Government Announces Real Estate Regulation Easing Measures

Housing Indicators Expected to Improve After February

[Asia Economy Reporter Hyungsoo Park] As the government boldly decides to ease real estate regulations, a tailwind is blowing for construction stocks. With the resale restriction period being reduced from a maximum of 10 years to 3 years, there are expectations that concerns over unsold housing inventory will be partially alleviated.

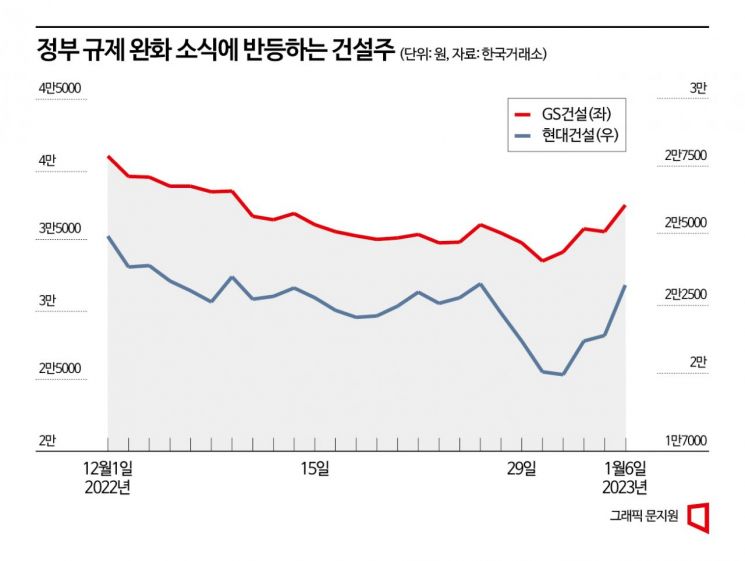

According to the financial investment industry on the 9th, the KOSPI rose 2.4% through the 6th of the new year, and the construction sector index increased by about 5.5%. GS Construction (9.5%), Hyundai Construction (7.7%), Daewoo Construction (7.4%), and DL E&C (6.8%) led the rebound in the construction sector index.

Due to the real estate market downturn, the construction sector index fell 36.0% last year. Its return relative to the market was -8.5 percentage points, showing poor performance. The construction sector, which struggled last year, is now catching its breath thanks to the government's regulatory easing this year.

On the 5th, areas in the metropolitan region excluding the three Gangnam districts of Seoul (Seocho, Gangnam, Songpa) and Yongsan District were removed from real estate regulation zones and price ceiling application areas. The resale restriction period applied to the metropolitan area will be drastically reduced by revising the enforcement decree in March this year. The plan to abolish the mandatory residence requirement will be pursued through related law amendments. All complexes sold before the law’s enforcement will be applied retroactively. The eligibility criteria for non-priority subscription for unsold units will also be relaxed.

Stock market experts welcomed the government's regulatory easing positively. Seungjun Kim, a researcher at Hana Securities, analyzed, "The government's real estate policy focuses on reducing unsold housing," adding, "It means to apply for subscription in areas excluding regulated zones." Sera Park, a researcher at Shin Young Securities, also explained, "The resale restriction on pre-sale rights is both the start of real estate regulation and the ultimate easing," and "This measure is a preemptive action to prevent the collapse of the construction system due to unsold units." She continued, "Because pre-sale rights trading is enabled and resale is possible, it can induce investment demand," and added, "Without the mandatory residence requirement, if the final payment cannot be made at the time of move-in, tenants can be brought in."

The fact that retroactive application is granted also shows the government's willingness to ease regulations. Retroactive application means that the Dunchon Jugong Olympic Park Foreon complex, which is currently under contract, is also subject to this. It indirectly confirms that the government is closely monitoring Dunchon Jugong, which is expected to have a significant ripple effect on the pre-sale market.

However, even if the government eases real estate regulations, it is expected to take time for the real estate market to recover. Although investment sentiment in the construction sector has revived and stock prices have rebounded, for this to lead to a sustained upward trend, the high interest rate environment must change. If the high interest rate trend does not break, the recovery in actual housing transaction volume due to regulatory easing is likely to be limited. Sunmi Kim, a researcher at Shinhan Investment Corp., said, "The housing market will continue to show a slow trend for the time being, but construction sector stock prices will stabilize after February," adding, "This is because housing indicators are expected to improve after February."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)