LG Electronics with an 'Omnidirectional Portfolio' in Automotive

LS and LX Groups Also Drive Automotive Sector

Full-Scale Absorption of Vehicle Waiting Demand This Year... Growth Expected to Continue

[Asia Economy Reporter Han Ye-ju] LG Group is seeking new opportunities through its automotive electronics business. The LS and LX groups, which are classified as part of the broader LG family, are doing the same. Automotive electronics refers to the automotive electrical and electronic equipment business, a sector expected to steadily grow despite the global economic downturn. Attention is focused on whether LG, a latecomer, can develop automotive electronics into a core business within a few years.

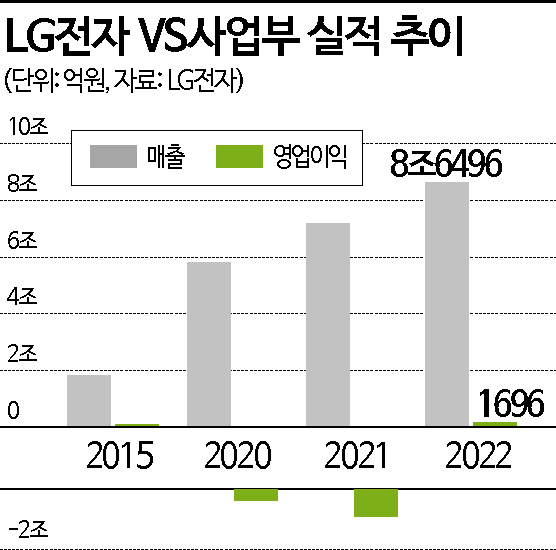

Recently, LG Group's automotive electronics business has grown rapidly. The VS Business Division of LG Electronics, responsible for the automotive electronics business, recorded annual sales of 8.6496 trillion KRW last year. For the first time, the automotive electronics business accounted for more than 10% of total sales. Annual operating profit reached 169.6 billion KRW, marking a successful turnaround. This is the result of ten years of investment.

LG Electronics' flagship automotive electronics business is in the infotainment equipment sector, including automotive navigation systems. In addition, the company is expanding its automotive electronics business across three main areas: electric vehicle powertrains, lighting, and infotainment. Starting this year, it is expected to enter a growth phase by increasing production capacity for electric vehicle drive components supplied to global automakers. As of the end of last year, LG Electronics' automotive electronics order backlog stood at around 80 trillion KRW. Industry insiders predict that the order backlog will reach 100 trillion KRW by the end of this year.

Kim Kwang-soo, a researcher at Ebest Investment & Securities, said, "Despite the economic slowdown, the automotive electronics business continues to see increasing order volumes, raising growth expectations," and projected the VS Business Division's operating profit for this year at 347 billion KRW.

LG Innotek, which produces automotive motors, sensors, and camera modules, also saw its automotive components business become a pillar of its performance. Last year's sales in the automotive components business increased by 45% year-on-year to 421.4 billion KRW, continuing six consecutive quarters of sales growth. The company explained that rising demand related to electric and autonomous vehicles led to increased sales, mainly in motors. This year, LG Innotek plans to focus on improving profitability by pursuing orders centered on high-value-added products.

LG Display identified vehicle sound solutions as a "market-creating business" alongside the automotive display market. This technology uses film-type speakers installed on ceilings and dashboards to reduce sound quality disparities depending on passenger seating positions.

The LS Group, part of the broader LG family, has also strengthened its organizational capabilities in electric vehicle-related businesses. Electric vehicle-related business is a new growth engine identified by LS Group Chairman Koo Ja-eun. LS EV Korea, a subsidiary of LS Cable & System specializing in electric vehicle parts, manufactures components that supply power to electric vehicles and operate and control sensors. Additionally, it supplies wiring harnesses for electric vehicles, battery pack components, and energy storage system (ESS) parts to global automakers such as Volkswagen and Volvo, as well as to LG Chem.

LX Group is expanding its business centered on LX Semicon, a fabless semiconductor design affiliate. It is developing power semiconductors, microcontroller units (MCUs), and heat dissipation substrates used in automotive parts. In June last year, it acquired a 10.9% stake in Telechips, a vehicle semiconductor company, for 26.8 billion KRW, becoming the second-largest shareholder. It also secured the authority to appoint directors to promote business cooperation such as research and development.

This year, LG Group's automotive electronics business growth is expected to be even more pronounced. As the backlog demand caused by the semiconductor supply shortage is fully resolved, performance is anticipated to improve significantly. The Korea Automotive Technology Institute forecasted in its '2023 Automotive Industry Outlook' report that "Although the global economic slowdown this year is expected to negatively impact new automobile demand sensitive to economic conditions, overall demand will increase due to the easing of semiconductor supply and the effect of backlog orders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)