Secured 3-4 Years of Orders for Three Joseon Shipyards

Order Backlog at 119 Trillion Won

Lowering This Year's Order Targets

Strong Order Boom and Revenue Growth Over Past Two Years

[Asia Economy Reporter Jeong Dong-hoon] The shipbuilding industry, which is experiencing a boom in eco-friendly vessels, is expected to strengthen its fundamentals as ship deliveries and payment settlements become full-scale this year.

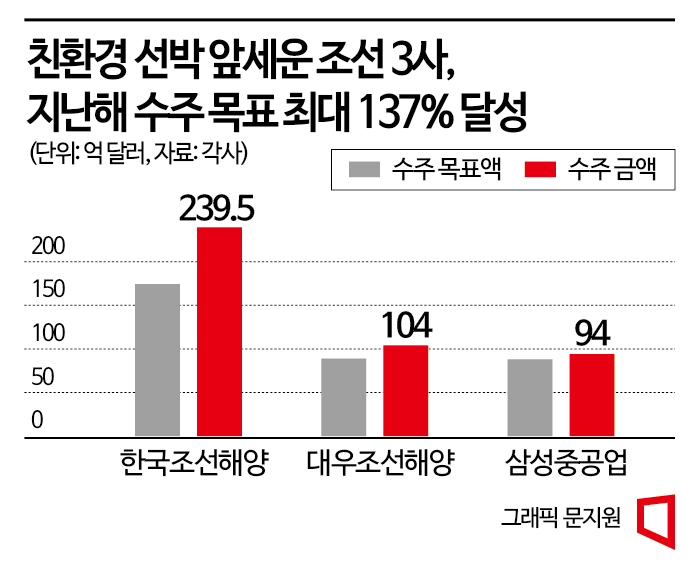

On the 9th, it was revealed that the three major domestic shipbuilders?Korea Shipbuilding & Offshore Engineering, Daewoo Shipbuilding & Marine Engineering, and Samsung Heavy Industries?have significantly exceeded their order targets over the past two years, filling their order backlogs for the next 3 to 4 years. As of the end of September, the order backlog of the three shipbuilders approached 119 trillion won.

Korea Shipbuilding & Offshore Engineering (Hyundai Heavy Industries, Hyundai Mipo Dockyard, Hyundai Samho Heavy Industries) secured orders worth $23.99 billion (approximately 30.52 trillion won for 197 vessels), achieving 138% of its target ($17.44 billion, approximately 22.19 trillion won). Samsung Heavy Industries received orders for 49 vessels worth $9.4 billion (approximately 11.95 trillion won), reaching 107% of its target, while Daewoo Shipbuilding & Marine Engineering secured $10.4 billion (46 vessels), achieving 116% of its target.

The shipyards of the shipbuilders are fully occupied. As the demand for eco-friendly vessels such as LNG (liquefied natural gas) powered and carrier ships rises, global shipping companies have signed 'slot contracts' to pre-secure dock space at shipyards. Because they have secured work in advance, the three major shipbuilders can avoid the 'low-price order' competition that previously led to losses. This environment allows them to selectively choose orders with higher prices and sign contracts accordingly.

Sales for the three shipbuilders are expected to accelerate this year. The shipbuilding industry follows a 'heavy-tail' payment method, where a small advance payment is received, and most of the construction payment is made upon delivery. Orders secured since 2021 will be fully reflected in performance starting this year. Korea Shipbuilding & Offshore Engineering’s three subsidiaries?Hyundai Heavy Industries, Hyundai Samho Heavy Industries, and Hyundai Mipo Dockyard?forecast sales growth of 30%, 29%, and 13%, respectively, compared to last year. Cost reductions due to increased sales and improved profitability are also anticipated.

New orders are expected to decline starting this year. With the global economic downturn intensifying and interest rates rising sharply, ship orders are expected to decrease significantly. Korea Shipbuilding & Offshore Engineering’s order target for the shipbuilding and offshore sectors this year is $15.7 billion (approximately 19.96 trillion won), about 35% lower than last year’s order performance of $23.95 billion (approximately 30.45 trillion won). This target is also lower than the $17.44 billion (approximately 22.17 trillion won) target set at the beginning of last year. It is known that Korea Shipbuilding & Offshore Engineering set this target conservatively based on the assumption of fulfilling orders due in 2026, three years from now. Daewoo Shipbuilding & Marine Engineering and Samsung Heavy Industries have not yet announced their order targets but are also expected to set lower targets than last year.

An industry insider said, "The global economic downturn and interest rate hikes are reducing ship orders, which could negatively impact shipbuilding orders," but added, "Due to strengthened environmental regulations, demand for vessel replacement is expected to continue increasing, so there is no problem with the industry outlook."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)