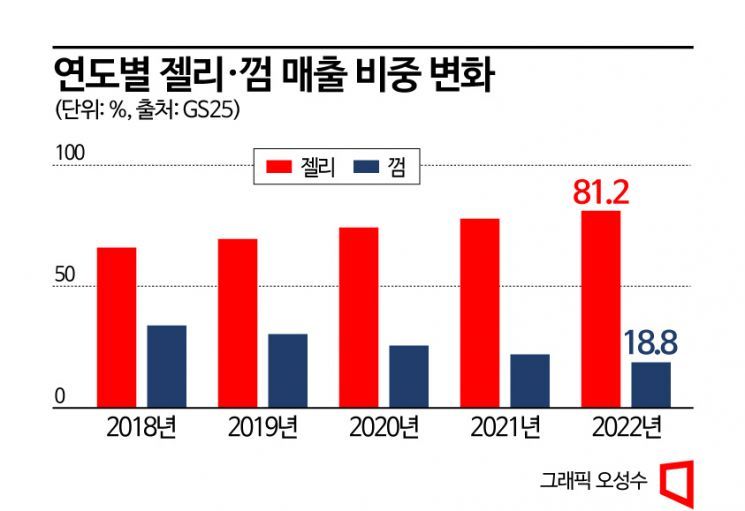

Gum Sales Share 18.8%, Jelly 81.2%

Sales Gap Widens Over 5 Years

Popular Amid Fun-sumer Trend

Recently, in the chewing food market, jelly has emerged as the nation's representative snack, replacing gum. Gum, which has always been a staple at convenience store checkout counters, has given way to jelly, and the sales ratio between gum and jelly has been widening over the past five years.

According to GS25 on the 25th, last year, gum accounted for 18.8% of sales, while jelly accounted for 81.2%. By year, gum's share has been declining from 34% in 2018, 30.4% in 2019, 25.7% in 2020, to 22.1% in 2021. On the other hand, jelly's share has been steadily rising from 66% in 2018, 69.6% in 2019, 74.3% in 2020, to 77.9% in 2021.

Similar trends have appeared in other convenience stores. At CU, gum's sales share decreased from 25.4% in 2018 to 12.3% last year, while jelly increased from 50.1% in 2018 to 53.6%. During the same period, at 7-Eleven, gum's sales share dropped from 25% to 12%, and jelly rose from 35% to 40%. Emart24 also saw gum's share fall from 23% to 11%, while jelly's share increased from 44% to 46%.

The decline of gum and the popularity of jelly are expected to continue. According to market research firm Euromonitor, the domestic gum market shrank from 321 billion KRW in 2015 to 254 billion KRW last year. It is projected to decrease further to 250 billion KRW by 2025. The popularity of jelly is linked to the fun-seeking trend of fun consumers (Fun+Consumer), going beyond simple consumption. While gum has focused on functionality such as bad breath removal rather than taste, jelly has gained great popularity by offering various flavors and shapes. Additionally, products applying jelly formulations, such as hangover remedies and vitamins, have been released, broadening the consumer age range from children to adults.

Convenience stores are eager to introduce differentiated jelly products. At GS25, the top five jelly sales were held by Pok?mon Keyring Jelly, Jjanggu Keyring Jelly, Sanrio Surprise My Keyring, Haribo Goldb?ren, and Haribo Happy Cola. Pok?mon Keyring Jelly, exclusively launched in June last year, caused a rush, selling out 1 million units in the first and second batches at once. The cumulative sales of Pok?mon Keyring Jelly, Jjanggu Keyring Jelly, and Sanrio Surprise My Keyring have reached 10 million units.

CU is expanding its jelly lineup through collaborations with famous characters and brands such as Belly Bear Peach Jelly, Wiggle Wiggle Jelly Mix, and Top Tier Energy Fruits Jelly. 7-Eleven upgraded and re-released its private brand (PB) yogurt-flavored jelly in August last year, establishing it as a steady seller. This product has gained popularity not only domestically but also overseas, becoming a must-buy item for foreign tourists.

A convenience store industry official said, "Jelly is emerging as a representative snack not only for children but also for adults, and its sales share continues to increase. New products planned with various flavors and shapes such as cider, yogurt, and coffee are being released one after another, and with the character boom, the jelly market is rapidly expanding."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)