100 Billion Won Medifood Market

Rapid Growth Through Aging Population and COVID-19

Bright Market Outlook... Companies Also Entering One After Another

The demand for 'specialized medical purpose foods (Medifood)' for patients and those requiring health management is rapidly increasing, leading to a booming related market. This is mainly attributed to the heightened interest in health following COVID-19 and the accelerated aging process in South Korea. The government's proactive support measures have also played a role.

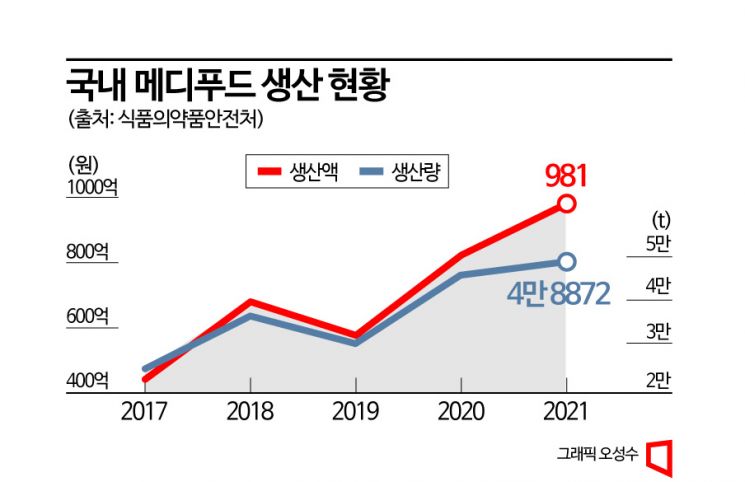

According to the Ministry of Food and Drug Safety and others on the 2nd, the production value of Medifood reached 98.1 billion KRW in 2021, a 19% increase compared to the previous year (82.3 billion KRW). During the same period, production volume also rose by 6.8% to 48,872 tons from 45,762 tons the previous year. This is the highest level in the past five years. The industry expects that last year’s production value exceeded 100 billion KRW, setting a new record. Medifood production value surged by 53.7% from 44.2 billion KRW in 2017 to 68 billion KRW in 2018, then declined to 57.7 billion KRW in 2019. However, growth accelerated again in 2020, expanding the market size.

The rapid aging of the domestic population is a key factor behind Medifood’s growth. As the elderly population increases and chronic disease patients rise accordingly, the demand for easy nutritional management has also grown. Naturally, it has become common for patients hospitalized for surgery or disease treatment to consume Medifood in hospitals or nursing hospitals.

Additionally, since December 2019, government-level market development policies have been implemented, such as the Ministry of Agriculture, Food and Rural Affairs and the Ministry of Food and Drug Safety selecting Medifood as one of the five promising food sectors. In 2020, the Ministry of Food and Drug Safety classified Medifood as an independent food category and established a new type called ‘dietary management food for chronic disease patients,’ continuously creating standards and specifications. Accordingly, if certain criteria set by the Ministry are met, companies can market their products using the label 'patient food,' which has served as an incentive for businesses. The standard manufacturing criteria for specialized medical purpose foods are expected to expand from the current seven types to a total of twelve by 2026.

Medifood produced domestically is mostly consumed within South Korea. Exports are low, but imports have steadily increased, with import value rising in line with the domestic market growth. In 2021, Medifood imports amounted to 3.17 million USD, a 69% increase from 1.87 million USD in 2017. The global Medifood market is also continuing its growth trend. The global Medifood market size in 2021 was 7.8 billion USD, a 4.1% increase from 7.4 billion USD the previous year. Compared to 6.7 billion USD in 2017, this represents a 16.3% increase. The industry expects the global Medifood market to grow at an average annual rate of about 7.95% going forward.

Companies are also actively moving to capture the domestic market. Pulmuone Foods introduced diet-type foods for cancer patients through its customized diet management brand 'Design Meal.' It consists of a total of 10 menus for two meals a day, with saturated fat less than 7% of calories, protein over 18% per meal, and sodium below 1350 mg. These meet the Ministry of Food and Drug Safety’s dietary standards for cancer patients. The diet is designed to provide sufficient nutrition in one meal, considering the single serving size for cancer patients and cancer survivors.

Ourhome has also entered the Medifood development business in earnest. Ourhome will lead a research project under the Rural Development Administration’s Food Technology Planning and Evaluation Institute by 2025. The project aims to industrialize Medifood for cancer patients that promotes digestion and nutritional supplementation after surgery for gastrointestinal cancer patients. As the lead research institution, Ourhome will establish nutritional standards for gastrointestinal cancer patients and design diets and products. Based on this, they will develop diets, cooking methods, and products tailored for cancer patient recovery.

Hyundai Green Food provides customized diets through its personalized health diet brand Greeting in a subscription format. In addition to care foods such as calorie-controlled diets and longevity village diets, it launched 24 types of diabetic diets last year. Each meal consists of five side dishes and is delivered as home meal replacements tailored for consumers who need to manage blood sugar levels. Since its launch, the Greeting diabetic diet subscription has grown by an average of 15% monthly, with a repurchase rate exceeding 50%.

An industry insider said, "With support measures and regulatory easing following, the Medifood market has become an attractive market," adding, "As demand continues steadily, competition for market share through product competitiveness and diversification will become even more intense."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.