Price fluctuation range changed from 63~260% to 60~400%

Financial Services Commission approval obtained, policy to revise work regulations within the year

[Asia Economy Reporter Son Sun-hee] A plan is being promoted to allow the stock price of newly listed stocks on the stock market to rise up to 4 times in one day. The purpose is to reflect investors' intentions as much as possible for rookie stocks that are being valued for the first time in the market.

According to the Korea Exchange on the 1st, the price fluctuation range on the listing day for stocks newly listed after an initial public offering (IPO) will be expanded from the existing 63~260% to 60~400%. Son Byung-doo, the chairman of the exchange, held a press conference at the exchange's Seoul office conference hall the day before and said, "We will improve the system to sufficiently widen the price fluctuation range on the listing day to quickly find the (appropriate) price."

The price limit for general listed stocks is 30%. Among these, rookie stocks that attract investors' attention can have their prices rise up to 260%. The so-called 'Ttang-sang', where the opening price is set at twice the public offering price and then rises to the maximum limit during the day, falls under this category.

The problem is when the stock hits the upper limit price and there is no selling volume, so the trading ends as is. Even though investors want to invest, trading is effectively halted due to the price limit. From the perspective of the listed company, there may be dissatisfaction that the corporate value is not fully recognized because of the price limit.

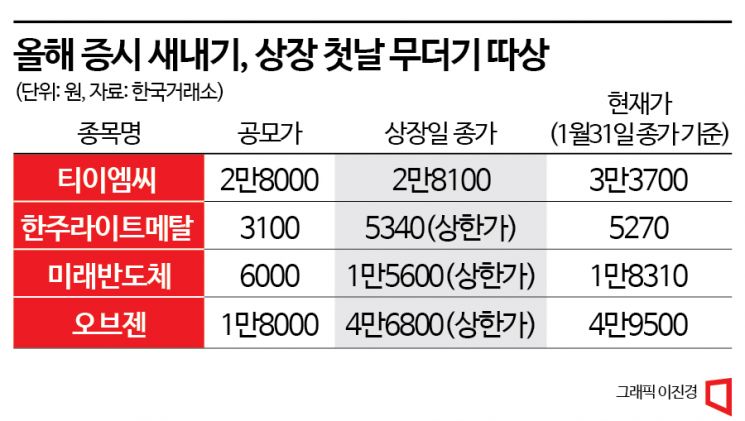

Looking at the stock price trends on the listing day of companies listed this year, three out of four reached the upper limit price on the first day and ended trading as is. In particular, Mirae Semiconductor and Obzen recorded 'Ttang-sang' as their opening price reached twice the public offering price. After that, the stock price rose further, forming a price about three times higher than the public offering price (based on the closing price on January 31). Although the public offering price is decided through procedures such as demand forecasting, there was a large gap from the actual market evaluation.

With the system reform, the stock price is expected to rise more sharply than the 'Ttang-sang-sang', which hits the upper limit price until the day after listing. Assuming the public offering price is 10,000 won, under the existing system, if 'Ttang-sang' and 'Ttang-sang-sang' are achieved consecutively, the stock price rises to 33,800 won in two days. After the system changes, it will be possible to reach 40,000 won in just one day on the listing day.

The exchange plans to revise the business regulations within the year after obtaining approval from the Financial Services Commission. An exchange official said, "Before the system reform, we will also go through a process of gathering opinions from market investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.