①Large Incentives from US IRA... Korea Limited to Small Amounts

"Need to Attract Korean and Foreign Companies through Large-Scale Deregulation"

[Asia Economy Reporter Yoo Hyun-seok] South Korea is falling behind in the competition for leadership in the future car industry. While countries around the world are making great efforts to attract future car production facilities by offering massive benefits and growth potential, Korea appears to be standing still. Experts point out the need to strengthen administrative and financial support at the government-wide level and create an environment conducive to investment.

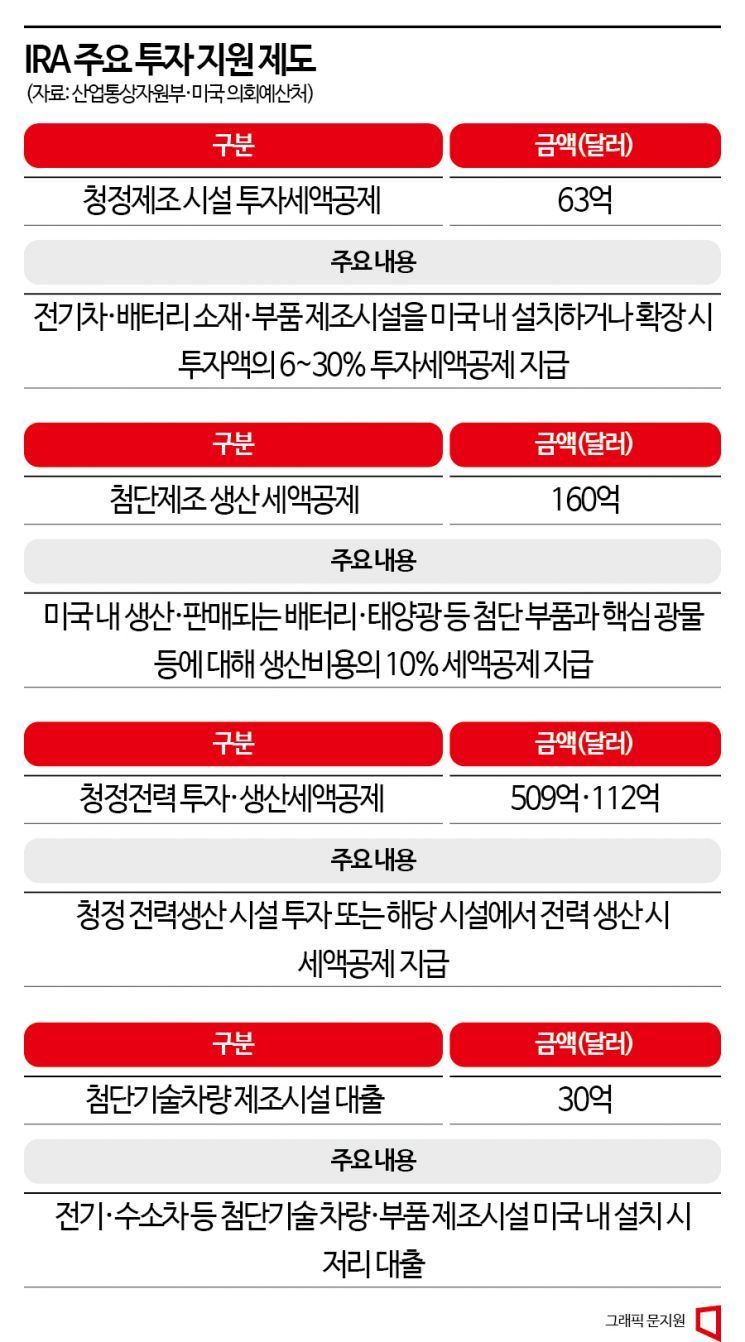

The most proactive country in future cars is the United States. Through the Inflation Reduction Act (IRA) introduced last year, the U.S. offers a tax credit of up to 30% for building electric vehicle factories. In contrast, South Korea offers only 1% (5% for medium-sized enterprises, 10% for small businesses).

Let’s compare the benefits Hyundai Motor Group receives in the U.S. and Korea as it begins building electric vehicle factories in both countries, aiming for operation in 2025. Hyundai Motor Group plans to invest 6.3 trillion won in Georgia, USA, to build an electric vehicle-only factory with an annual capacity of 300,000 units, along with parts and battery cell factories. The U.S. classifies electric vehicle factories as clean manufacturing facilities and offers tax credits ranging from 6% to 30% of the investment amount.

Additionally, a certain amount of costs are refunded when using clean electricity. On top of that, trillions of won can be borrowed early through federal government loan and guarantee programs. State-level support is also generous. Local media reported that the Georgia state government has set incentives worth $1.8 billion (about 2.2 trillion won). Not only are taxes reduced, but infrastructure such as roads and water supply is directly managed at the state government level.

Domestically, about 3 trillion won will be spent to build electric vehicle-only factories in Ulsan (Hyundai) and Hwaseong (Kia), but the scale of support is far too small. In Korea, electric vehicle factories are classified under general manufacturing technology. The tax credit rate for investment is 1%. In the U.S., it is 30% plus alpha, which means 300 billion won per 1 trillion won invested, but domestically, even if 1 trillion won is invested, only 10 billion won is credited.

Compared to other future industries in Korea, electric vehicles are treated like a stepchild. Semiconductors, batteries, and displays are classified as national strategic technologies, and large companies can receive tax credits of up to 15%. This year, it can go up to 25%. When measured by sales by industry, automobiles account for about 12% of total manufacturing, making it the largest single industry. The future of automobiles is electric vehicles. There is a call to pay more attention to the future of Korea’s largest industry.

Of course, the government decided earlier this year to introduce a temporary investment tax credit, raising the general technology credit rate to 3%, but the gap with the U.S. remains large. Moreover, since this is a legislative matter, it has no effect if it is not passed by the National Assembly. Both new factories in the U.S. and Korea will begin construction this year.

The labor market, represented by strong unions, is also a factor that discourages investment. According to the World Economic Forum (WEF) survey, South Korea ranks 97th out of 141 countries in labor flexibility. Korea’s hourly labor productivity was $41.7 (about 52,000 won, based on 2021), ranking 29th among 38 OECD member countries.

The reluctance of foreign automakers operating factories in Korea to transition to electric and other future vehicles appears to stem from similar reasons. Under the Foreign Investment Promotion Act, if Korea GM or Renault Korea Motors invest domestically at the headquarters level, cash support is possible at a certain rate. However, there is debate over whether electric vehicles can be considered eligible under current laws, and support is limited to new or expanded facilities, making it virtually impossible to receive support when converting existing facilities.

South Korea ranks fifth worldwide in automobile production and exports. However, due to limited national-level support and low labor flexibility, companies inevitably have less incentive to invest.

According to data compiled by the Korea Automotive Technology Institute, Korea’s budget for future cars over five years is about 5 trillion won, while the U.S. budget reaches 400 trillion won. Kim Joo-hong, executive director of the Korea Automobile Manufacturers Association, said, "The U.S. and Europe are trying to nurture their industries domestically." He added, "Korea also needs to provide more tax credits for future cars like it does for semiconductors and actively ease regulations on foreign companies."

There are calls to enact a special law for fostering and supporting the future car industry or to designate it as a national strategic technology to enhance the effectiveness of support, but there is no active movement inside or outside the National Assembly or government. Recently, the ruling party, after consultations with the government, is preparing to propose a future car special law, but it is reported that this bill targets small and medium-sized enterprises.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.