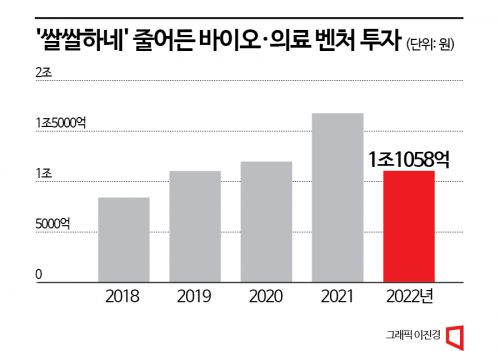

[Asia Economy Reporter Chunhee Lee] Last year, venture capital (VC) investments in the domestic bio and medical sectors decreased by 34% compared to the previous year. Amid a global sharp decline in investments in bio ventures, there are calls for large pharmaceutical companies, which secured financial capacity through the COVID-19 pandemic, to engage in collaboration through open innovation.

According to the '2022 Domestic and International Bio Venture Investment Trends' report published on the 31st by the Korea Bio Association's Bio Economy Research Center, investments in bio ventures across the US, Europe, and Asia, including South Korea, significantly decreased last year. Analyzing the BCIQ database from BioCentury, a US bio industry specialized media, the Bio Economy Research Center found that the US saw bio venture investments of $26.4 billion (approximately 32 trillion KRW) last year, down 22.8% from the previous year. The Asia-Pacific region also decreased by 12.3% to $7.1 billion (approximately 8.733 trillion KRW). Particularly, Europe’s investment halved to $4 billion (approximately 4.92 trillion KRW) from $8.6 billion the previous year, a 53.5% drop.

Of the $7.1 billion invested in the Asia-Pacific region, including South Korea, more than half, $3.78 billion (approximately 4.6494 trillion KRW), was invested in China alone. This means that China’s investment volume was comparable to the entire European region.

Domestically, according to the Ministry of SMEs and Startups, VC investments in the bio and medical sectors amounted to 1.1058 trillion KRW last year, down 34.1% from 1.677 trillion KRW the previous year. After four consecutive years of growth since 2018, when the total investment was 841.7 billion KRW, the total investment scale decreased for the first time last year. Quarterly analysis shows that the first quarter saw 413.7 billion KRW, an increase of 48.9 billion KRW compared to the same period last year, but investments sharply froze from the second quarter onward. The second quarter recorded 156.1 billion KRW, the third quarter 203.7 billion KRW, and the fourth quarter 260.3 billion KRW, all showing decreases compared to the same periods last year. Especially in the third and fourth quarters, the investment scale shrank by more than half compared to the previous year.

The sharp reduction in investment scale is attributed to factors such as the decline in stock prices of listed bio companies and the strengthening of technology special listing review processes, which led to fewer cases of technology special listings.

The Bio Economy Research Center stated, "Meanwhile, multinational pharmaceutical companies’ financial capacity is at an all-time high, and cash assets of large and mid-sized domestic bio pharmaceutical companies are also on the rise." They added, "The decrease in investments and valuation drops in bio ventures can serve as an opportunity to expand cooperation opportunities such as investments, technology transfers, and mergers and acquisitions (M&A) with existing large and mid-sized companies. Therefore, open innovation between large and small companies is more necessary than ever."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)