“Including Ostem's US subsidiary favors major shareholders,” claim

Unison official refutes, calling it a separate transaction for governance restructuring

[Asia Economy Reporter Hwang Yoon-joo] Suspicions have been raised that the UCK Consortium (Unison Capital Korea·MBK Partners) effectively acknowledged a controlling shareholder’s management premium in its tender offer for Ostem Implant shares. Contrary to public perception, it is claimed that the same premium was not applied equally to Ostem Implant’s major and minority shareholders.

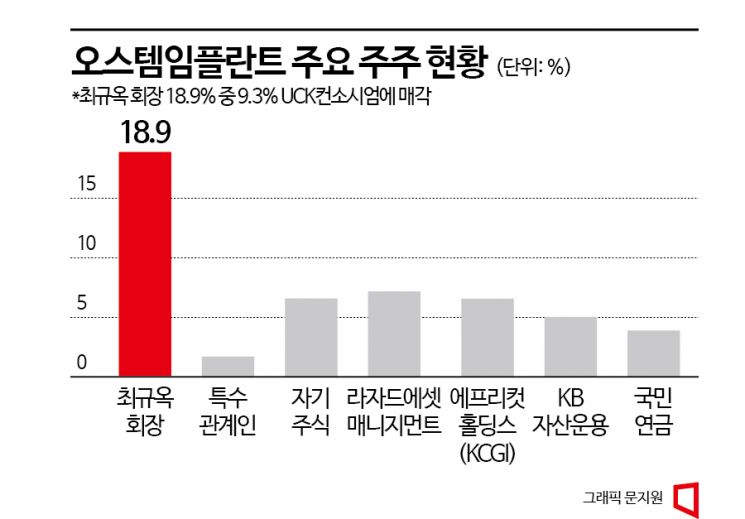

According to the tender offer report, the UCK Consortium established a special purpose company (SPC) called Dentistry Investment to purchase 9.3% (1,442,421 shares) out of the 18.9% stake held by Ostem Implant founder Chairman Choi Kyu-ok for approximately KRW 274 billion. The price per share is KRW 190,000. The UCK Consortium also disclosed in the tender offer report that it would acquire the shares of Ostem Implant’s subsidiaries held by Chairman Choi for KRW 91.8 billion and shares held by Chairman Choi’s related parties for KRW 4.6 billion. The total acquisition amount reaches KRW 370.6 billion.

Ostem Share Acquisition Price Per Share is KRW 190,000

Among these, the acquisition of subsidiary shares owned by Chairman Choi and related parties together with the UCK Consortium has become a point of controversy. An investment banking (IB) industry insider said, “The tender offer itself has a high premium, so there is no reason to view it negatively,” but added, “Depending on the valuation of the subsidiaries, it can be seen as a tender offer where controlling and minority shareholders effectively receive different premiums.”

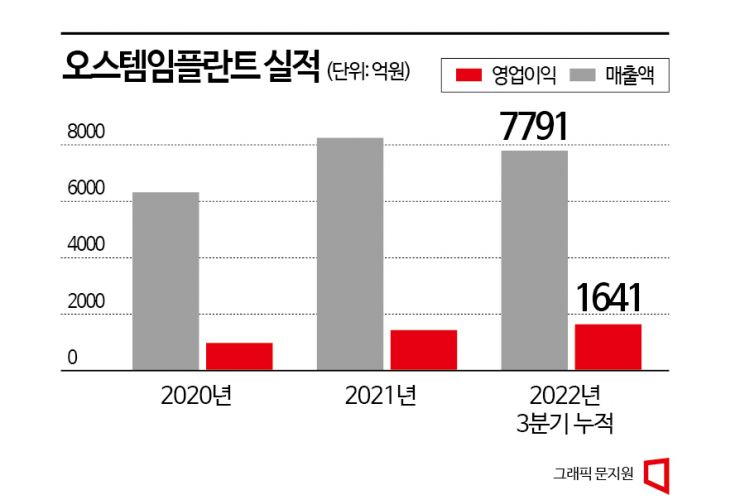

Although not explicitly stated in the tender offer report, Ostem Implant’s subsidiaries are known to include six unlisted companies such as Ostem Implant’s U.S. corporation (Hiossen, Inc.) and Ostem Pharma. The IB industry has raised questions about the value of Ostem Implant’s U.S. corporation and Ostem Pharma. Another IB industry insider pointed out, “The U.S. corporation made profits in 2021 and 2022, so the shares have value, but there were controversies over capital increases and controlling shareholder share acquisitions. It is unusual that the price-to-book ratio (PBR) was evaluated almost the same as Ostem Implant.”

