In the Downturn of the Leading Economic Index, Interest Rate Hikes Halted or Lowered

Turning Point of Government Bond Yields Coincides with the End of Base Rate Increases

[Asia Economy Reporter Son Sunhee] There is a forecast that the sharp U.S. interest rate hikes will end around March. The securities industry, which suffered sluggishness due to frozen investment sentiment amid last year's tightening by major countries worldwide, is now buoyed by expectations of a rally in the second half of this year.

Hi Investment & Securities recently published a report forecasting that the U.S. Federal Reserve (Fed) will finish raising interest rates in March. Prior to that, it is expected that the Federal Open Market Committee (FOMC) in February will take a 'baby step,' meaning a 0.25 percentage point increase. This implies that the Fed will further reduce the pace of rate hikes following last month.

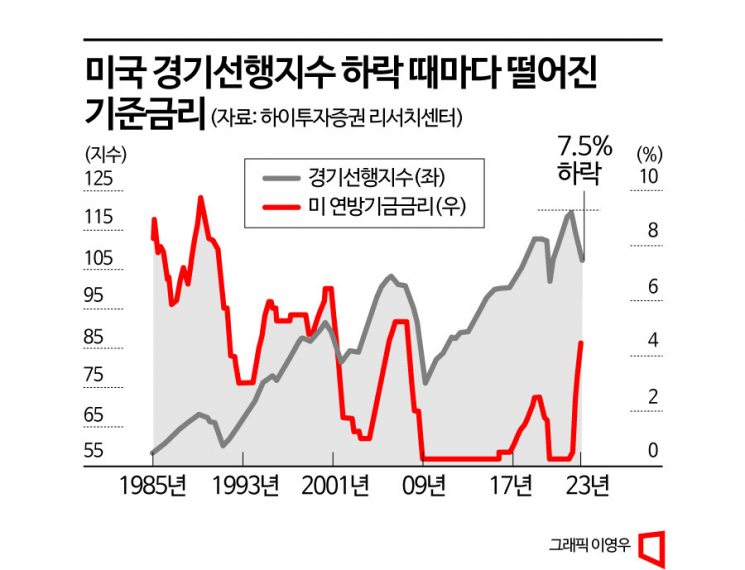

As evidence, they pointed to the recent decline in the U.S. Leading Economic Index. Park Sanghyun, a researcher in the Investment Strategy Department at Hi Investment & Securities, explained, "The decline in the U.S. Leading Economic Index indicates that the U.S. economy is entering a recession phase, which inevitably has a significant impact on the Fed's interest rate hike cycle. (In the past,) whenever the growth rate of the Leading Economic Index (year-on-year) turned downward, the Fed invariably stopped raising rates or cut them."

On the 23rd (local time), the U.S. Leading Economic Index for December last year was announced, showing a 1.0% drop from the previous month to 110.5 (2016=100). It has declined for 10 consecutive months. Compared to the peak in February last year, it fell by 7.5%. The Leading Economic Index is an indicator that predicts economic turning points about seven months in advance and is mainly used for economic outlooks. The continuous decline of the Leading Economic Index is a sign that concerns over a U.S. economic recession are growing.

What is particularly noteworthy is the correlation between the U.S. Leading Economic Index and the interest rate hike cycle. Looking at the trends of these two indicators since the 1980s, whenever the Leading Economic Index showed a downward trend, the benchmark interest rate also stopped rising or turned to cuts. The Leading Economic Index is closely correlated with the Gross Domestic Product (GDP) growth rate. From this perspective, it is interpreted that monetary policy inevitably followed to stimulate the economy.

Hi Investment & Securities identified the period most similar to the recent economic trend as the recession following the 2001 IT bubble burst. Considering that the inflection point of the 10-year and 2-year Treasury yields coincided with the end of the interest rate hike cycle at that time, they also attached great significance to the recent peak and reversal in Treasury yields. Researcher Park said, "Along with signals of easing inflationary pressure and growing recession risks, there is strong expectation that the Fed will switch to baby steps and end the rate hike cycle at the March FOMC meeting. The technology-driven economic paradigm, which had stalled due to rate hikes, is likely to regain momentum."

In the domestic securities industry, there is growing optimism that the economy will rebound as early as the second quarter of this year and that investment sentiment will recover in the second half. A clear example is the sharp rise in securities-related stocks since the beginning of the year. Last year, the KOSPI fell nearly 25% annually, and trading volume decreased, causing investment sentiment to shrink rapidly and securities firms' performance to suffer. Nevertheless, this year, major securities firms such as Mirae Asset Securities, NH Investment & Securities, Samsung Securities, and Kiwoom Securities have seen their stock prices soar well above the KOSPI's rise. In particular, Hanwha Investment & Securities and SK Securities have seen their stock prices rise about 35% and 25%, respectively, this year alone. During the same period, the 'KRX Securities' index also jumped 14%. This is interpreted as reflecting expectations that the previously subdued stock trading will be revitalized.

However, there is also cautious opinion warning against excessive optimism. Hana Securities researcher Han Jaehyuk said, "Because market liquidity is shrinking due to high interest rates, the KOSPI's rise will not be very large," adding, "Given the heavy reliance on a single supply-demand entity, foreigners, it is cautious to increase the KOSPI weighting." He continued, "The recent rally in the stock market can be attributed entirely to foreigners' 'Love Korea.' There is a constant possibility that hidden negative factors will be reflected in the Korean stock market when foreign capital inflows shrink."

Choi Yujun, senior researcher at Shinhan Investment Corp., also pointed out, "A significant part of the recent KOSPI rebound momentum comes from the 'expectation' that the semiconductor industry has bottomed out," adding, "It is necessary to verify the basis for this expectation through major corporate earnings announcements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)