Lithium Prices Exceeding 100 Million KRW per Ton Turn Downward

Concerns Over Slowing Electric Vehicle Demand from Tesla and Others

Lithium Price Decline Also Negatively Impacts Battery Prices

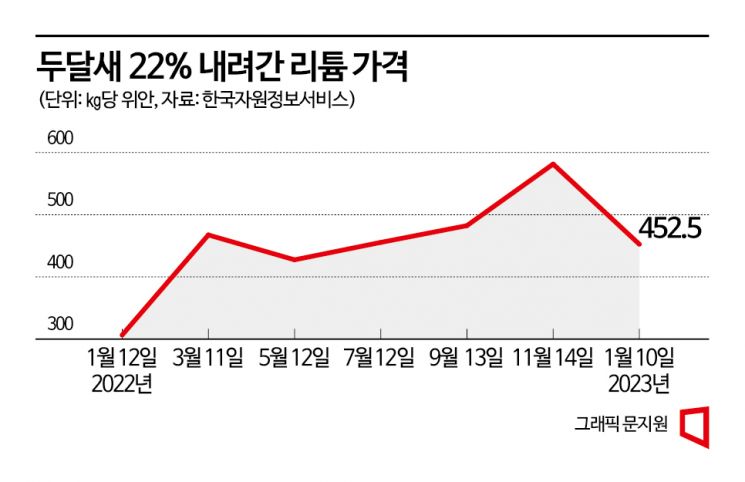

[Asia Economy Reporter Jeong Dong-hoon] The price of lithium, a key mineral for electric vehicle batteries, is gradually stabilizing with a downward trend. Since reaching its peak last November, it has dropped by about 22%. Some suggest that, coupled with a slowdown in electric vehicle demand, the price could be halved again.

On the 13th, the Korea Resource Information Service revealed that the price of lithium carbonate stood at 452,000 yuan per ton (approximately 83.21 million KRW), down about 22.2% from 581,500 yuan per ton (approximately 107.05 million KRW) just two months ago. Following the Russia-Ukraine war last year, raw material prices surged and demand for electric vehicle batteries increased, pushing lithium prices above 100 million KRW per ton at one point. However, prices have sharply fallen again over the past two months.

Lithium accounts for 60-70% of the cost of cathode materials in ternary batteries, which are mainly produced by domestic battery companies. Cathode materials make up about 40-50% of the battery price. Zhu Yidongshu, Secretary-General of the China Passenger Car Market Information Joint Conference, told Chinese media Pengpai News, "The removal of electric vehicle subsidies has lowered market growth expectations, leading to a downward trend in lithium carbonate prices," and predicted that "as battery costs for electric vehicles gradually decrease, lithium carbonate prices will return to around 200,000 yuan per ton (approximately 36.83 million KRW)."

The sharp decline in lithium prices is linked to the slowdown in electric vehicle demand. Tesla, considered a 'barometer' of electric vehicle demand, implemented price cuts in the Chinese market this month following a reduction in October last year. Prices were lowered by 13-24% compared to September last year. In December last year, deliveries of new vehicles produced in China totaled 55,796 units, down 44% from November and 21% from the same period the previous year. This demand slowdown raises concerns that electric vehicle battery demand may not match previous years.

Tesla's delivery decline followed by price cuts signals a 'chicken game' in this year's electric vehicle market. As Tesla, the top-selling electric vehicle company, lowers prices on its models, other electric vehicle companies are expected to follow suit. Professor Park Cheol-wan of the Department of Automotive Studies at Seojeong University said, "Electric vehicle and battery companies had been raising prices due to inflation, but Tesla, the number one electric vehicle company, has reduced prices," adding, "If other companies do not join in lowering prices, they will face a situation where they cannot sell electric vehicles produced through new factory establishments."

The decline in lithium prices itself also affects battery selling prices. Last year, due to the surge in raw material prices, battery companies faced increased production costs and an environment where they could raise selling prices. Electric vehicle and battery companies have contracts linking raw material prices to selling prices with a 2-3 month lag. The rise in lithium prices positively contributed to the upward trend in selling prices. As a result, the three major domestic battery companies achieved record-high sales and operating profits. However, with the drop in lithium prices, there are expectations that battery prices cannot be maintained at last year's levels.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)