[Asia Economy Yeongnam Reporting Headquarters Reporter Kim Yong-woo] Pay your vehicle tax all at once and enjoy the benefits!

Ulsan City will accept applications for annual vehicle tax prepayment from the 16th to the 31st of this month.

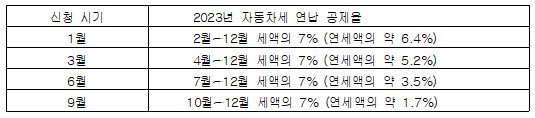

The vehicle tax annual prepayment system allows taxpayers to receive a 7% discount (6.4% for a one-year period) on the vehicle tax, which is usually levied in June and December, if paid in a lump sum in January.

Until last year, the prepayment discount rate was 10% (9.15% for a one-year period), but due to amendments in the Local Tax Act, it has been reduced to 7% (6.4% for a one-year period) starting this year.

For the convenience of citizens, for vehicles that had their vehicle tax prepaid last year and have no change in ownership, the city plans to send the prepayment tax bills with the discounted amount collectively without a separate application.

Applications for prepayment can be made by phone, visit, internet, or smartphone via Smart Wetax to the vehicle tax department of the district or county office where the vehicle is registered.

Payment can be made by receiving the prepayment tax bill by the 31st and paying at financial institutions, virtual accounts, credit cards, CD/ATM, or through the internet and apps.

If you move your address to another city or province within the year after prepaying the vehicle tax, you do not have to pay additional vehicle tax at the new address.

Also, if you transfer or scrap your vehicle, you can receive a refund for the vehicle tax corresponding to the period after the transfer or scrapping date without a separate application.

An official from Ulsan City said, “The vehicle tax annual prepayment system is a great opportunity to save on taxes,” and added, “We hope citizens actively use this to receive tax-saving benefits.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)