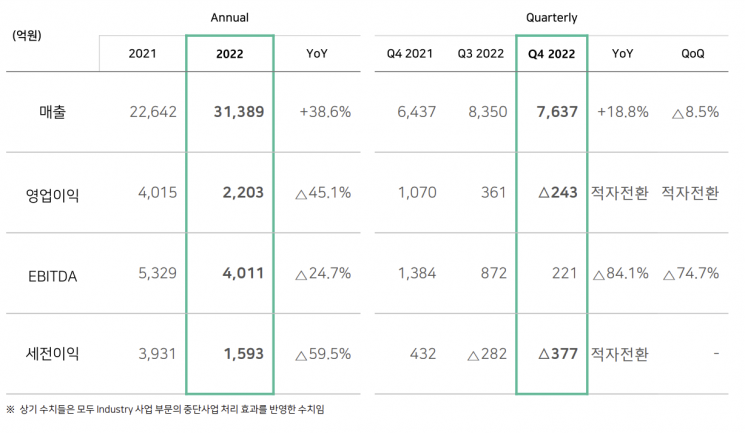

Sales of 3.1389 trillion KRW and Operating Profit of 220.3 billion KRW

[Asia Economy Reporter Choi Seoyoon] SKC announced on the 6th that it achieved consolidated sales of KRW 3.1389 trillion and a profit of KRW 220.3 billion last year. Sales increased by 38.6% compared to the previous year, but operating profit decreased by 45.1%.

The decline in operating profit is due to the sluggish chemical business. This year, the chemical business segment's operating profit was KRW 140.9 billion, down 57.6% from KRW 332.2 billion the previous year. SKC stated, "In the case of propylene oxide (PO), a basic raw material for the polyurethane (PU) industry, the spread fell to the lowest level due to China's zero-COVID policy and continued weak demand," adding, "For propylene glycol (PG) and polypropylene glycol (Polyol), oversupply and the global economic downturn caused profits to decline."

Operating profits from future growth businesses such as secondary battery materials and semiconductor materials all increased. The secondary battery materials business, centered on SK Nexilis, a copper foil business investment company, recorded sales of KRW 810.1 billion and operating profit of KRW 98.6 billion last year. Thanks to the operation of the Jeongeup Plant 6 equipped with the latest smart factory facilities, both sales and operating profit increased compared to the previous year, continuing the growth trend. SK Nexilis plans to complete its Malaysia plant by the end of this year and expand mid- to long-term supply contracts with global battery manufacturers to further grow its scale and profitability.

The chemical business, centered on SK PIC Global and SK PU Core, recorded sales of KRW 1.7046 trillion and operating profit of KRW 140.9 billion last year. Despite the overall sluggish chemical market conditions, sales increased by 54.7% compared to the previous year. This year, the company plans to continue its growth by expanding long-term supply of high value-added products mainly in North America and Europe. In November last year, SKC commercialized the world's first standalone process for DPG, a high value-added eco-friendly material, and in December, it became the first in the industry to obtain official quasi-noncombustible material test results for polyurethane insulation materials, steadily securing future growth engines for the chemical business.

The semiconductor materials business, centered on SK Enpulse, recorded sales of KRW 598.2 billion and operating profit of KRW 28.8 billion last year. Despite the global semiconductor market downturn, sales and profits grew together by increasing sales of high-margin products such as CMP pads. The proportion of high value-added growth business products, including CMP pads, in total semiconductor materials sales increased from 21% in 2021 to 36% last year. SKC plans to further expand the proportion of high value-added growth business products such as blank masks this year and proceed smoothly with the construction of a semiconductor glass substrate production plant.

An SKC official said, "After completing the sale of the film business last year, SKC will start to realize its 'global story' by completing the Malaysia copper foil plant and the US semiconductor glass substrate plant this year," adding, "Despite the difficult domestic and international business environment, we will continue to innovate toward becoming a global ESG materials solution company by expanding investments in future growth engines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)