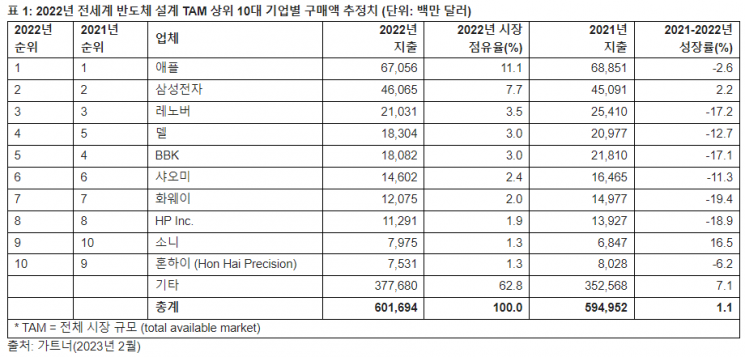

2021 Top 10 Companies' Purchase Amounts Totaled $224 Billion

[Asia Economy Reporter Kim Pyeonghwa] Last year, the purchase amount of the top 10 semiconductor customers decreased due to the economic recession. Many companies recorded a negative growth in purchase amounts compared to the previous year. However, Samsung Electronics saw a slight increase in purchase amount by expanding its mobile business.

On the 7th, market research firm Gartner announced that the semiconductor chip purchase amount of the world's top 10 original equipment manufacturer (OEM) companies last year was $224.014 billion, down 7.6% from the previous year. This accounts for 37.2% of the total chip purchase amount of all OEM companies.

Gartner attributed the market impact to global inflation and economic recession. It also added that as demand for PCs and smartphones rapidly declined last year, global OEM companies were unable to increase unit production and shipment volumes. In fact, most of the top 10 semiconductor customers are PC and smartphone-related OEMs.

Masa Tsune Yamaji, Senior Director Researcher at Gartner, said, "China's zero-COVID policy caused severe material shortages and short-term supply disruptions in the electronic component supply chain." He added, "As semiconductor shortages appeared in the automotive, network, and industrial electronics markets, the average selling price (ASP) of semiconductor chips rose, and semiconductor sales in related markets increased sharply," explaining that "this led top OEM companies to reduce their overall semiconductor spending last year."

Among the top 10 semiconductor customers, Apple (1st), Samsung Electronics (2nd), Lenovo (3rd), Xiaomi (6th), and HP (8th) maintained the same rankings as the previous year. Among them, only Samsung Electronics increased its chip purchase amount by 2.2% compared to the previous year. By increasing its smartphone market share centered on foldable products, semiconductor chip spending rose.

Researcher Yamaji analyzed, "Memory, which accounted for 25% of semiconductor sales last year, recorded the worst performance in the device sector, with sales decreasing by 10% due to a sharp price drop in the second half amid weak demand." He continued, "The share of the top 10 OEM companies in total memory spending was only 49.2%, meaning that the scale of memory spending significantly decreased as a result."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)