Venture Capital-Invested Funds

Investment Recovery Hindered by IPO Market Slump

Focus on Secondary Funds Investing in Unlisted Shares

[Asia Economy Reporter Kwangho Lee] Venture capitalists (VCs) are under intense pressure. This is because the number of funds maturing this year is rapidly increasing. They need to exit investments and liquidate funds, but the situation is challenging.

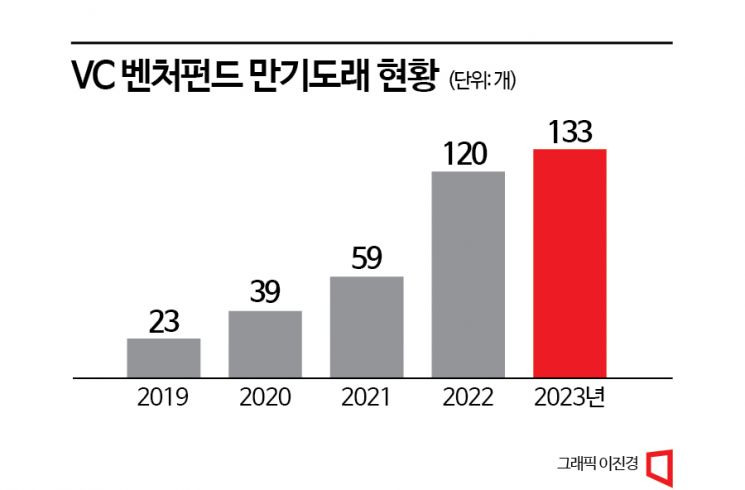

According to statistics from the Korea Venture Capital Association on the 8th, the scale of funds maturing this year amounts to 3.4421 trillion KRW (133 funds). Considering that many funds were forced to extend their maturity last year without liquidation, the scale and number are expected to increase further.

The more funds are raised in a year, the larger the scale of maturing funds naturally becomes. Last year, a record-breaking amount of over 9 trillion KRW in funds was raised. By around 2028, the scale of maturing funds is expected to grow even more.

The scale of maturing funds has been increasing annually, with 1.27 trillion KRW (59 funds) in 2021 and 2.9482 trillion KRW (120 funds) in 2022. Most funds maturing this year were formed around 2013 to 2015. Typically, the lifespan of a venture fund is set at 7 to 8 years. During this period, they support the growth of invested companies and aim to exit through initial public offerings (IPOs) or other means. The problem is that recent stock market sluggishness has made IPOs difficult.

Most of these are general partners (GPs) who formed funds after securing capital through limited partners (LPs). They have the obligation to recover investments and distribute returns to the LPs. Therefore, they must actively pursue IPOs for invested companies or consider mergers and acquisitions (M&A).

Of course, there are other methods besides IPOs and M&A. A representative example is the ‘secondary fund,’ which mainly invests in existing shares held by previous funds. The secondary market, which represents intermediate exits, is growing steadily. As of September last year, there were 29 secondary funds. This is about double the usual annual formation of around 15 secondary funds.

VCs holding maturing funds tend to try to meet fund returns by selling shares of invested companies that have not yet reached the listing stage. This situation creates opportunities for secondary funds. Accordingly, the number of venture capitals planning new secondary funds this year is increasing.

Yuanta Investment is pushing to form a secondary fund of around 50 billion KRW. Kiwoom Investment is also reviewing the formation of a new secondary fund. Interest is high in how these efforts will turn out, given that secondary funds recorded meaningful returns after past economic downturns.

A venture capital industry insider said, “Because numerous venture funds have been launched in recent years, concerns about exits are naturally growing day by day. The intermediate exit market to absorb the scale of maturing funds is still at a minimal level compared to the size of maturing funds.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)