Behind the Scenes of Kurly's KOSPI Listing Postponement

Anchor PE That Invested 4 Trillion Won in Kurly in 2021 Faces Inevitable Losses

Kurly Unable to Secure Sufficient Funding with Current 1 Trillion Won Valuation

[Asia Economy Reporter Hwang Yoon-joo] The background behind the decision to postpone the listing of Kurly, once considered a major player in this year’s initial public offering (IPO) market, is known to involve an implicit agreement between CEO Kim Seul-ah and the anchor private equity partner (PE) investor regarding the exercise of the ‘listing veto’ right. The anchor PE was the only investor in Kurly with the right to refuse the listing, but in reality, it managed to bring about the postponement of Kurly’s listing without actually exercising that right.

The anchor PE invested 250 billion KRW in Kurly in December 2021. At that time, the anchor PE’s recognition of Kurly’s corporate value at around 4 trillion KRW drew market attention. The anchor PE was among the early investors in Kurly who invested a relatively large amount and was the only investor promised a ‘listing veto right.’ This was a ‘safeguard’ allowing them to agree to or reject Kurly’s listing. There were also rumors in the market that the anchor PE and Kurly had agreed on a qualified IPO clause setting a market capitalization threshold of 6 trillion KRW for the listing.

However, it is known that the anchor PE did not actually exercise this right ahead of Kurly’s listing. An investment banking industry insider explained, “If the veto right is exercised, the anchor PE would bear the burden of funding when Kurly needs to raise additional capital.” If the anchor PE exercised the veto right and Kurly’s listing was canceled, existing investors who failed to exit (recover their investment) could shift the responsibility for funding to the anchor PE.

Kurly officially announced the postponement of its listing on the 4th. In a statement, Kurly said, “Considering the deterioration of the global economic situation and the resulting contraction in investment sentiment, we have decided to postpone the listing,” adding, “We plan to relaunch the listing at the optimal time when the corporate value can be fully evaluated.” Indeed, Kurly’s corporate value, which once reached 4 trillion KRW, has now fallen below 1 trillion KRW. Despite the cumbersome process of having to pass the preliminary listing review again, this is cited as a major reason why Kurly broke its IPO promise.

From the perspective of the anchor PE, which invested about 250 billion KRW in Kurly at a corporate value of around 4 trillion KRW, an immediate listing would inevitably result in huge losses. CEO Kim Seul-ah, who needs funds for business expansion, also cannot raise the desired amount in the public offering market at the current valuation of around 1 trillion KRW. The amount of funds that can be raised through the listing has shrunk to about one-quarter to one-fifth compared to last year.

Previously, Kurly used its pre-IPO investment funds for logistics services, upgrading data infrastructure, and acquiring new members to expand the coverage area of its Saetbyeol Delivery service. In contrast, Kurly’s current investment focus is not on expanding logistics facilities but on ‘category (product group) diversification.’ This is because it is difficult to increase market share and improve profitability with a business model limited to food delivery. The launch of the ‘beauty’ category is also for this reason. Expanding categories also requires operating funds since products are purchased. Kurly planned to aggressively invest the funds raised through the listing into category expansion and other areas.

A securities industry official analyzed, “Ticket Monster disappeared from the market after focusing only on selling profitable products to turn a profit and losing market share. Kurly needs funds to both turn a profit and expand its customer base and product categories, but with the current valuation, it cannot raise the desired funds in the public offering market, so it postponed the listing.”

Kurly, which pioneered the domestic dawn delivery market with its so-called ‘Saetbyeol Delivery’ service, has seen its deficit grow every year. Kurly’s losses increased from 33.7 billion KRW in 2018 to 101.3 billion KRW in 2019, 116.3 billion KRW in 2020, and 217.7 billion KRW in 2021.

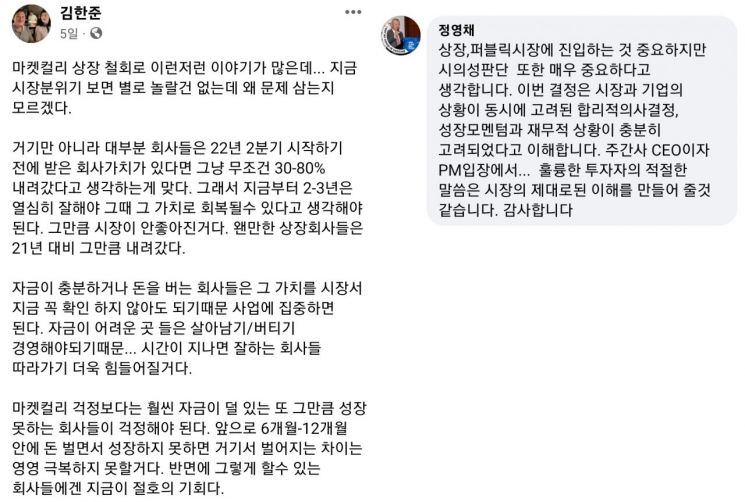

Facebook conversation between Kim Han-jun, CEO of Altos Ventures, and Jung Young-chae, CEO of NH Investment & Securities.

Facebook conversation between Kim Han-jun, CEO of Altos Ventures, and Jung Young-chae, CEO of NH Investment & Securities.

NH Investment & Securities CEO Jung Young-chae, the lead underwriter of the listing, also mentioned Kurly’s listing postponement on his Facebook on the 11th, which can be interpreted in the same context. CEO Jung wrote, “Entering the listing market is important, but timing judgment is also very important,” adding, “The decision to postpone the listing is a rational decision considering both the market and the company’s situation.”

Prior to CEO Jung, Kim Han-joon, CEO of Altos Ventures, addressed the controversy over Kurly’s listing postponement on Facebook on the 6th, stating, “The value of companies that received funds before the second quarter of last year has decreased by 30-80% compared to then, so Kurly’s withdrawal from the listing is not surprising,” and added, “If it does not make money and grow within the next 6 to 12 months, it will never catch up with companies that are doing well.” CEO Jung also posted a message agreeing with this.

The market expects Kurly to attempt relisting. However, the timing is uncertain. Both management and investors want to receive a proper valuation. It remains unknown when the sentiment in the public offering market will turn around.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)