Maintained No.1 in Exports

Clear Growth in China...Thanks to Electric Vehicles

Toyota and Others Set Electrification Plans

"Obsessed with Hybrid Shift like Prius"

Japanese Government's Passive Response Also a Problem

"Korea Needs Tax Benefits and More"

[Asia Economy Reporter Oh Gyumin] Amid intensifying competition in the electric vehicle (EV) market, the Japanese automobile industry is showing a ‘turtle-like’ pace. Analysts attribute this to Japan’s adherence to a hybrid strategy and delayed government response due to concerns over job losses within the country following electrification.

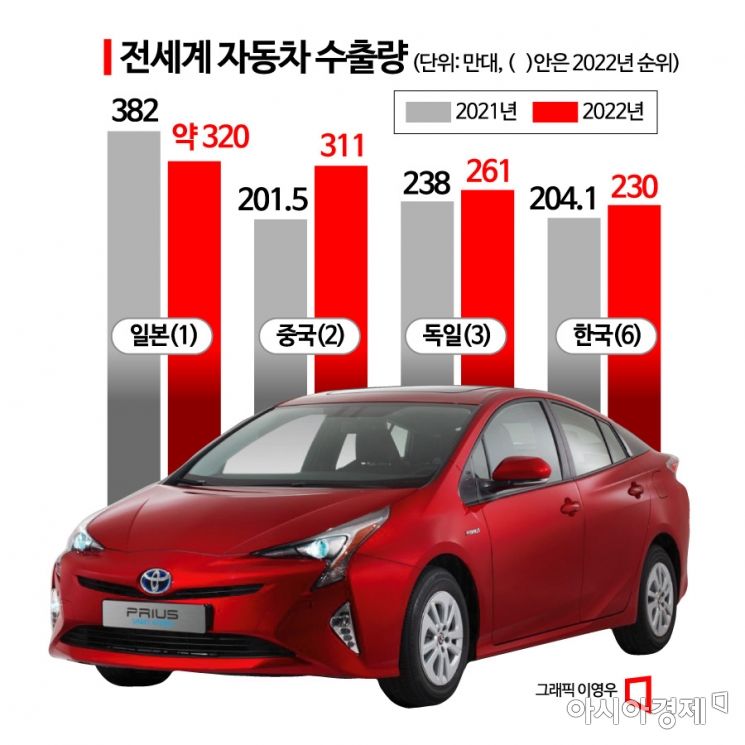

Japan maintains its position as the top automobile exporter. However, China’s growth is formidable. From January to November last year, Japan exported approximately 3.2 million vehicles, a decrease from 3.82 million units exported in 2021. In contrast, China’s exports rose by 54.4% year-on-year to 3.11 million units, surpassing Germany (2.61 million units) to claim the second spot in automobile exports. South Korea recorded 2.3 million units, marking a 13.3% increase compared to the previous year.

The driving force behind China’s growth is electric vehicles. New Energy Vehicle (NEV) exports?which include both pure electric vehicles and plug-in hybrids?increased by 120% year-on-year to 680,000 units, accounting for 21.8% of total automobile exports. The export destinations have also shifted. Previously, China’s automobile exports were mainly to countries with lower per capita income or politically close ties. Recently, the expansion into the European market through eco-friendly vehicles has increased. In 2016, Iran, India, and Vietnam ranked first to third among export countries, but last year Belgium, Chile, Australia, and the United Kingdom occupied the top positions.

Japan is struggling in the electric vehicle market. Toyota ranked first globally last year with 10.48 million new car sales. However, in the EV market, it failed to enter the top 10 companies, trailing behind U.S. Tesla, China’s BYD, and South Korea’s Hyundai and Kia. Toyota’s EV sales amounted to 24,466 units. Honda also recorded only 1,273 EV sales across 10 European countries last year, capturing a mere 0.1% market share.

Despite this, Japan is belatedly preparing for the transition to electric vehicles. Honda is the most proactive, announcing plans to establish a dedicated EV division called the ‘BEV Development Center,’ separating EV development personnel from the internal combustion engine division. Additionally, Honda showcased its first EV, the Afeela, co-developed with Sony, at CES 2023, the world’s largest electronics and IT exhibition. Toyota also replaced its president for the first time in 14 years and announced plans to build a dedicated EV platform. Previously, Toyota’s EV platform shared some structural components with internal combustion and hybrid vehicles.

Nevertheless, the pace of electrification in the Japanese automobile industry is considered slow. Even Honda, the most aggressive player, plans to introduce its first EV domestically only by 2026. Toyota has set a goal to increase global EV sales to 3.5 million units by 2030, which is 143 times last year’s sales volume. Experts predict achieving such figures within seven years will be challenging.

Analysts suggest that the Japanese automobile industry has been complacent due to the success of hybrids. Toyota’s hybrid vehicle ‘Prius’ debuted in October 1997 and surpassed 1 million cumulative global sales within 10 years. By January 2017, it had exceeded 10 million units. The Prius became synonymous with hybrid vehicles. Subsequently, Japanese companies like Honda (Insight) focused heavily on hybrid vehicle production.

Due to this success, companies that produced the world’s first commercial electric vehicle (Nissan Leaf) had little incentive to aggressively produce EVs. Professor Kim Pilsoo of Daelim University stated, “The success of the hybrid strategy, combined with Japan’s unique cultural ‘exclusivity,’ delayed their transition to electrification.”

The Japanese government’s slow national response to EVs also played a role. Authorities’ passive policies, driven by concerns over job losses from EV production, influenced Japanese companies. Professor Kim explained, “As EV production increases, the manufacturing process is shorter and the number of parts is reduced compared to internal combustion and hybrid vehicles.”

South Korea also needs proactive government measures to survive the EV competition. Although South Korea’s automobile exports increased last year compared to the previous year, its ranking is expected to drop from 5th to 6th. EV exports reached 210,000 units, accounting for 11% of total automobile exports and gradually increasing, but tax incentives remain insufficient. Domestically, EV factories are classified under general manufacturing technology, with an investment tax credit rate limited to 1%. In contrast, the U.S. offers over 30% tax credits. Additionally, semiconductors, batteries, and displays are classified as national strategic technologies, granting up to 15% tax credits for large corporations, but the automobile industry, including EVs, is excluded.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)