Annual Sales Reach Record High of 302 Trillion

Q4 Semiconductor Operating Profit Down 96.9%... Earnings Shock

"This Year's Investment at Last Year's Level"

[Asia Economy Reporter Han Yeju] Samsung Electronics opened the era of annual sales exceeding 300 trillion KRW for the first time in history last year. However, it failed to achieve the expected operating profit of 60 trillion KRW. This was due to a fourth-quarter earnings shock caused by sluggish performance in its core business, memory semiconductors.

Nevertheless, Samsung Electronics decided to maintain its stance of 'no artificial production cuts.' Rather than focusing on short-term profitability improvement, the company plans to continue mid- to long-term investments for future businesses.

'Semiconductor Cold Wave' Hits Mobile and Home Appliances... 'Double Whammy'

Samsung Electronics announced on the 31st that its consolidated sales last year reached 302.2314 trillion KRW, an 8.09% increase compared to the previous year. This is the highest sales ever recorded. However, operating profit during the same period decreased by 15.99% to 43.3766 trillion KRW.

Operating profit in the fourth quarter of last year was 4.3061 trillion KRW, down 68.95% from the same period last year. This is the first time in over eight years since the third quarter of 2014 (4.06 trillion KRW) that Samsung Electronics' quarterly operating profit has remained in the 4 trillion KRW range. Fourth-quarter sales decreased by 7.97% to 70.4646 trillion KRW.

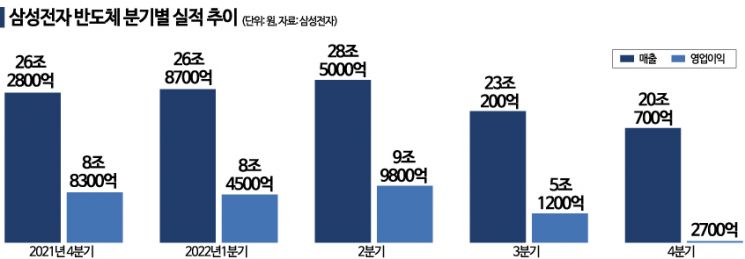

Looking at each division, the DS Division recorded fourth-quarter sales of 20.07 trillion KRW and operating profit of only 270 billion KRW. Operating profit plummeted 96.9% compared to the same period last year, barely avoiding a loss. The memory market faced the worst conditions ever, and ongoing inventory adjustments by customers dealt a blow to performance declines.

The DX Division posted fourth-quarter sales of 42.71 trillion KRW and operating profit of 1.64 trillion KRW, down 4% and 51.8% respectively from the previous year. The MX segment recorded operating profit of 1.7 trillion KRW, a 36.1% decrease year-on-year, due to a slowdown in smartphone sales and weak demand in the mid- to low-end market. The VD and home appliance segment recorded a quarterly operating loss of 60 billion KRW. It is the first time in over seven years since the first quarter of 2015 that the VS and home appliance business division has posted a loss.

Samsung Display (SDC) recorded fourth-quarter sales of 9.31 trillion KRW and operating profit of 1.82 trillion KRW. Although small- and medium-sized display performance declined compared to the previous quarter due to reduced smartphone demand, strong sales centered on flagship products resulted in solid performance.

Samsung Electronics expects that global IT demand weakness and semiconductor market downturn will continue in the first quarter of this year. Securities firms predict that Samsung Electronics' semiconductor division will post an operating loss of 2.5 trillion KRW in the first quarter of this year.

In response, Samsung Electronics stated, "Demand is expected to temporarily weaken in the first half of this year due to economic slowdown and customer inventory adjustments," but added, "We expect demand recovery in the second half based on high-performance computing (HPC), data centers, and automotive semiconductors."

Reaffirming 'No Artificial Production Cuts'... "Mass Production of 2nd Generation 3nm in 2024"

Although there were growing expectations that Samsung Electronics would cut production in the semiconductor division due to worsening performance, the company reaffirmed its existing position of 'no artificial production cuts' on this day.

Samsung Electronics said, "Although the market downturn is not favorable for immediate performance, we believe it is a good opportunity to prepare for the future," and added, "In conclusion, this year's CAPEX (capital expenditure) will be at a level similar to last year."

However, regarding memory production, the company stated, "We are strengthening production line maintenance and equipment relocation to ensure the highest quality and optimize line operations," adding, "In the short term, a meaningful scale of bit growth (memory production increase rate) impact is inevitable."

Samsung Electronics plans to strengthen competitiveness by leading with the next-generation transistor structure GAA (Gate-All-Around) applied to nanoprocess-based foundry (semiconductor contract manufacturing).

Samsung Electronics explained, "We are the world's first to mass-produce the 1st generation 3nm process with stable yield," and added, "The 2nd generation 3nm foundry process will be mass-produced as scheduled in 2024." The company emphasized, "Many mobile and HPC (high-performance computing) customers have shown interest," and "We are rapidly developing based on the experience of 1st generation mass production."

Regarding the foundry plant being built in Taylor City, USA, Samsung Electronics conveyed that it will maintain the existing plan. The company stated, "We plan to mass-produce 4nm in the second half of 2024 as originally planned."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)