Advantageous Timing for Insurance Enrollment Can Be Utilized

FSS "Long-term Consideration Possible for Unified Age System"

[Asia Economy Reporter Minwoo Lee] In insurance products, the 'full age' introduced from June 28 will not be applied, and the 'insurance age' will be used instead, so caution is advised when subscribing to products.

On the 26th, the Financial Supervisory Service conveyed the concept and precautions regarding insurance age ahead of the introduction of 'full age.'

With the revision of the Civil Act and the Framework Act on Administrative Regulations, from June 28, the age in laws and contracts will be unified as 'full age.' However, in the insurance industry, for life insurance (products that pay insurance benefits upon the occurrence of insured events related to a person's life or body), 'insurance age' is still applied separately from full age.

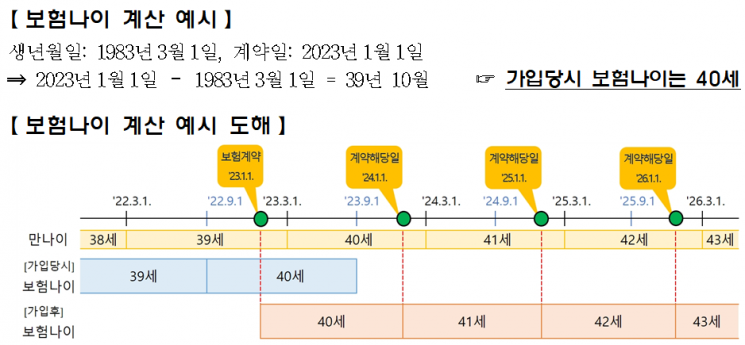

Insurance age, mainly applied in life insurance and long-term casualty insurance, is calculated by rounding the actual full age at the contract date. Age is considered to increase on each contract anniversary (the day that comes every year from the initial contract date). For example, if a person born on March 1, 1983, subscribes to a life insurance product on January 1, 2023, their current full age is 39 years and 10 months (January 1, 2023 - March 1, 1983). Rounding this based on a 6-month standard results in an insurance age of 40 years.

This insurance age calculation standard is stipulated in the standard terms and conditions for life insurance, disease and injury insurance (casualty insurance), and indemnity insurance. However, if the law specifies age separately, such as 'insurance contracts where death under 15 years of age is the insured event are invalid (Commercial Act Article 732),' or if individual terms set age separately, insurance age is not applied.

There are also ways to utilize insurance age. Generally, as age increases, the probability of disease or accident increases, making premiums more expensive, so it is advantageous to subscribe before 6 months pass based on full age (i.e., before insurance age increases by 1 year). If there is an age limit for subscription, it is advantageous to subscribe before exceeding the upper age limit or after reaching the lower age limit based on insurance age. For child insurance with subscription ages from 0 to 30 years, subscription is only possible up to under 30 years and 6 months insurance age, not full 30 years (until the day before reaching full 31 years).

When maturity is determined based on age, the maturity date means the last contract anniversary when the insurance age indicated as maturity is reached. For an 80-year maturity product subscribed on January 1, 2023 (insurance age 40) by a person born on March 1, 1983, the maturity date is January 1, 2063, the contract anniversary. It is not August 31, 2063, the last day of insurance age 80 converted based on the birth date (6 months before full 80 years).

If the age is incorrectly stated at the time of application, the age can be corrected without canceling the insurance contract, but additional premiums may need to be paid or refunds may occur.

A Financial Supervisory Service official said, "To prevent inconvenience caused by confusion between full age and insurance age when subscribing to insurance, we plan to ensure that the concept of insurance age is more clearly reflected in basic insurance documents such as terms and conditions and sufficiently guided to consumers through continuous communication with insurance companies." He added, "In the mid to long term, we will also consider unifying insurance age into full age if necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)