Securities Firms Launch Weekly US Stock Trading Services One After Another

Exclusive Contract Between Samsung Securities and Blue Ocean Alternative Exchange Expires

NH Investment, Kiwoom, Toss, Meritz, and Others Enter the Competition

[Asia Economy Reporter Lee Seon-ae] The path to conveniently trade U.S. stocks during the daytime hours when the Korean stock market is open continues to expand. Samsung Securities introduced the world's first 'U.S. stock daytime trading' service on February 7 last year, and this year, multiple securities firms are entering this service. This became possible as the exclusive contract between Samsung Securities and Blue Ocean Alternative Trading System (ATS) expired. Accordingly, the competition among securities firms to attract 'Seohak Ants' (Korean investors investing in overseas stocks) is expected to intensify.

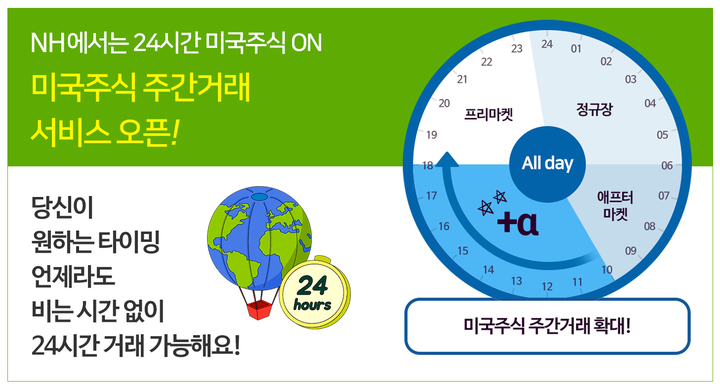

According to the financial investment industry on the 8th, NH Investment & Securities, Kiwoom Securities, Toss Securities, and Meritz Securities will start U.S. stock daytime trading services. NH Investment & Securities began offering 24-hour U.S. stock trading services from this day. This is the first case among domestic securities firms to provide 24-hour trading. Starting with daytime trading (10:00~18:00), it offers a total of 24-hour trading services including pre-market (18:00~23:30), regular market (23:30~06:00), and after-market (06:00~10:00). Daytime trading enables real-time buying and selling through liquidity provision (LP) by global market makers. Currently, daytime trading is open with 5 price levels, and there are plans to expand price quotations to 10 levels in the future.

An NH Investment & Securities official said, "We are the only securities firm in the industry to provide 24-hour overseas stock trading services, allowing customers to trade anytime," adding, "By streamlining the ledger management system to minimize daily settlement time, we secured the longest trading hours domestically." Jung Joong-rak, head of NH Investment & Securities Platform Innovation Division, said, "We will do our best to enhance the competitiveness of our overseas stock platform."

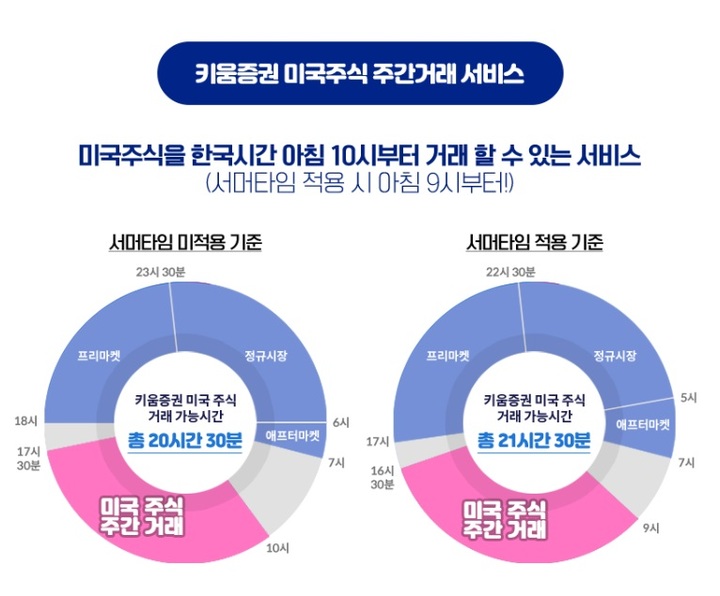

Kiwoom Securities also started U.S. stock daytime trading services from this day. During daylight saving time, it supports U.S. stock trading for up to 21 hours and 30 minutes per day. Previously, based on non-daylight saving time, trading was only possible during pre-market (18:00~23:30), regular market (23:30~06:00), and after-market (06:00~07:00) hours. Now, daytime trading (10:00~18:00, 09:00~17:00 during daylight saving time) has been added. A Kiwoom Securities Global Sales Team official said, "By supporting trading during daytime hours, we have alleviated the time difference inconvenience for customers who found it tiring to trade late at night," and added, "We expanded trading hours so customers can respond more actively to major corporate earnings announcements, disclosures, policies, and other news that usually occur after the U.S. regular market closes."

Toss Securities will expand U.S. stock trading hours starting from the 13th. Trading hours are divided into pre-market (18:00~23:30), regular market (23:30~06:00), after-market (06:00~08:00), and day market (10:00~17:50). In the newly added day market, trading can be done via limit and market orders. The trading method remains the same. Using Korean won-based price information, trading is possible with a 24-hour currency exchange service. If an order is not executed, it continues through pre-market, regular market, and after-market until 8 a.m. the next day. If not executed by after-market, the order is automatically canceled. A Toss Securities official said, "Just as the investment target and method are important, the available trading time is also a crucial factor in investment decisions," adding, "Being able to trade U.S. stocks during the same hours as the Korean stock market will allow investors to compare stocks across sectors and experience proactive investing based on U.S. disclosures and news."

Meritz Securities also announced that it will soon start U.S. stock daytime trading services.

Samsung Securities launched the U.S. stock daytime trading service last year, allowing trading from 10 a.m. to 5:30 p.m. At that time, Samsung Securities signed a one-year exclusive contract with Blue Ocean, the only alternative trading system approved by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) to support the 'Overnight Session' function. With the expiration of this contract, other securities firms now have the opportunity to offer this service. Mirae Asset Securities has been providing daytime trading services since October last year using a local subsidiary.

An official from the financial investment industry said, "As major domestic securities firms compete to launch U.S. stock daytime trading services one after another, the competition to attract Seohak Ants is expected to heat up further," and added, "Moreover, Seohak Ants will be able to choose securities firms that suit their preferences, which is expected to further activate overseas stock investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)