Recent Interest Rate Drop in Last 1-2 Weeks Applies Only to New Borrowers

Variable Mortgage Rates Reflect COFIX and Change After 6 Months

"I've seen many articles saying loan interest rates have dropped recently... So why has my rate gone up instead?"

Kim Juwon (42), who borrowed 480 million KRW when buying an apartment in Seongdong-gu, Seoul two years ago, felt a chill in his heart after receiving a text message about his variable-rate mortgage loan interest rate a few days ago. The mortgage interest rate he had been paying at 4.23% last July surged to 6.14% in just six months. As the interest rate rose, his monthly interest payment increased by more than 500,000 KRW. Kim sighed, saying, "Who exactly are these people whose loan interest rates have dropped?" and added, "To afford the increased interest, I might have to save on gas and not even turn on the boiler during this cold snap."

A 'Distant Story' for Existing Borrowers Who Borrowed to the Limit

Although commercial banks have started lowering loan interest rates this month, it remains a distant story for existing borrowers like Kim who borrowed to the limit. The rate cuts made in the past one to two weeks apply only to new borrowers. For example, mortgage interest rates were at 7% in December last year but dropped to 6% in January this year, meaning those who took out loans a month later could reduce their interest costs. The banking sector said, "Assuming interest rates continue to decline steadily as they are now, existing borrowers will likely feel the impact of rate cuts in the second half of this year."

The reason lies in the structure of variable mortgage interest rates. Variable mortgage rates reflect COFIX (Cost of Funds Index) and are adjusted once every six months. COFIX is the weighted average interest rate of funds raised by eight domestic banks. It moves in the same direction as deposit and savings rates and bank bond yields, which are the banks' funding sources.

Until mid-November last year, deposit interest rates surged, pushing COFIX announced in December (4.34%) to an all-time high. Compared to June last year (1.98%), it rose by 2.36 percentage points in just half a year. This increase is directly applied to consumers' loan interest rates. The approximately 2 percentage point rise in Kim's loan rate also reflected the COFIX increase.

A representative from Bank A said, "Under the condition that COFIX continues to decline, those who had their new variable rates set in December last year will only see their rates drop in June this year." He added, "Since COFIX began rising significantly after September last year, existing borrowers whose variable rate adjustment cycles fall within the first quarter of this year will actually feel their rates have increased compared to before."

How Much Have Rates Dropped?

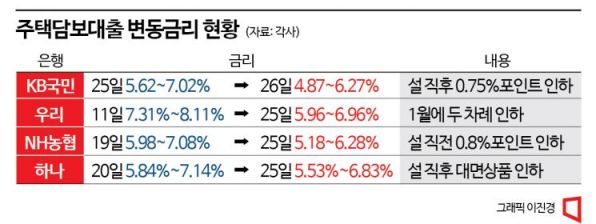

Bank loan interest rates peaked 17 months ago and have now started to decline. How much further they will fall and the speed of the decline remain uncertain, but it is clear that banks are moving their rates downward. On the 26th, KB Kookmin Bank lowered its variable mortgage loan interest rates by 0.75 percentage points from the previous day, setting the range at 4.87% to 6.27%. The interest rate for the Jeonse Deposit Safety Loan was also cut by the same margin, bringing the upper limit below 5%.

The downward trend began earlier this month. Woori Bank lowered its variable mortgage loan rates twice this month. The rate, which was above 8% at the start of the new year, dropped to the 6% range within three weeks. NH Nonghyup Bank and Hana Bank also joined this trend around the Lunar New Year holiday. Combined with forecasts that the U.S. base interest rate is nearing its terminal point, the financial sector widely agrees that "loan interest rates have peaked."

Even if the Bank of Korea raises the base rate once more at its second monetary policy meeting of the year on the 23rd of next month, it is widely expected that bank interest rates will not be significantly affected. After the Bank of Korea raised the base rate by 0.25 percentage points on the 13th, bank rates actually fell due to regulatory pressure to lower rates and bond market stabilization. A senior official from the Financial Supervisory Service predicted, "Loan interest rates will remain slightly soft throughout this year."

A senior official from the Financial Services Commission analyzed, "The interest rates that overshot after the Legoland incident are now returning to their original levels." During the liquidity crunch between October and November last year, companies like KEPCO and financial institutions competed for funding, causing bank bond and deposit rates to surge, which in turn pushed loan rates, based on these indicators, excessively high. This means the interest rate bubble is deflating.

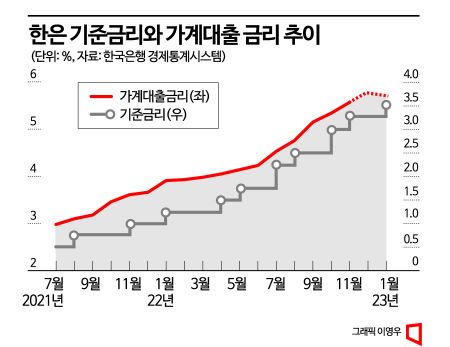

According to the Bank of Korea Economic Statistics System, household loan interest rates at domestic deposit banks (weighted average for new loans) rose sharply from August 2021. Household loan rates, which had stayed around 2% for nearly two years, quickly surpassed 3%. This was an immediate effect of the Bank of Korea's base rate hikes. During the ten base rate hikes up to January this year, household loan rates nearly doubled to 5.57% (as of November last year). A representative from a commercial bank said, "Once January statistics reflecting the clear downward trend in rates are released, the sharply rising graph over the past 17 months will begin to bend downward gradually."

For New Borrowers, Which Is Better: Fixed or Variable Rate?

For borrowers seeking new loans, which is more advantageous: fixed or variable interest rates? Since late November last year, as bank bond rates clearly declined, fixed mortgage rates became more than 1 percentage point cheaper than variable rates, attracting attention. The atmosphere at bank branches at the end of the year was that "everyone chooses fixed rates." However, as the recent rate decline has become more evident, variable rates are regaining interest.

A representative from Bank B explained, "With market interest rates falling, loan rates are likely to continue downward for the time being, making variable rates more favorable now." He added, "When refinancing from variable to fixed rates, there is no early repayment penalty, so if rates start rising again, quickly switching to fixed rates is a strategy worth considering."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)