Last Year, Beer Was the Top-Selling Alcoholic Beverage in the Domestic Market

Traditional Liquor, Wine, and Whiskey Lead in Sales Growth Rate

Last year, the throne of the domestic alcoholic beverage market was claimed by the traditional powerhouse, beer. Traditional liquors such as Makgeolli and distilled soju, as well as imported alcoholic beverages like wine and whiskey, have shown steep growth for several years following the COVID-19 pandemic, indicating that competition in the domestic alcoholic beverage market is expected to become increasingly fierce.

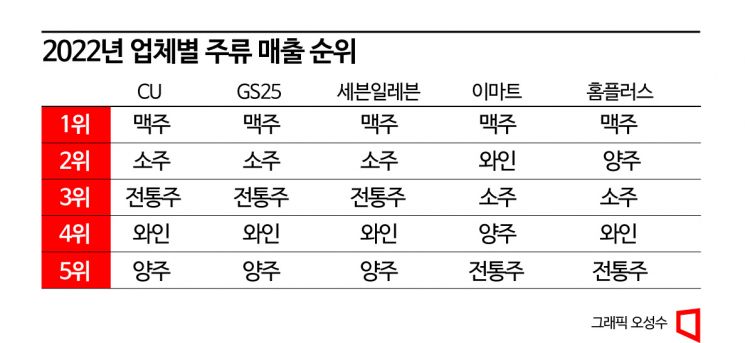

According to the distribution industry on the 5th, a comparison of sales rankings by beverage type in the domestic market last year showed that beer ranked first. Beer was the best-selling beverage type at all five major marts and convenience stores surveyed (CU, GS25, 7-Eleven, E-Mart, Homeplus).

Beer, along with soju, is one of the most familiar alcoholic beverages to domestic consumers, maintaining continuous sales growth by securing not only familiarity and comfort but also recent diversity. Additionally, its relatively affordable price and low alcohol content, which allow consumers to purchase and drink without burden, are cited as reasons why consumers consistently seek beer. Furthermore, the increased shelf presence of small domestic craft beer companies, alongside products from major domestic and international liquor companies, appears to have contributed to the rise in beer sales.

The rankings behind beer differed between convenience stores and large marts. At the three major convenience stores, soju and traditional liquor ranked second and third respectively, while wine and Western liquor took fourth and fifth places. Convenience stores, with their excellent accessibility as their greatest strength, seem to sell more relatively inexpensive alcoholic beverages that can be conveniently purchased near home.

On the other hand, at large marts, E-Mart ranked wine second, while Homeplus placed Western liquors such as whiskey, brandy, and vodka in second place. Traditional liquors ranked only fifth at both stores, showing relatively weaker performance. Large marts, capable of handling a wide variety of products, appear to have increased sales of relatively high-priced alcoholic beverages by leveraging a diverse product lineup that is difficult to maintain at convenience stores.

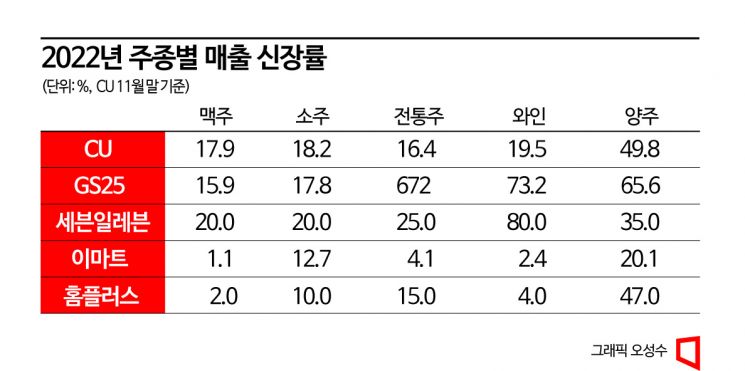

While beer and soju led in overall sales volume, traditional liquors and imported alcoholic beverages such as wine and whiskey showed more remarkable growth rates. CU reported that sales of Western liquors increased by 49.8% last year compared to the previous year, further expanding despite the high growth of 99.0% in 2021. A CU representative explained, “Whiskey purchases, which offer a wide lineup that allows consumers to enjoy according to their preferences, recorded the highest sales growth among alcoholic beverages.”

GS25 saw a 672% increase in traditional liquor sales last year compared to the previous year, with the company attributing the roughly sevenfold surge to the popularity of the distilled soju ‘Wonsoju.’ During the same period, 7-Eleven’s wine sales increased by 80.0%. The company analyzed that focusing on the wine sector was effective. 7-Eleven introduces a ‘Recommended Wine of the Month’ every month, selecting high cost-performance wines that are difficult to find domestically, which appears to have led to the rise in wine sales.

At large marts, the growth rate of Western liquors centered on whiskey was prominent. Last year, sales of Western liquors at E-Mart and Homeplus increased by 20.1% and 47.0% respectively compared to 2021. Western liquor sales have rapidly grown as demand shifted from duty-free shops to large marts due to the home drinking and solo drinking trends following COVID-19 and the difficulty of overseas travel. Additionally, the popularization of highball culture and the ‘whiskey open run’ phenomenon, where consumers seek limited-edition whiskeys, have contributed to related sales growth.

An E-Mart representative said, “Whiskey’s strength lies in its storability, allowing one or two drinks to be consumed and the rest stored.” He added, “This aligns well with the home drinking trend among MZ generation (Millennials + Generation Z) customers who do not drink excessively.” During the same period, wine maintained its upward trend with 2.4% growth at E-Mart and 4.0% growth at Homeplus, despite explosive growth over the past two years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)