COVID-19 Impact Fades... Economic Slowdown Also a Hurdle

Car Insurance Effects Increase... Accounting Standard Changes Add Variables

Polarization Deepens in Recession... "Profit Management Needed"

[Asia Economy Reporter Minwoo Lee] The performance of the non-life insurance industry is expected to start declining this year after peaking last year. In particular, as profits tend to concentrate in large companies amid this trend, managing the profitability and soundness of small and medium-sized non-life insurers will become even more important, according to analysis.

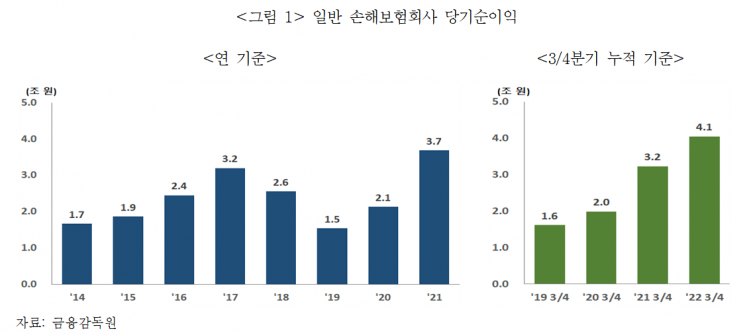

On the 29th, the Korea Insurance Research Institute diagnosed this in its report titled "Profit Concentration and Profitability Variance of Non-life Insurers." According to the report, the net profit of 11 general non-life insurers classified by the Financial Supervisory Service's Financial Statistics Information System (DB Insurance, NH Insurance, Lotte Insurance, Meritz Fire & Marine Insurance, Samsung Fire & Marine Insurance, MG Insurance, KB Insurance, Hana Insurance, Hanwha Insurance, Hyundai Marine & Fire Insurance, Heungkuk Fire & Marine Insurance) is expected to reach an all-time high last year. Since the net profit reversed to an increasing trend in 2020 due to the COVID-19 rebound effect, it grew significantly, with the cumulative net profit exceeding 4.1 trillion won by the third quarter of last year.

The Biggest Variable in Non-life Insurers' Profits is 'Car Insurance'

From the insurance business perspective, the loss ratio of automobile insurance had the greatest impact on the profit fluctuations of non-life insurers. Since the automobile insurance premium was raised in 2020, the automobile insurance loss ratio declined, and during the same period, the net profit of non-life insurers increased. Although the loss ratio and expense ratio of long-term non-life insurance also affected net profit, the relationship was not as clear as with the automobile insurance loss ratio.

From the investment business perspective, gains on disposal of available-for-sale securities were the biggest variable. The report explained that insurers likely disposed of available-for-sale securities during the low-interest-rate period to reduce net profit volatility. Interest income, which accounts for the largest portion of investment business income, generally maintained an increasing trend since 2014 and showed no clear correlation with net profit fluctuations.

Polarization Deepens When Industry Conditions Worsen

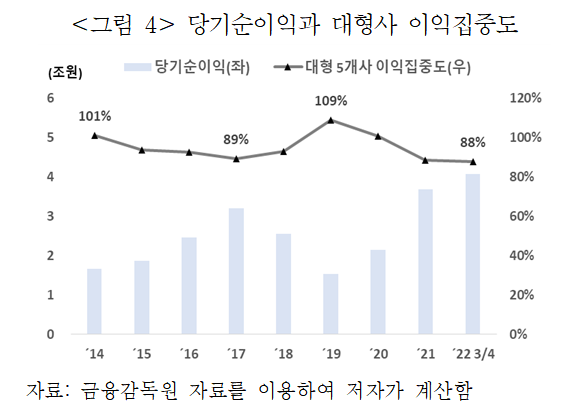

When the overall net profit of the non-life insurance industry increased, the profit concentration of large companies and the profitability variance decreased, whereas the opposite occurred during periods of net profit decline. The profit concentration, which is the proportion of profits held by the five largest companies by assets and profits (Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, Meritz Fire & Marine Insurance), was highest at 109% in 2019, when the industry's total profit was the smallest since 2014. Recently, as the industry's total profit increased, it decreased. Additionally, when total profits increased, the variance in the return on assets (ROA) distribution of the 11 companies narrowed, and when profits decreased, the variance widened.

Researcher Younghyun Cho of the Korea Insurance Research Institute explained, "During periods of deteriorating management conditions, the profitability of small and medium-sized companies worsens more than that of large companies," adding, "This is because small and medium-sized companies have higher loss ratios, greater volatility in automobile insurance loss ratios, and less capacity for profit adjustment." He also noted, "Although long-term insurance loss ratios are relatively stable for small and medium-sized companies, they remain at high levels, leaving little room for profitability improvement."

Small and medium-sized companies also had limited capacity to adjust profits using gains on disposal of available-for-sale securities. This contrasts with large companies, which defended against profitability declines with such gains in 2018 and 2019 when the industry's overall profits decreased.

Non-life Insurance Industry Profits Peaked Last Year... Risk of Insolvency for Small and Medium-sized Companies May Increase This Year

Profits in the non-life insurance industry are expected to decline starting this year. This is due to the disappearance of the COVID-19 rebound effect, premium reductions in automobile insurance, increased risk of asset impairment due to a downturn in the real estate market, and economic slowdown, all of which worsen the management environment. Therefore, the risk of insolvency for small and medium-sized companies, which have less capacity to manage profits, is expected to be relatively higher compared to large companies.

Although the newly introduced accounting standard 'IFRS 17' from this year may temporarily increase net profit figures, this is merely an 'optical illusion.' Since profit fluctuations by company are more deeply related to the company's fundamentals rather than accounting standards, the profitability variance is expected to persist.

Ultimately, small and medium-sized companies, whose profitability may worsen further, need not only to strengthen loss ratio management but also to develop and supply products that can stably manage loss ratios. Researcher Cho said, "IFRS 17 can change contract service margin (CSM) and profit size depending on the assumptions used, so companies that manage assumptions well will show stable profits," expressing concern that "if irrational assumptions are used to increase profits in the short term, the gap between expected and actual costs will widen in the mid to long term, making profits unstable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)