Integration of Standard Ansim Conversion Loan and Qualified Loan into Existing Bogeumjari Loan

Use Up to 500 Million KRW Within LTV and DTI Limits

Loan Interest Rate Reduced to 3.75~4.05% with Preferential Rates Applied

[Asia Economy Reporter Sim Nayoung] The Financial Services Commission, together with the Korea Housing Finance Corporation, is launching a special BoGeumJaRi loan, a fixed-rate mortgage loan in the 4% range during the interest rate hike period. Starting from the 30th, this product, which integrates the existing BoGeumJaRi loan with the general-type Safe Conversion Loan and Qualified Loan, will be operated for one year. Borrowers with housing prices of 900 million KRW or less can use it up to 500 million KRW within the LTV (Loan to Value ratio) and DTI (Debt to Income ratio) limits without income restrictions. The DSR (Debt Service Ratio) is not applied.

The interest rate, lower than that of commercial mortgage loans, will be applied from the end of January, and adjustments will be made as necessary considering market interest rates and available resources of the Korea Housing Finance Corporation. Interest rates of ▲4.65~4.95% for housing prices of 600 million KRW or less & combined spousal income of 100 million KRW or less ▲4.75~5.05% for housing prices exceeding 600 million KRW or income exceeding 100 million KRW will be applied. Preferential interest rates will be discounted up to 0.9 percentage points depending on borrower characteristics.

The target is housing priced at 900 million KRW or less, applied in the order of 'KB Market Price > Korea Real Estate Board Market Price > Official Housing Price > Appraisal Value'. Unlike the BoGeumJaRi loan, which had an income limit of 70 million KRW per year, there is no income restriction. However, to apply preferential interest rates, proof of income for the borrower and spouse is required. The purposes are divided into three: housing purchase, repayment of existing loans, and return of rental deposit. Non-homeowners can apply for purchase purposes, and one-homeowners can apply for repayment or compensation purposes. Temporary two-homeowners for replacement acquisition can apply on the condition that the existing home is disposed of within two years.

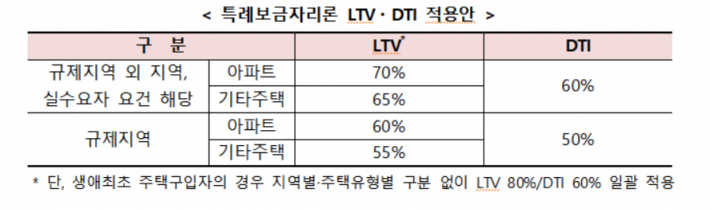

The loan limit is up to 500 million KRW. It is handled only within a maximum LTV of 70%. For multi-family houses, row houses, and detached houses, an additional 5 percentage points, and for regulated areas, an additional 10 percentage points are deducted. However, if the borrower meets the real demand requirements (housing price 800 million KRW, income 90 million KRW, non-homeowner), the deduction for regulated areas is exempted. First-time homebuyers can apply up to 80% LTV. This is limited to cases where neither the borrower nor the spouse has previously owned a home.

DTI is handled only within a maximum of 60%. For regulated areas, a 10 percentage point deduction applies, but the deduction is exempted if the real demand requirements are met. DSR is not applied. There are six maturity options: 10, 15, 20, 30, 40, and 50 years. The 40-year maturity applies to those aged 39 or younger or newlyweds married within 7 years. The 50-year maturity applies to those aged 34 or younger or newlyweds.

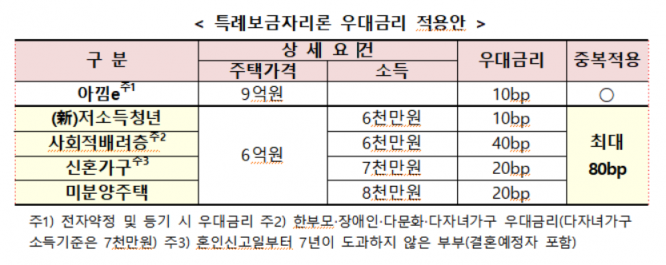

The basic loan interest rates are divided into preferential type at 4.65~4.95% and general type at 4.75~5.05%, with additional preferential interest rates applied up to 0.9 percentage points. The basic loan interest rate is adjusted monthly considering market interest rates and funding conditions. A preferential interest rate (0.1 percentage points) for low-income youth (aged 39 or younger & housing price 600 million KRW or less & combined spousal income 60 million KRW or less) has been newly established. When applying the preferential interest rate, the loan interest rate can be reduced to as low as 3.75~4.05%.

The Financial Services Commission stated, "Since the loanable amount is the lesser of the LTV applied amount and the loan limit, it is necessary to establish a funding plan accordingly." For example, for a 500 million KRW apartment, an LTV of 70% applies, allowing a loan up to 350 million KRW. For an 800 million KRW apartment, a loan of 500 million KRW can be obtained.

They also said, "Since the one-home ownership condition is strictly applied during the loan period, if you plan to own two or more homes by purchasing additional homes, you need to be cautious in using the special BoGeumJaRi loan." The acquisition of additional homes will be checked annually, and if the additional home is not disposed of within six months, the loan will be terminated, and the borrower will be restricted from using the BoGeumJaRi loan for three years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)