Increased Homeownership Opportunities for the Homeless, Reduced Tax Burden for Multi-Homeowners

[Asia Economy Reporter Cha Wanyong] The new year of 2023, the Year of the Black Rabbit (Gyemyo Year, 癸卯年), has dawned, but the dark clouds over the real estate market are growing thicker. As monetary authorities worldwide have decided to maintain the interest rate hike trend next year, forecasts suggest that the real estate contraction will worsen. Both homeowners and those without homes face great concerns.

However, it is not all negative news. The government has introduced a variety of measures to ease regulations related to loans, taxes, and subscription systems to facilitate a soft landing for the sluggish real estate market, offering more breathing room compared to last year. The subscription system will become more favorable to those without homes, and multi-homeowners will see a reduction in real estate tax burdens.

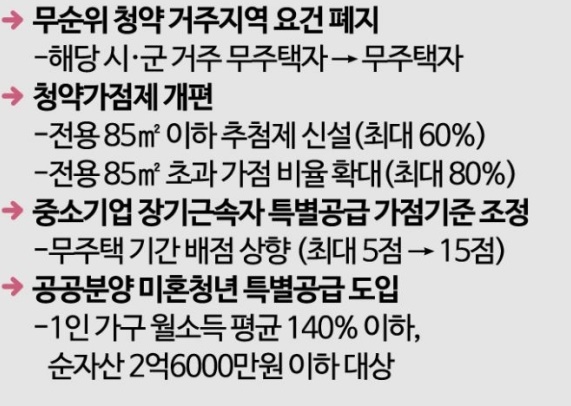

◆Expanded Opportunities for Non-Homeowners... Changes in the Subscription System= First, starting this year, the residency requirement for unsubscribed applications in the relevant area will be abolished. This means that any non-homeowner can participate. Previously, to prevent overheating in the subscription market, applicants for unsubscribed subscriptions in regulated areas had to reside in the corresponding city or county.

Also, considering the inconvenience of having to repeatedly apply when uncontracted units occur, the retention period for preliminary winners, which was discarded 60 days after the main subscription, will be extended to 180 days, and the number of preliminary winners will be significantly increased to at least 500% of the number of households.

The scoring criteria for special supply to long-term employees of small and medium enterprises will also be adjusted. The points awarded for being non-homeowners for over five years will increase from the existing 5 points to a maximum of 15 points. The residency requirement for unsubscribed applications will also be abolished, greatly lowering the entry barriers for subscriptions.

The lottery quota for private apartments supplied in regulated areas will also be expanded. Currently, all houses under 85㎡ in regulated areas are supplied based on a point system. The government plans to reform this within the first half of the year so that private apartments under 60㎡ will be allocated 40% by points and 60% by lottery. For apartments between 60 and 85㎡, the ratio will be 70% points and 30% lottery. Conversely, for large apartments over 85㎡, the point system quota will increase from the current 50% to 80%.

During the first half of the year, a special supply for unmarried youth will be newly established in public housing. This will provide housing units for unmarried individuals aged 19 to 39 who have never owned a home. The eligibility criteria include a monthly average income below 140% and net assets below 260 million KRW for single-person households.

First-time homebuyers will be exempt from acquisition tax up to 2 million KRW regardless of income or housing price.

◆Significant Easing of Real Estate-Related Loans= From January, the special jeonse loan guarantee limit provided by the Korea Housing Finance Corporation (HF) at low interest rates for non-homeowner youth aged 34 or younger with a combined annual income of 70 million KRW or less will be increased from 100 million KRW to 200 million KRW.

Regulations on mortgage loans for owned homes will also be eased. The separate loan limit of 200 million KRW applied to mortgage loans for living stabilization purposes will be removed, and loans will be managed within the existing loan-to-value (LTV) and debt-to-income (DTI) ratios.

A special Bogeumjari loan will also be launched. It will integrate the Safe Conversion Loan (for homes priced up to 600 million KRW, loan limit 360 million KRW) and the Eligible Loan (for homes priced up to 900 million KRW, loan limit 500 million KRW) into the existing Bogeumjari loan. It is expected that loans up to 500 million KRW will be available at an annual interest rate in the 4% range for home purchases under 900 million KRW.

◆Abolition of Heavy Taxation on Multi-Homeowners and Easing of Mortgage Loans= From June, the basic deduction amount for comprehensive real estate tax will be raised from 600 million KRW to 900 million KRW. For single-home households, it will be adjusted from the current 1.1 billion KRW to 1.2 billion KRW.

The heavy taxation rate on two-homeowners will also be abolished. Owners of two or more homes in regulated areas will be taxed at the general tax rate (0.5?2.7%) instead of the heavy tax rate (1.2?6.0%). Multi-homeowners with three or more homes and a taxable base exceeding 1.2 billion KRW will still be subject to the heavy tax rate, but the top rate will be lowered from the current 6.0% to 5.0%.

The tax burden cap rate, which was applied differently depending on the number of homes, will be unified at 150%. Previously, the combined property tax amount for owners of one to two homes was capped at 150%, and for owners of two to three or more homes in regulated areas, taxation on amounts exceeding 300% was excluded. Now, the cap will be uniformly lowered to 150%.

However, from this year, it will become more difficult to save on capital gains tax through gifting. If real estate is gifted to a spouse or child and sold after the rollover taxation period (currently 5 years), the capital gains will be calculated based on the value received by the recipient, not the acquisition cost of the donor.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)