Survey of Research Center Heads at 13 Securities Firms

Samsung Bio, LG Energy Solution, and Samsung SDI Also Receive High Praise

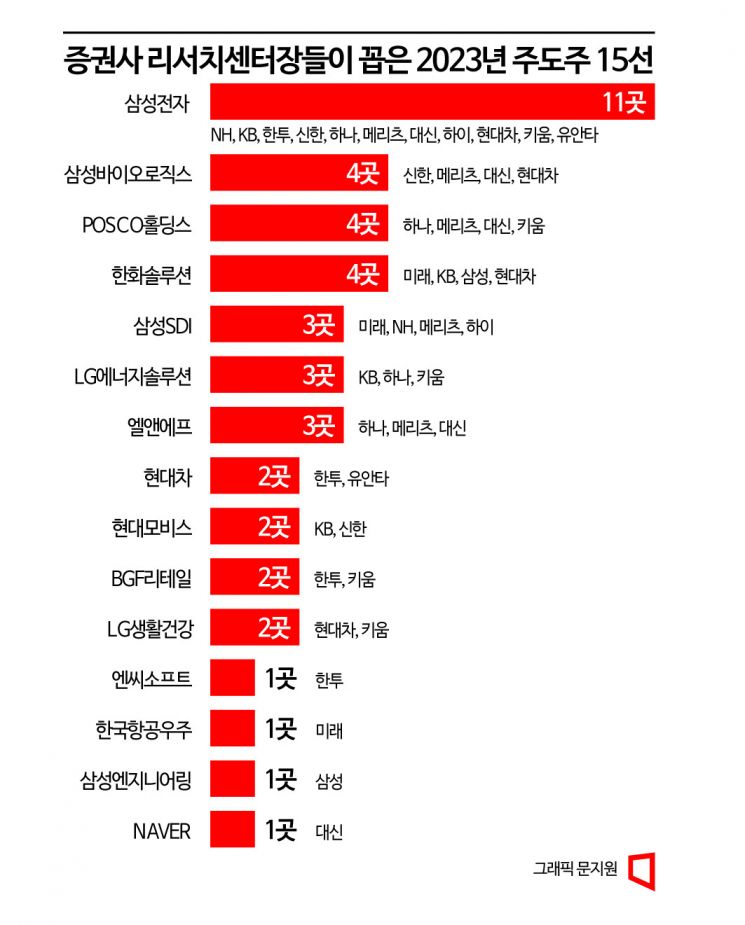

[Asia Economy Reporters Jeongsoo Lim, Minji Lee, Jeongyun Lee] Research center heads selected Samsung Electronics, Samsung Biologics, POSCO Holdings, Hanwha Solutions, LG Energy Solution, Samsung SDI, Hyundai Motor, Hyundai Mobis, L&F, and Korea Aerospace Industries (KAI) as the leading stocks to drive the market in the new year.

Among the 13 securities firms' research center heads, 11 chose Samsung Electronics as the top pick to lead the market in the new year. NH, KB, Korea Investment, Shinhan, Hana, Meritz, Daishin, Hi Investment, Hyundai Motor, Kiwoom, and Yuanta all selected Samsung Electronics. It is expected that the semiconductor industry will hit bottom and improve in the second half of the year, and the leading company in the semiconductor sector that survived the recession will see a greater rise. No Geun-chang, head of the research center at Hyundai Motor Securities, said, "Recessions have historically created opportunities for leading companies," adding, "The semiconductor cycle is expected to bottom out this year, so the rebound will be significant."

11 Securities Firms Recommend 'Samsung Electronics'... SK Hynix is 'Questionable'

In contrast, SK Hynix was recommended as a leading stock only by Hana Investment & Securities. It is widely expected to record operating losses in the trillions of won this year, and even if the semiconductor industry improves, its stock price increase is expected to be relatively smaller compared to Samsung Electronics. While SK Hynix's stock price will rise alongside Samsung Electronics if the semiconductor market recovers, profitability will be impaired due to one-time costs, causing a partial reduction in net asset value (BPS).

Experts identified POSCO Holdings and Samsung SDI as representative leading stocks in the secondary battery sector. POSCO Holdings is expected to benefit from the recovery of the steel market as well as growth in the secondary battery materials segment. Yoo Jong-woo, head of the research center at Korea Investment & Securities, said, "POSCO Holdings' subsidiary, POSCO Chemical, will start procuring lithium and nickel independently from the end of this year, and from next year, it will supply cathode materials produced at its Canadian plant to finished car companies such as General Motors (GM) in the U.S., making it the biggest beneficiary of the U.S. Inflation Reduction Act (IRA)."

Kim Ji-san, head of the research center at Kiwoom Securities, said, "As the Chinese economy recovers, the steel market will also improve," adding, "The expansion of POSCO Holdings' secondary battery materials business will provide upward momentum to its stock price." He also said, "Samsung SDI is the most undervalued among domestic secondary battery companies," and "Considering the aggressive moves to reorganize the U.S. secondary battery supply chain, Samsung SDI's undervaluation will be largely resolved." LG Energy Solution and L&F were also selected as leading stock candidates for the new year by three securities firms.

Research center heads chose Samsung Biologics as the expected leading stock in the healthcare sector. Lee Kyung-soo, head of the research center at Meritz Securities, said, "Many biopharmaceutical patents will expire this year, greatly increasing demand for contract manufacturing organizations (CMO)," and predicted, "Domestic companies' CMO market share will reach global number one within the year."

Hanwha Solutions, KAI, Samsung Engineering, Hyundai Doosan Infracore Also in Focus

In the renewable energy sector, Hanwha Solutions is expected to be a leading stock; in the defense industry sector, KAI; and in construction and construction machinery sectors, Samsung Engineering and Hyundai Doosan Infracore are expected to lead.

Kim Sang-hoon, head of the research division at KB Securities, said, "The solar power industry appears to have entered a 10-year upward cycle starting from the second to third quarter of last year," adding, "Solar technology has reached the first maturity stage, nearing theoretical maximum efficiency, and the passage of the U.S. IRA will provide demand and tax benefits for 10 years."

Hyundai Motor, Hyundai Mobis, BGF Retail, LG Household & Health Care, NAVER, and NCSoft were also expected to be leading stocks by at least one securities firm this year. Yoo Jong-woo said, "Hyundai Motor's global market share will continue to soar this year," adding, "In the domestic market, the Grandeur, and overseas, the Genesis lineup and expansion will drive Hyundai Motor's performance."

Kim Seung-hyun, head of the research center at Yuanta Securities, suggested that cyclical stocks will gain momentum during the stock market rebound, naming Hyundai Motor, Hyundai Department Store, Amorepacific, and Hyundai Doosan Infracore as leading stock candidates. He analyzed that foreign net buying inflows are likely to be large and that these companies are undervalued compared to their earnings forecasts and other financial figures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)