Extension of Hope Plus Credit Loan Support Period and Expansion of Eligibility

Missed Payments on Smile Microcredit Foundation Loans Also Included in New Start Fund

[Asia Economy Reporter Sim Nayoung] The Financial Services Commission has decided to improve the low-interest refinancing program for small business owners. Initially, only personal business loans of self-employed individuals were eligible for refinancing, but going forward, household credit loans of self-employed individuals will also be included up to a certain limit.

The refinancing eligibility will be expanded from borrowers affected by COVID-19 to all self-employed individuals, and the refinancing limit will be increased to 100 million KRW for individuals and 200 million KRW for corporations. To reduce the repayment burden due to the increased limit, the grace and principal repayment period has been set to "3 years grace, 7 years installment." The refinancing application deadline, originally set for the end of this year, has been extended by one year to the end of next year.

On the 30th, the Financial Services Commission announced through the presidential work report that the expansion of support targets and limit increases will be implemented in March.

For the Hope Plus credit loan, the secondary interest subsidy support period will be extended from the original 1 year to 2 years, and the target will also be expanded. The Credit Guarantee Fund provides a 2.1 percentage point secondary interest subsidy to reduce the interest burden on small business owners' bank credit loans. A Financial Services Commission official stated, "We decided to add 'small business owners receiving the secondary interest subsidy program' to the existing support targets of 'recipients of loss compensation or quarantine funds.'"

The secondary interest subsidy refers to compensation for the interest difference. When the government needs to support low-interest funds to a specific sector to achieve a particular goal, a difference arises between the procurement interest rate of the support funds and the loan interest rate. This difference is compensated by the government, local governments, or the relevant policy institution.

To enhance the effectiveness of the New Start Fund, delinquent borrowers of Miso Finance will also be included in the support targets within the first half of this year. Although the Miso Finance Foundation has many loan users, it is not a financial institution that has signed an agreement with the New Start Fund, causing issues where debtors cannot receive support if the relevant debt becomes non-performing. As of the end of December last year, the Miso Finance Foundation had 95,000 users and a loan balance of 655.5 billion KRW.

A Financial Services Commission official explained, "Even before signing the agreement, multiple debtors including Miso Finance Foundation loans who provide proof of delinquency on loans from this foundation will be recognized as eligible for New Start Fund support," adding, "Since delinquency information for Miso Finance Foundation loans is not registered with the Credit Information Center even if delinquent for more than 3 months, separate proof of delinquency is required."

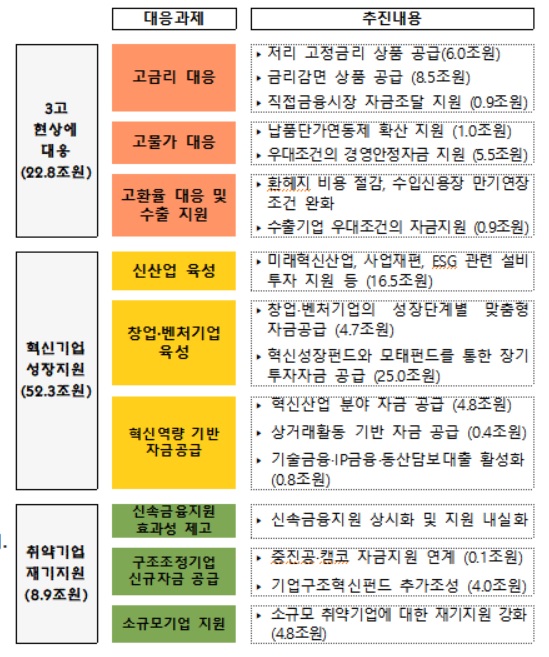

Meanwhile, a 80 trillion KRW scale financial support program for small and medium-sized enterprises will also be implemented. The Financial Services Commission will invest 52 trillion KRW, and the Ministry of SMEs and Startups will invest 32 trillion KRW. To respond to high interest rates, high inflation, and high exchange rates, 22.8 trillion KRW will be allocated, 52.3 trillion KRW for supporting the growth of innovative companies, and 8.9 trillion KRW for supporting the recovery of vulnerable companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)