Financial Services Commission to Announce Security Token Offering (STO) Guidelines in January

Securities Industry Accelerates Business Preparation for New Growth Opportunities

[Asia Economy Reporter Lee Seon-ae] As the institutionalization of Security Token Offerings (STO) becomes visible, the financial investment industry is actively moving to secure a new market. The Financial Services Commission (hereinafter FSC) plans to release STO guidelines within January. In line with this, the industry is accelerating its business entry.

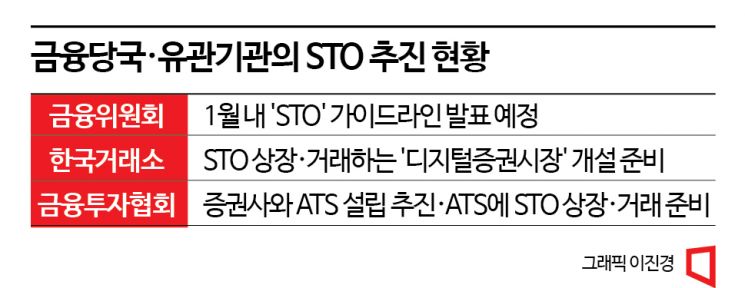

According to financial authorities and the financial investment industry on the 4th, the FSC is expected to announce the STO guidelines soon. The slow progress of the National Assembly in enacting the Digital Asset Basic Act (Virtual Asset Business Act) is interpreted as the administration's intention to release separate guidelines to prevent market confusion. The FSC's stance is that guidelines defining tokens with securities characteristics and their distribution must be prepared quickly.

Originally, as a follow-up measure to the government's national task in the capital market sector, "Establishing a regulatory system for the issuance and distribution of security tokens," the standards were scheduled to be announced by the end of last year, but preparations were delayed, pushing the announcement into the new year. Recently, with a series of incidents in the virtual asset market, market interest in the STO guidelines is higher than ever. There is a strong demand for financial authorities to present clear standards for operating related businesses. The FSC stated, "We will disclose it within January," adding, "We are promoting improvements to the issuance and distribution market system of STOs to prevent market manipulation or unfair trading."

Digital assets are broadly divided into security-type assets like STOs and non-security-type assets like virtual assets. Unlike virtual assets such as Bitcoin, STOs are classified as having securities characteristics because they are issued in token form using blockchain technology based on real value, similar to stocks. Since they fall under securities under the Capital Markets Act, if incorporated into the regulatory system supervised by financial authorities, various investor protection measures will be applied.

Above all, it becomes possible to issue assets that were difficult to securitize, such as high-priced artworks, automobiles, and copyrights, into thousands or tens of thousands of tokens. Holding tokens has the same effect as holding shares of the underlying asset. Accordingly, investors can invest in high-priced artworks, real estate, and other tangible assets in smaller units. Since various assets can be fractionally owned (fractional investment), investors can build diverse portfolios, and because they are based on real value, they are less risky than other digital assets.

In line with financial authorities, related organizations are also moving actively. The Korea Exchange, which formed a "New Business Task Force (TF)" under the Strategic Planning Department last May and has been preparing to enter the STO market, plans to open a digital securities market for trading STOs. Sohn Byung-doo, Chairman of the Korea Exchange, said, "We plan to list and trade STOs on a digital securities market this year," adding, "Although the security token market is not yet large, we will start small, but if the situation requires establishing a new headquarters, we will set it up in Busan." The Korea Financial Investment Association is preparing to establish an Alternative Trading System (ATS) with securities firms and is reviewing whether to handle STO trading on the ATS.

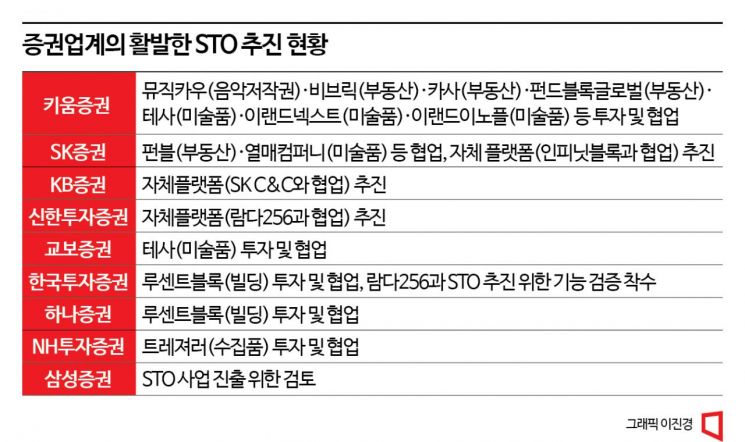

The securities industry has been hesitant to jump into the STO business despite the advantage of easily securitizing tangible assets due to government regulations on entering the virtual asset market. However, the situation changed as the new government allowed issuance under the regulatory framework of the Capital Markets Act regarding STOs. If issuance is permitted, securities firms can raise funds by issuing securities at a lower cost than general securities. This is why the securities industry is accelerating preparations, viewing STOs as a new growth opportunity.

Korea Investment & Securities is promoting the construction of a platform capable of tokenizing any underlying asset. It is collaborating with Lambda256, a blockchain-specialized company affiliated with Dunamu, the operator of Upbit, and has started a Proof of Concept (PoC) to advance the STO platform business.

Shinhan Investment Corp. is also pushing forward with the STO platform business in partnership with Lambda256, which supports blockchain consulting. They plan to internalize technologies related to security tokens, including ▲blockchain infrastructure construction ▲digital wallet design ▲token issuance, subscription, and distribution ▲integration with existing financial systems. A Shinhan Investment Corp. official said, "We have formed a preliminary task force for building a security token platform and plan to design internal systems in line with the authorities' guidelines."

KB Securities recently completed the development and testing of core functions of the STO platform. They conducted function tests such as token issuance, distribution to wallets, and product trading using smart contracts. They plan to launch the platform within the first half of the year after the financial authorities release the guidelines.

Kiwoom Securities is collaborating with Funble, a platform that issues digital securities for real estate securitization, and is also reviewing platform business cooperation through a business agreement with Casa, a digital real estate securities exchange.

A securities industry official said, "Most securities firms already have STO technology capabilities, so if the market opens, they can immediately engage in related businesses," adding, "Once the financial authorities announce the guidelines, a full-scale competition to secure market share will begin accordingly."

The tangible asset industry is also paying close attention to the financial authorities' guideline announcement, as it can assess the securities characteristics of virtual assets. However, since the financial authorities are expected to announce administrative guidelines that specify the Capital Markets Act rules, it is anticipated to be difficult to fully verify the securities nature of virtual assets.

The FSC is defining the STO guidelines at the same level as general securities. The guidelines will include examples of cases with high and low possibilities of virtual assets being securities, cases with high investment value, and cases with high utility value. The purpose is not to create a new securities concept applied to tokens but to prepare guidelines so that traders, financial authorities, and issuers can clearly predict which tokens are defined as securities under the Capital Markets Act and which are not.

Once the FSC's guidelines are released, virtual asset issuers and exchanges are expected to focus on assessing the securities characteristics of the virtual assets they issue and distribute. However, industry observers believe that very few tangible assets will be recognized as securities. An industry official in the tangible asset sector said, "The outcome of the lawsuit between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs, which is engaged in a legal battle over Ripple's securities status, will serve as an important guideline for determining the securities nature of domestic virtual assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)