Significant Impact of Oil Prices and Exchange Rate Decline

Fed Expected to Cut Interest Rates by End of Next Year

Core Inflation Rising for One Year

Uncertainty over Public Utility Charges Remains

[Asia Economy Reporter Seo So-jeong] As the expected inflation rate, which reflects consumers' inflation outlook, has fallen to the 3% range, expectations are spreading that the pace of inflation slowdown will accelerate. The Bank of Korea had forecast that the consumer price inflation rate would remain in the 5% range until early next year, indicating a high inflation environment. However, with international oil prices and exchange rates, which had previously fueled inflation, showing a downward stabilization trend and expected inflation also declining, optimism about inflation easing is growing. Nonetheless, core inflation excluding food and energy has continued to rise for a year, and upcoming increases in public utility fees such as electricity and gas could stimulate expected inflation, leaving inflation uncertainty still present.

According to the Bank of Korea on the 27th, the expected inflation rate, which is the forecast for consumer price inflation over the next year, peaked at a record high of 4.7% in July but has dropped to the 3% range this month. The decline in expected inflation was largely influenced by falling international oil prices and the won-dollar exchange rate. International oil prices, which had soared due to the Russia-Ukraine conflict, have recently stabilized at around $70 per barrel, and the won-dollar exchange rate has fallen to about 1,270 won, the lowest level in six months, lowering expected inflation.

According to the Bank of Korea, when oil prices are above $120, a 10% increase in oil prices leads to an average rise in expected inflation of 0.3 percentage points in the U.S. and 0.5 percentage points in the Eurozone. When international raw material prices such as oil surge, a high level of inflation is likely to persist for a considerable period. However, since oil prices have shown a clear downward trend since the second half of this year, this has influenced expected inflation.

Bank of Korea Governor Lee Chang-yong recently stated at an inflation briefing, "Consumer prices will continue to rise around 5% for the time being, but as the increase in petroleum prices narrows and domestic and international economic downward pressures grow, the upward trend is expected to gradually slow." The won-dollar exchange rate is also gradually stabilizing downward, easing inflationary pressure. Due to the sharp interest rate hikes in the U.S., the exchange rate soared to 1,439.9 won as of the closing price on September 28 but is currently fluctuating in the high 1,260 won range this morning.

Bank of Korea Governor Lee Chang-yong is explaining the "2022 Second Half Inflation Target Management Status" at the Bank of Korea press room in Jung-gu, Seoul, on the 20th. Photo by Joint Press Corps

Bank of Korea Governor Lee Chang-yong is explaining the "2022 Second Half Inflation Target Management Status" at the Bank of Korea press room in Jung-gu, Seoul, on the 20th. Photo by Joint Press Corps

◆Global IBs "U.S. Rate Cuts by End of Next Year"= In the U.S., which is focusing on curbing inflation, there is an assessment that the housing market downturn could aid the Federal Reserve's efforts to control inflation. The Wall Street Journal (WSJ) reported on the 25th (local time) that the U.S. housing market has entered a severe downturn comparable to the 2007-2009 financial crisis due to seven interest rate hikes this year. This increases the likelihood that the Fed's expected reduction in inflation and economic activity slowdown will materialize in the future.

Major global investment banks (IBs) have suggested that the Fed may raise policy rates until March or May next year and then begin cutting rates by the end of next year. Many IBs expect that as U.S. inflation trends downward, rate hikes will end when the policy rate exceeds inflation, around the low 5% range. Most IBs anticipate that the final rate (upper bound) will be around 5-5.25%, with rate hikes stopping in March or May next year, and many expect the Fed to cut rates by the end of next year.

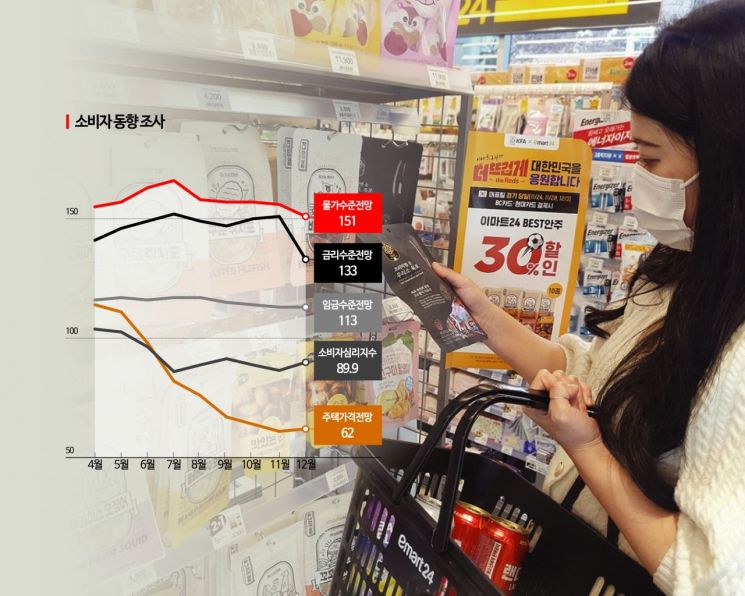

Although Fed Chair Jerome Powell dismissed the possibility of rate cuts next year, the market is anticipating rate cuts by the end of next year, drawing attention to the timing of rate cuts domestically as well. According to the Bank of Korea, the December interest rate level expectation index dropped by 18 points from November to 133. Hwang Hee-jin, head of the Bank of Korea's statistics survey team, explained, "As inflation slows and market interest rates are perceived to have risen sufficiently, the interest rate level expectation index has fallen significantly," adding, "The index itself was very high, so it still remains above 100."

Kim Jeong-sik, emeritus professor of economics at Yonsei University, said, "With the slowdown in consumer price inflation and the decline in expected inflation, one of the key indicators, future inflation is expected to gradually stabilize." He added, "As the effects of rapid interest rate hikes become fully apparent next year and shocks such as the risk of a real estate bubble burst materialize, the Bank of Korea may also consider rate cuts as early as the end of next year." However, Governor Lee responded, "It is still premature to discuss rate cuts," emphasizing that "most Monetary Policy Committee members agree that there must be clear evidence that inflation is converging to the target in the medium to long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)