My Share Was Offered, but Rejected as "Property Not Required"

The Truth Is... "Lotto Winnings Are Also Included in Inherited Property"

# A lottery ticket purchased by my father a year ago won the first prize. Just before he passed away due to worsening illness, my father gifted most of the winnings to my older brother. I found out about this late. I demanded a return of the statutory reserved portion (yuryubun) from my brother, but he said, "Since it is not my father's earned income, I cannot give it." Are lottery winnings really not included in the inheritance property?

Holidays when the whole family gathers often become days when new conflicts arise. Disputes over inheritance property are typical examples.

In principle, the scope of the inheritance property of the decedent (the deceased) includes almost all assets held until death.

However, it is true that it is not easy to determine whether suddenly acquired lottery winnings are included in the inheritance property.

Lottery winnings are classified as windfall income under tax law. In other words, it is income obtained temporarily by chance, not as a result of labor. Typical examples include prize money and gratuities.

If the decedent's windfall income is gifted to a specific heir, there can be confusion about whether the statutory reserved portion claimants can demand their share.

Lottery winnings, even if not earned income, are included in inheritance property

Experts advise that a lawsuit to claim the return of the statutory reserved portion (yuryubun) is possible even for first-prize lottery winnings.

Attorney Eom Jeong-sook (Beopdo Comprehensive Law Office) said, "If the property acquired without the decedent's effort is legally obtained without any issues, it is included in the scope of inheritance property, and a lawsuit to claim the return of the statutory reserved portion is possible."

A statutory reserved portion claim lawsuit is a suit where the remaining heirs assert their reserved portion rights against the heir who inherited all the property according to the deceased's will.

When there are only two siblings, the statutory reserved portion is half of the originally entitled inheritance amount. For example, if the total property left by the father is 200 million KRW, the inheritance amount is 100 million KRW each, and the statutory reserved portion is half of that, 50 million KRW each.

Attorney Eom explained, "The lottery is a legal business operated by public institutions, and the winnings are not legally problematic, so they become the winner's personal property. Therefore, if the decedent who won the lottery gifted or bequeathed the entire amount to a specific heir, the other heirs have grounds to file a lawsuit to claim the return of the statutory reserved portion."

However, check the statute of limitations first... Lawsuit must be filed within 1 year of death

Even if the decedent's property was legally acquired without issues, heirs must keep one thing in mind.

The Civil Act stipulates that a lawsuit to claim the return of the statutory reserved portion must be filed by the heir within one year from the time they become aware of the gift or bequest and the decedent's death. In other words, there is a statute of limitations for filing such a lawsuit.

Attorney Eom advised, "It is wise to first check the statute of limitations on any property of the decedent before proceeding with legal procedures."

Unlike lottery winnings, death insurance benefits cannot be claimed in statutory reserved portion lawsuits

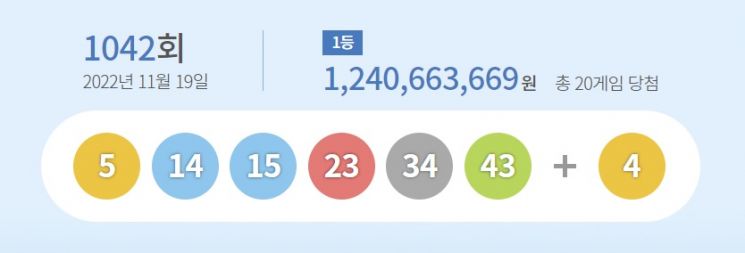

'Winning odds of 1 in 8,145,060' A game with the same probability as finding a single black grain of rice among a sack of rice (80kg) spread out on the floor with your eyes covered, the fantasy about Lotto may seem somewhat childish. However, in the prolonged economic downturn, the hearts of citizens visiting Lotto sales points are earnest.

'Winning odds of 1 in 8,145,060' A game with the same probability as finding a single black grain of rice among a sack of rice (80kg) spread out on the floor with your eyes covered, the fantasy about Lotto may seem somewhat childish. However, in the prolonged economic downturn, the hearts of citizens visiting Lotto sales points are earnest.

Meanwhile, there are cases where suddenly acquired property like lottery winnings is not included in the basic inheritance property for claiming the statutory reserved portion. Death insurance benefits of the decedent are a representative example.

Death insurance benefits, like lottery winnings, are income not derived from the decedent's labor or effort. However, death insurance benefits differ from lottery winnings in that the recipient can be specifically designated. In other words, lottery winnings become the property of the person who purchased the ticket, but death insurance benefits, if a recipient is separately designated, cannot be considered the property of the deceased insured.

Attorney Eom said, "For example, if the decedent designated a third party as the recipient of the death insurance benefits, it becomes the third party's personal property under the law, so no heir can claim even the statutory reserved portion on the death insurance benefits. Conversely, lottery winnings are, in principle, owned by the person who purchased the ticket, so the lottery winner can freely exercise property rights."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)