FDA Grants Accelerated Approval for 'Lecanemab'

Biogen and Eisai Succeed Again Following 'Aduhelm'

Slows Cognitive Decline by 27%

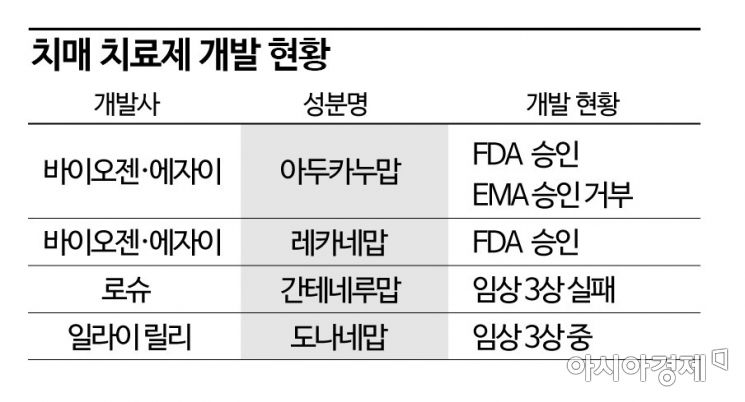

Lilly's 'Donanemab' and Roche's 'Gantenerumab' Also in Development

139 Million Dementia Patients Worldwide by 2050

Treatment Market Expected to Reach 25 Trillion Won

[Asia Economy Reporter Lee Chun-hee] Could 2023 be the starting point for conquering dementia? Expectations for overcoming dementia are growing as a treatment with higher efficacy than existing dementia drugs has been approved early this year.

According to industry sources on the 9th, on the 6th (local time), the FDA granted accelerated approval for Biogen and Eisai's Alzheimer's dementia treatment, Lecanemab. Accelerated approval is a procedure that permits limited use based on early clinical trial results. With this, Lecanemab became the second FDA-approved fundamental dementia treatment following Aduhelm (active ingredient Aducanumab), also developed by Biogen and Eisai, which was approved in July last year.

In the previously announced Phase 3 clinical trial results, Lecanemab succeeded clinically by showing a 27% reduction in cognitive decline compared to the placebo group based on the Clinical Dementia Rating-Sum of Boxes (CDR-SB) score at 18 months. Secondary endpoints were also met, and amyloid-related adverse events (ARIA) were confirmed to be within expected ranges. However, the more severe ARIA-H, including brain microhemorrhages, occurred in 17% of cases. Additionally, the FDA warned caution in prescribing the drug to patients taking anticoagulants after a death was reported among treated patients on such medication during the trial.

Biogen and Eisai's Alzheimer's dementia treatment 'Leqembi (generic name: lecanemab)' [Image source=AP Yonhap News]

Biogen and Eisai's Alzheimer's dementia treatment 'Leqembi (generic name: lecanemab)' [Image source=AP Yonhap News]

Immediately after the accelerated approval, Biogen and Eisai named the product Leqembi and applied for full FDA approval. Although accelerated approval was based on results up to Phase 2, the better outcomes in Phase 3 suggest no major obstacles to full approval. Applications for new drug approval will soon be submitted in Europe and Japan as well. Furthermore, clinical trials for a subcutaneous (SC) injection formulation are underway to improve patient convenience, as the current formulation is intravenous (IV).

Biogen and Eisai’s development of dementia treatments is a second attempt. Aduhelm faced controversy over efficacy during the approval process, leading to rejection by the European Medicines Agency (EMA) and failure to enter insurance coverage, resulting in commercial failure. Aduhelm’s CDR-SB reduction effect was only 22%, and the incidence of ARIA-H was as high as 28.3%.

Leqembi’s pricing strategy reflects this. The wholesale price of Leqembi is set at $26,500 per year (approximately 33.39 million KRW). Considering that Aduhelm initially priced at $56,000 and lowered to $28,200 (approximately 35.53 million KRW) in January last year but still struggled to enter the insurance market, this price appears to be set accordingly. Eisai explained, "We estimate the annual value of Leqembi treatment per patient in the U.S. at $37,600," but "set a lower price aiming to expand patient access, reduce financial burden, and support healthcare system sustainability."

The World Health Organization (WHO) estimates that the global number of dementia patients, which was 55 million in 2019, will increase to 78 million by 2030 and reach 139 million by 2050. The dementia treatment market is also expected to grow rapidly. Pharmaceutical research firm Kotelis projects the Alzheimer's treatment market size to grow from $1.6 billion (approximately 2 trillion KRW) in 2020 to $5.7 billion in 2030 and $20 billion (approximately 25 trillion KRW) in 2050, with an average annual growth rate of 29%. As antibody treatments continue to be developed, the current prescription share of acetylcholinesterase inhibitors at 47% is expected to be dominated by amyloid-beta antibody treatments at 69% by 2025.

This is why global big pharma companies are continuing follow-up developments beyond Lecanemab. The next anticipated candidate is Eli Lilly’s Donanemab. Lilly plans to announce Phase 3 results for Donanemab within the first half of this year. In Phase 2, it showed a 23% reduction in cognitive decline compared to placebo. Donanemab has also applied for accelerated approval based on Phase 2 results, and a decision on accelerated approval is expected as early as this month.

However, developing dementia treatments remains a challenging issue. Last year, Roche’s Gantenerumab showed only a 6-8% reduction in cognitive decline compared to placebo in Phase 3. Moreover, it failed to demonstrate statistical significance proving that the results were due to actual drug efficacy rather than chance. Nevertheless, Roche plans to continue related development, including clinical trials of 'RG6102,' a bispecific antibody combining Gantenerumab with enhanced blood-brain barrier (BBB) penetration.

Moreover, insurance coverage for Lecanemab is not guaranteed to be a rosy future. While some evaluate the 27% improvement level as not very high, and with deaths among clinical trial participants, there remains skepticism about whether Lecanemab will be covered by insurance benefits.

Researcher Heemin Heo from Kiwoom Securities said, "A 20-27% reduction in cognitive decline is difficult to regard as a game changer," but added, "The competition among Biogen, Lilly, and Roche, including active combination clinical trials and BBB penetration platform integration, will bring vitality to the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.