Ostem Pharma was in a state of complete capital erosion but resolved this last year. Notably, Ostem Implant wrote off nearly half (KRW 8.2 billion) of the KRW 16.6 billion long-term loan it had extended to Ostem Pharma. Ostem Implant is the largest shareholder of Ostem Pharma with a 50.33% stake. The remaining nearly half of the shares are held by Chairman Choi and his family, who are related parties.

"Questions Raised Over Value of Ostem U.S. Corporation, etc."

Private equity funds sometimes acquire subsidiary shares with high controlling shareholder ownership to minimize the controlling shareholder’s influence, such as through related-party transactions. However, Ostem Pharma and others have less than 50% ownership by Chairman Choi and related parties, so this rationale does not apply.

An IB insider said, “The UCK Consortium’s acquisition of Ostem Implant subsidiaries’ shares from Chairman Choi and related parties for about KRW 96.4 billion means they valued the subsidiaries highly,” adding, “If the actual value of the subsidiaries is not high, it is equivalent to acquiring Chairman Choi’s Ostem Implant shares at a price higher than the tender offer price of KRW 190,000 per share.”

Although it was said that the per-share value was evaluated equally for controlling and minority shareholders in the tender offer, it is claimed that a differential premium was actually applied. This is because the structure involves acquiring not only Ostem Implant shares but also shares of unlisted companies owned by the owner family. While the tender offer is meaningful in that the private equity fund offered a management premium to minority shareholders as well, the background for acquiring the controlling shareholder’s subsidiary shares is unclear, which is seen as a limitation.

Regarding these suspicions, a senior official from Unison Capital Korea dismissed them as “nonsense spread by some who want to gain more than the tender offer.” He said, “Since the company needs to go global, if Chairman Choi and others hold shares in the U.S. corporation, it could cause disputes later and is not clean from a governance perspective.”

He emphasized, “It is illogical to bundle the value of an apple and a pear when they were bought separately.” This means that the acquisitions of Ostem Implant and its subsidiaries are separate transactions. He added, “If this tender offer fails, it will be difficult to try again, and in that case, there is concern that the stock price will fall significantly.”

An MBK official countered, “The reason for acquiring the subsidiaries’ shares held by Chairman Choi and related parties is to resolve conflicts of interest and improve governance,” adding, “If the subsidiary shares are not disposed of, we proposed not to acquire (Ostem Implant shares) first.”

"Acquired High-Value Ostem U.S. Corporation Cheaply"

Regarding the valuation controversy of Ostem Implant’s U.S. corporation, it was explained, “Because the U.S. corporation is also involved in the Chinese market, its value is high, but it was acquired at an EV/EBITDA multiple of 11.4 times, which is lower than the Ostem Implant tender offer price (12 times).” EV/EBITDA is the enterprise value (EV) divided by earnings before interest, taxes, depreciation, and amortization (EBITDA), used as a measure to assess a company’s appropriate stock price. For example, an EV/EBITDA of 2 means that if the company’s market value (EV) is paid, the investment principal can be recovered in two years from the earnings (EBITDA) generated.

Meanwhile, the market is also paying attention to the fact that the UCK Consortium gave Chairman Choi the option to reinvest in the special purpose company 'Dentistry Investment' created for this tender offer. According to the tender offer report, “Some of the purchase price may be raised through the issuance of bonds with warrants (BW) with a maximum principal amount of KRW 100 billion to the controlling shareholder (Chairman Choi) or his related parties at the controlling shareholder’s discretion,” and “The exercise price of the warrants will be calculated based on the per-share issuance price applied in the capital increase that the tender offeror will conduct to raise funds for the stock purchase agreement.”

An accounting expert explained, “This means that if Chairman Choi wishes, Dentistry Investment could issue BWs to him up to KRW 100 billion,” adding, “It is a structure where the management rights seller can also invest money and exit together with the private equity fund’s SPC created to acquire Ostem Implant.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)