether Limited's bank account. Then, Tether Limited creates a Tether account for the user and grants credit so that USDT can circulate. The amount of fiat currency deposited by the user and the amount of USDT issued to the user are the same. Users can transfer, exchange, and store the USDT they receive, and if they wish to redeem, Tether Limited burns the USDT and sends fiat currency back to the user's account.

USDT surpasses even Bitcoin, which boasts the highest value among virtual assets, in trading volume. On this day, the 24-hour USDT trading volume exceeded $40 billion, which is more than $10 billion higher than Bitcoin's trading volume of $27 billion. USDC also ranked 5th in trading volume, just below Ethereum, which boasts the largest market capitalization among altcoins.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)