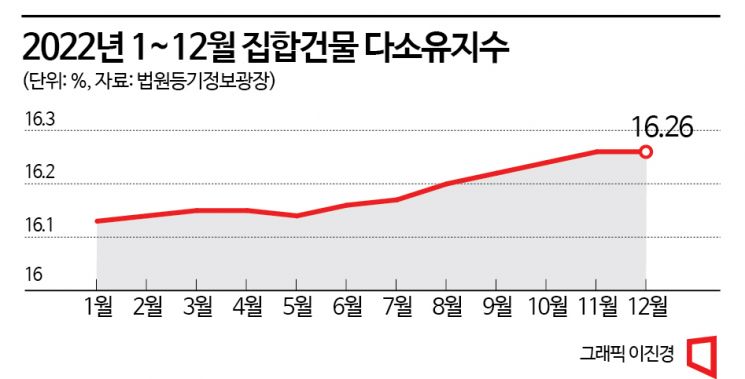

Dasyoyujisu Increased from 16.13 in January 2022 to 16.26 in December 2022

[Asia Economy Reporter Minyoung Kim] Despite the ongoing period of house price decline coinciding with interest rate hikes, the proportion of multi-homeowners nationwide has rather increased. This is interpreted as a result of more homeowners withdrawing their listings after their houses failed to sell, and an increase in multi-homeowners postponing sales following the government's announcement of capital gains tax surcharges suspension and comprehensive real estate tax relief measures. It also appears that the rise in multi-homeowners taking advantage of the recent house price decline to make low-priced purchases has had an impact.

According to the Court Registry Information Plaza on the 13th, the multi-ownership index for collective buildings rose from 16.13 in January last year to 16.20 in August, when interest rate hikes became full-scale, then continued to increase to 16.22 in September, 16.24 in October, and 16.26 in November and December. The multi-ownership index for collective buildings refers to the proportion of owners who own two or more units among all owners of collective buildings such as apartments, multi-family row houses, and officetels. For example, if the multi-ownership index is 16.26, it means that out of 100 owners of collective buildings, 16 own multiple units.

The multi-ownership index rose to 16.69 in July 2020 but decreased to 16.12 by the end of 2021 as the Moon Jae-in administration tightened regulations on multi-homeowners. However, after the inauguration of the Yoon Seok-yeol administration and its announcement of easing housing-related regulations, the index turned upward to 16.14 in May last year. May last year was when the Yoon administration announced a one-year temporary suspension of the capital gains tax surcharge on multi-homeowners, prompting multi-homeowners to withdraw their listings.

The housing market stagnation, at a level where transactions are almost nonexistent, also influenced the multi-ownership index. As it became difficult to dispose of properties even if they wanted to sell, multi-homeowners shifted their stance from selling to holding, causing the related index to increase. In other words, the interpretation is that the proportion of multi-homeowners temporarily rose due to the transaction freeze.

According to the Ministry of Land, Infrastructure and Transport, the cumulative housing sales volume from January to November last year was 480,187 units, a 50.1% decrease compared to the same period the previous year (961,397 units). By region, the metropolitan area saw a 58.4% decrease to 190,587 units, while the provinces experienced a 33.5% decrease to 289,600 units.

The slight increase in multi-homeowners with cash liquidity who engaged in low-priced purchases mainly through urgent sales also seems to have partially influenced the multi-ownership index. Moreover, government measures such as easing acquisition tax surcharges on multi-homeowners, extending the one-year exemption from capital gains tax surcharges, and extending the sales period for temporary one-household two-houses owners have expanded the scope for multi-homeowners to make additional purchases in the housing market. Additionally, these measures may slow down the movement of multi-homeowners selling properties for tax-saving purposes.

Yoon Ji-hae, Senior Researcher at Real Estate R114, said, "Although the housing market this year cannot be considered optimistic due to interest rate variables, more people are viewing the recent decline in housing prices as an opportunity to purchase homes, along with regulatory easing policies on taxes and finance." She added, "Typically, the proportion of multi-homeowners tends to increase during market contractions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)