Blackstone, Starwood Capital, and Others Temporarily Suspend Partial Fund Redemptions

Redemption Halted for 'Port Korea Green Energy No. 1~4' Sold by KB and Shinhan Securities

Pension Funds and Mutual Aid Associations Restructure Alternative Investment Portfolios, Reduce Investment Ratios

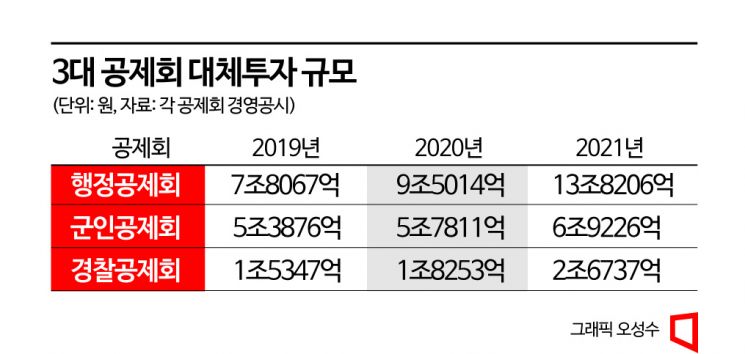

[Asia Economy Reporter Park So-yeon] As domestic and international real estate and infrastructure-related funds have consecutively declared redemption suspensions, causing a rapid deterioration in the alternative investment market, institutional investors such as pension funds and mutual aid associations are seen readjusting their alternative investment portfolios and reducing their investment proportions.

According to the investment banking (IB) industry on the 23rd, institutional investors have begun focused risk management on alternative investments, anticipating a worsening market for alternative assets such as real estate and infrastructure.

A senior official from Institution A said, "We had generated returns through public offerings and futures investments, but we lost everything in alternative investments," adding, "Institutions with alternative investment proportions reaching 70-80% are struggling as they cannot exit." He continued, "There will be continuous problems in alternative investments," and "We need to reduce the proportion, but it is not easy to do so without incurring losses."

Recently, the alternative investment market has become quite chaotic as participants scramble to find targets for secondary transactions. A senior official from Institution B said, "They are desperate to offload alternative investment products from well-known overseas private equity funds that everyone recognizes to Korean institutions," adding, "Brokers are even offering premiums to transfer these, but upon closer inspection, many of these products are damaged, so caution is necessary."

The market situation is worsening, with major private equity funds and securities firms recently suspending redemptions of their fund products one after another. Blackstone, the world's largest private equity fund, declared a partial redemption suspension earlier this month on its flagship product 'BREIT (Blackstone Real Estate Income Trust fund),' which has $125 billion (approximately 162 trillion KRW) in assets under management. This fund invests in assets such as logistics centers, apartments, offices, and casinos. As concerns over the fund's soundness grew amid forecasts of a real estate downturn, investors made large-scale redemption requests.

Another alternative asset manager, Starwood Capital, operating the $26.2 billion 'SREIT (Starwood Real Estate Income Trust),' also temporarily suspended redemptions last month after investor redemption requests exceeded the monthly limit.

Redemption requests in the U.S. unlisted REIT and real estate fund markets are not yet large and may remain a short-term issue. However, if the commercial real estate market does not recover quickly and the number of investors demanding their money back continues to rise, the problem could escalate. As more REITs and funds sell off assets to meet redemptions, the risk of price declines inevitably increases.

Domestically, redemption has been suspended for the UK renewable energy power plant loan investment fund 'Port Korea Green Energy No. 1 to 4,' sold by KB Securities and Shinhan Investment Corp. This fund was created by the domestic asset management company Port Korea Asset Management. It invests in products backed by Eurobonds issued by Danos, a Hong Kong corporation (borrower), which then loans the invested funds to build a waste incineration power plant in Peterborough, UK. The fund was sold domestically with a total scale of 48 billion KRW. However, due to the deterioration of the power plant construction company's management, development was delayed, and neither principal nor interest was paid at the fund's maturity.

Meanwhile, financial authorities have urged securities firms and asset management companies to manage risks related to alternative investment funds to prevent further investor damage caused by domestic and international real estate and infrastructure fund insolvencies. A Financial Supervisory Service Asset Management Inspection Division official stated, "We have urged asset managers to conduct their own risk management," warning, "If there are violations of investment guidelines, strict sanctions will be imposed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)