LG Energy Solution and Samsung SDI Record Highest Ever Earnings

Production Bases and Next-Generation Technology Development Accelerate

SK On Faces Continued Losses and Delayed Facility Expansion

[Asia Economy Reporter Oh Hyung-gil] Battery companies are consecutively setting new performance records amid the popularization of electric vehicles. Despite concerns about demand slowdown and news of joint venture failures, they appear confident in continuous growth as they have secured long-term orders. However, SK On, which has been continuously posting losses, has yet to escape the dark clouds, resulting in mixed fortunes among companies.

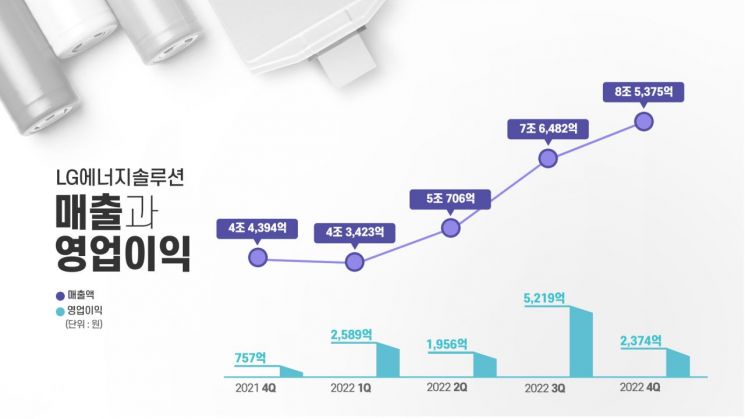

LG Energy Solution and Samsung SDI each surpassed KRW 25 trillion and KRW 20 trillion in sales last year, respectively, accelerating their growth. LG Energy Solution achieved KRW 25.5986 trillion in sales and KRW 1.2137 trillion in operating profit last year, marking increases of 43.4% and 57.9% compared to the previous year. Samsung SDI also recorded KRW 20.1241 trillion in sales and KRW 1.808 trillion in operating profit, up 48.5% and 69.4% year-on-year. All are record highs.

Electric vehicle batteries were at the center of this growth. Lee Chang-sil, Vice President and Chief Financial Officer (CFO) of LG Energy Solution, explained, "Shipment volume increased due to improved demand for electric vehicles and energy storage systems (ESS) for power grids, and we achieved the highest annual sales thanks to expanded price linkage reflecting raw material cost increases."

LG Energy Solution plans to expand key production bases, while Samsung SDI aims for qualitative growth centered on premium products as their management strategies for this year.

Having secured a production capacity of 200GWh last year, LG Energy Solution is preparing to operate its North American joint venture.

By the end of this year, with the operation of the first and second plants of Ultium Cells, a joint venture with US automaker GM, North American production capacity will increase to 55GWh. Adding the 90GWh production plant in Wrocław, Poland, Europe, and 155GWh production plants in Asia including Korea and China, the total production capacity will reach 300GWh. This capacity can supply approximately 4.3 million high-performance pure electric vehicles.

This year, LG Energy Solution has set a goal to increase sales by 25-30% compared to the previous year. The order backlog stood at KRW 385 trillion as of the end of last year, indicating the ability to generate sales stably and long-term.

Samsung SDI plans to complete its 46mm cylindrical battery line in the first half of this year. The 46mm battery is an improved product in terms of energy capacity and output compared to the existing 2170 battery (21mm cylindrical battery). Samsung SDI is reportedly receiving strong interest from several automakers, including BMW.

Additionally, Samsung SDI will complete its next-generation solid-state battery pilot line and begin validation. Son Mikael, Vice President of Samsung SDI, said, "We will complete the solid-state pilot line in the first half of this year and produce sample cells in the second half to test materials and manufacturing methods," adding, "We are discussing cooperation with multiple automakers."

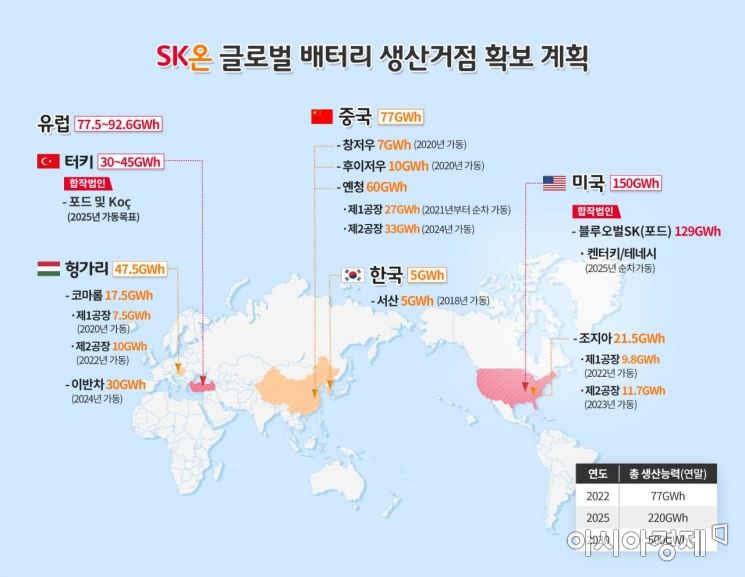

On the other hand, SK On, the battery subsidiary of SK Innovation, which is scheduled to announce its earnings on the 7th, is unlikely to turn a profit.

NH Investment & Securities expects SK On's operating loss in the fourth quarter to widen to KRW 224.5 billion compared to the previous quarter. Shinhan Investment Corp. analyst Lee Jin-myung assessed, "Profitability deteriorated due to depreciation expenses reflecting the accelerated commercial operation of the second plant in Georgia, USA, which was originally scheduled to start in the first quarter of this year."

SK On's battery production facility expansion is also expected to slow down. SK On and Ford are reportedly considering withdrawing their plan for a joint battery plant project in T?rkiye.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)